India Cements Ltd

NSE :INDIACEM BSE :530005 Sector : Cement

About Company: India Cements Ltd is a leading cement manufacturing company headquartered in Chennai. It was incorporated in the year 1946 by Shri S N N Sankaralinga Iyer and Sri T S Narayanaswami. While retaining cement over the years as its mainstay, India Cements has ventured into related fields like shipping, captive power and coal mining that have purposeful synergy to the core business. The co is also a sponsor of the IPL franchise “Chennai Super Kings

News in India Cement: Ace investor has raised stake in India Cements Ltd. from 20.73 per cent to 22.76 per cent. As per the latest communication by BSE, market magnet has bought 62,98,686 shares of India Cements, which is 2.03 per cent of the total issued paid up capital of the company.

Weekly Chart of India Cement:

Technical Outlook of India Cement:

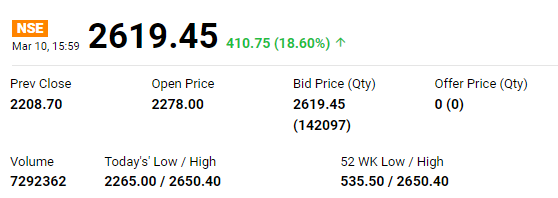

Stock on Friday 7th Jan hits 2 upper circuits and closed at 239.85 per share gaining 15.28%. Volumes were on the decent level. Fresh breakout is seen in the stock today on account of news of Ace investor Radha Krishanan Damani increased stake by 2.03 per cent in India Cement. On Weekly chart time frame as per price action 225 is the decent support level for the stock. Till stock holds above 225 one should keep strategy to buy stock on corrections. Stock is trading upward sloping channel pattern, as shown on the chart above.

As per the chart setup, news & momentum in India Cements, We recommend to buy stock on correction till 225 level for the target of 300 Stoploss should be kept below 200 level on closing basis.