Want a perfect stocks portfolio for 2026?

Create Now

Want a perfect stock portfolio for 2026?

Create Now

Nifty 50 Today

Explore On

Prev. Close

Open price

Today's Low / High

52 Week Low / High

Volume

Bid Price (qty)

Offer Price (qty)

Nifty 50 Chart

Returns

| 20 Feb 25571.25 (0.46%) | 19 Feb 25454.35 (-1.41%) | 18 Feb 25819.35 (0.37%) | 17 Feb 25725.40 (0.17%) | 16 Feb 25682.75 (0.83%) | 13 Feb 25471.10 (-1.30%) | 12 Feb 25807.20 (-0.57%) | 11 Feb 25953.85 (0.07%) | 10 Feb 25935.15 (0.26%) | 09 Feb 25867.30 (0.68%) | 06 Feb 25693.70 (0.20%) | 05 Feb 25642.80 (-0.52%) | 04 Feb 25776.00 (0.19%) | 03 Feb 25727.55 (2.55%) | 02 Feb 25088.40 (1.06%) | 01 Feb 24825.45 (-1.96%) | 30 Jan 25320.65 (-0.39%) | 29 Jan 25418.90 (0.30%) | 28 Jan 25342.75 (0.66%) |

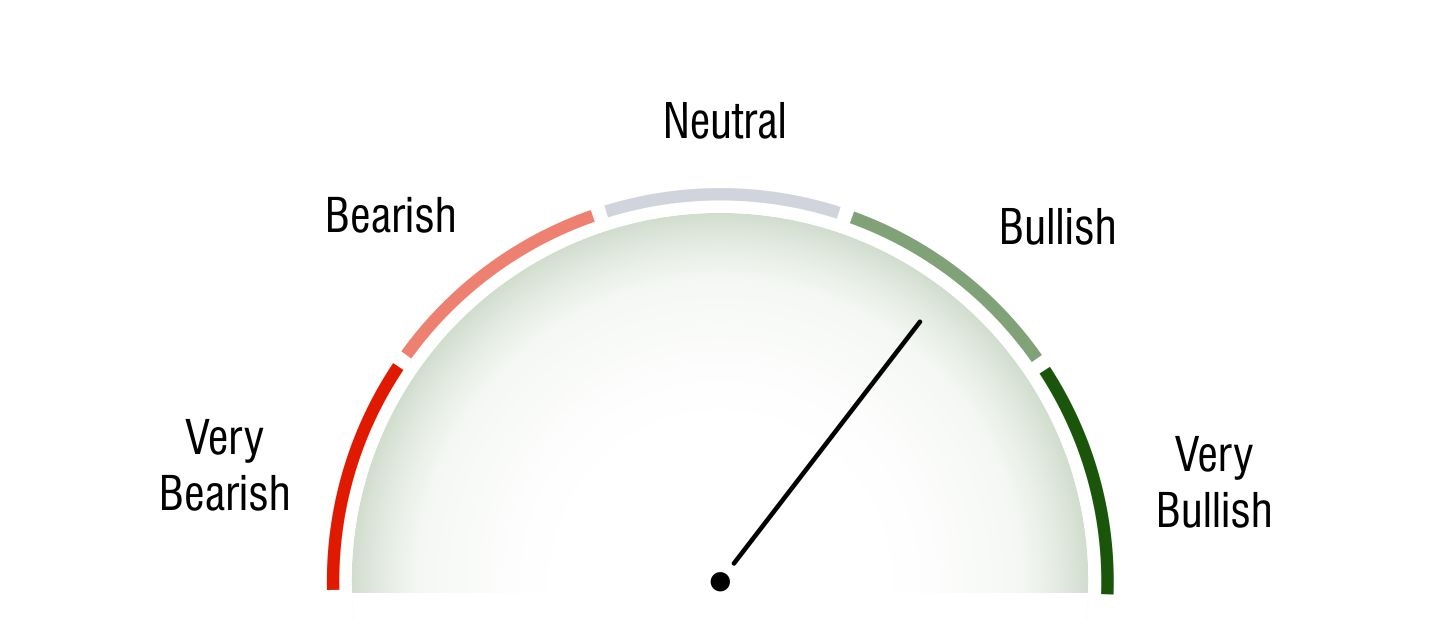

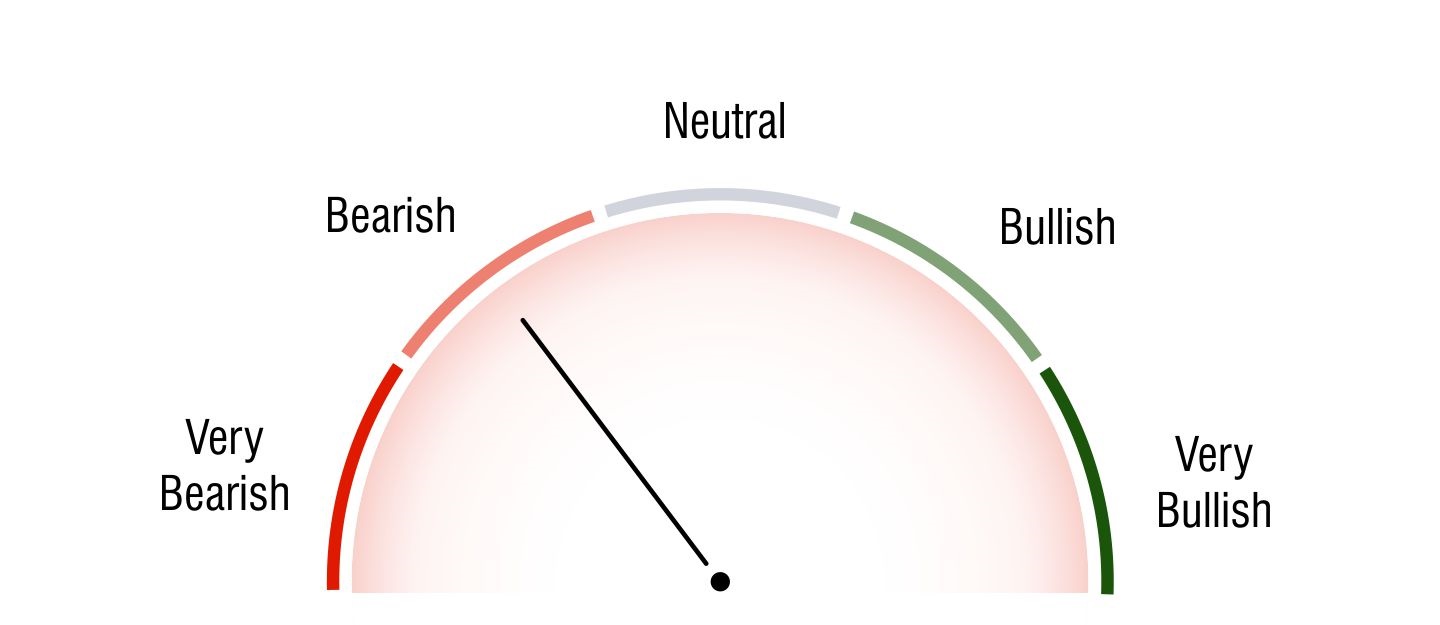

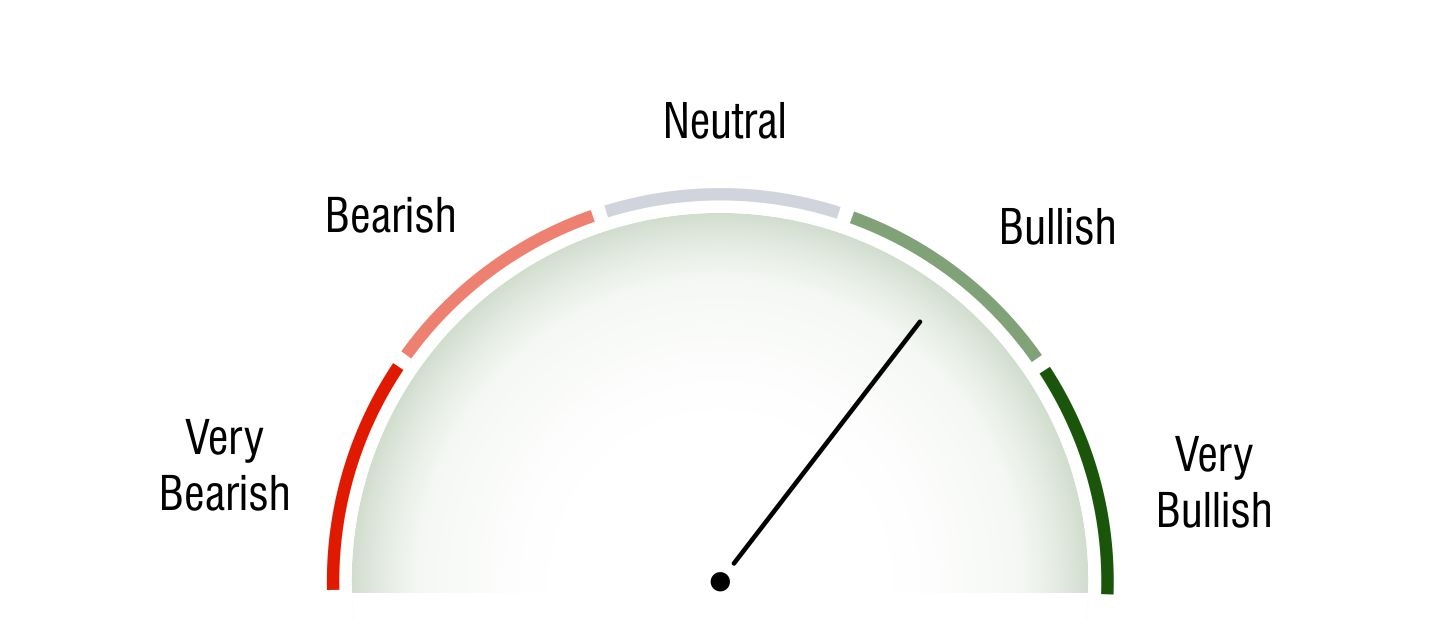

Nifty 50 Bullish / Bearish Zone

Technical Analysis

Short Term Investors

Bullish

Medium Term Investors

Bearish

Long Term Investors

Bullish

Moving Averages

5 DMA

Bearish25650.62

10 DMA

Bearish25728.77

20 DMA

Bullish25564.97

50 DMA

Bearish25741.58

100 DMA

Bearish25716.75

200 DMA

Bullish25324.49

Intraday Support and Resistance

(Based on Pivot Points) Updated On Feb 20, 2026 04:00 PM For Next Trading Session| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 25980.41 | 25821.98 | 25649.3 | - | - |

| R2 | 25821.98 | 25713.57 | 25623.28 | 25830.25 | - |

| R1 | 25696.61 | 25646.59 | 25597.27 | 25713.15 | 25759.3 |

| P | 25538.18 | 25538.18 | 25538.18 | 25546.45 | 25569.53 |

| S1 | 25412.81 | 25429.77 | 25545.24 | 25429.35 | 25475.5 |

| S2 | 25254.38 | 25362.79 | 25519.22 | 25262.65 | - |

| S3 | 25129.01 | 25254.38 | 25493.21 | - | - |

Nifty 50 Stock List

Stuck on a Stock? Get clear short term view in seconds!

Just Ask The Analyst| Company Name | Price | Chg. | Market Cap (Cr) | 52 Week High | 52 Week Low | ROE | P/E | P/B | EBITDA |

|---|