EquityPandit’s Outlook for Sun Pharma for the week (September 28, 2015 – October 02, 2015):

SUN PHARMA:

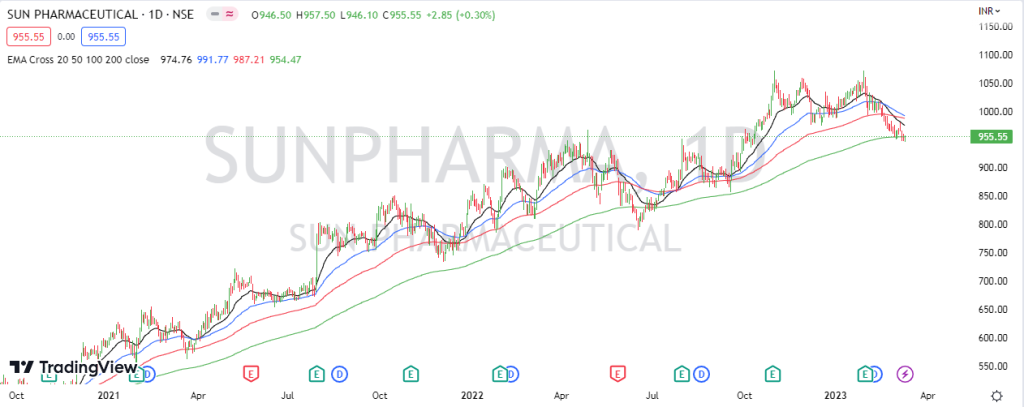

SUN PHARMA closed the week on negative note losing around 1.5%.

As we have mentioned last week that resistance for the stock lies in the range of 920 to 930. If the stock manages to close above the levels of 920 the stock can move to the levels of 960 from where the stock has retraced couple of times in last 2 months. The stock manages to hit a high of 913 during the week.

During the week the stock was trading in very tight range of 890 on lower end to 915 on upper end. A breakout on either side will move the stock further 2% to 4% in that direction.

Support for the stock lies in the zone of 860 to 880 where 100 Daily SMA and long term support trend-line are positioned. If the stock moves below this levels then the stock can drift to the levels of 810 where long term support for the stock is lying.

Resistance for the stock lies in the range of 910 to 920 where 200 Daily SMA is positioned. If the stock manages to close above the levels of 920 the stock can move to the levels of 960 from where the stock has retraced couple of times in last 2 months.

Broad range for the stock in the coming week can be 860 – 880 on lower side to 930 – 940 on upper side.