Tara Chand Infralogistic Solutions Ltd

NSE :TARACHAND BSE :535058 Sector : DiversifiedBuy, Sell or Hold TARACHAND? Ask The Analyst

BSE

prev close

OPEN PRICE

volume

Today's low / high

52 WK low / high

bid price (qty)

offer price (qty)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 10 Jan 55.21 (1.84%) | 09 Jan 54.21 (-2.32%) | 08 Jan 55.50 (0.13%) | 07 Jan 55.43 (-4.20%) | 06 Jan 57.86 (-3.18%) | 03 Jan 59.76 (-2.26%) | 02 Jan 61.14 (-1.96%) | 01 Jan 62.36 (3.07%) | 31 Dec 60.50 (-3.82%) | 30 Dec 62.90 (-3.38%) | 27 Dec 65.10 (-4.48%) | 26 Dec 68.15 (-3.88%) | 24 Dec 70.90 (2.31%) | 23 Dec 69.30 (-4.02%) | 20 Dec 72.20 (-2.83%) | 19 Dec 74.30 (1.30%) | 18 Dec 73.35 (-1.15%) | 17 Dec 74.20 (0.61%) | 16 Dec 73.75 (-3.28%) | 13 Dec 76.25 (-1.49%) | 12 Dec 77.40 (-2.82%) |

Price Chart Historical Data Technical Chart

Technical Analysis

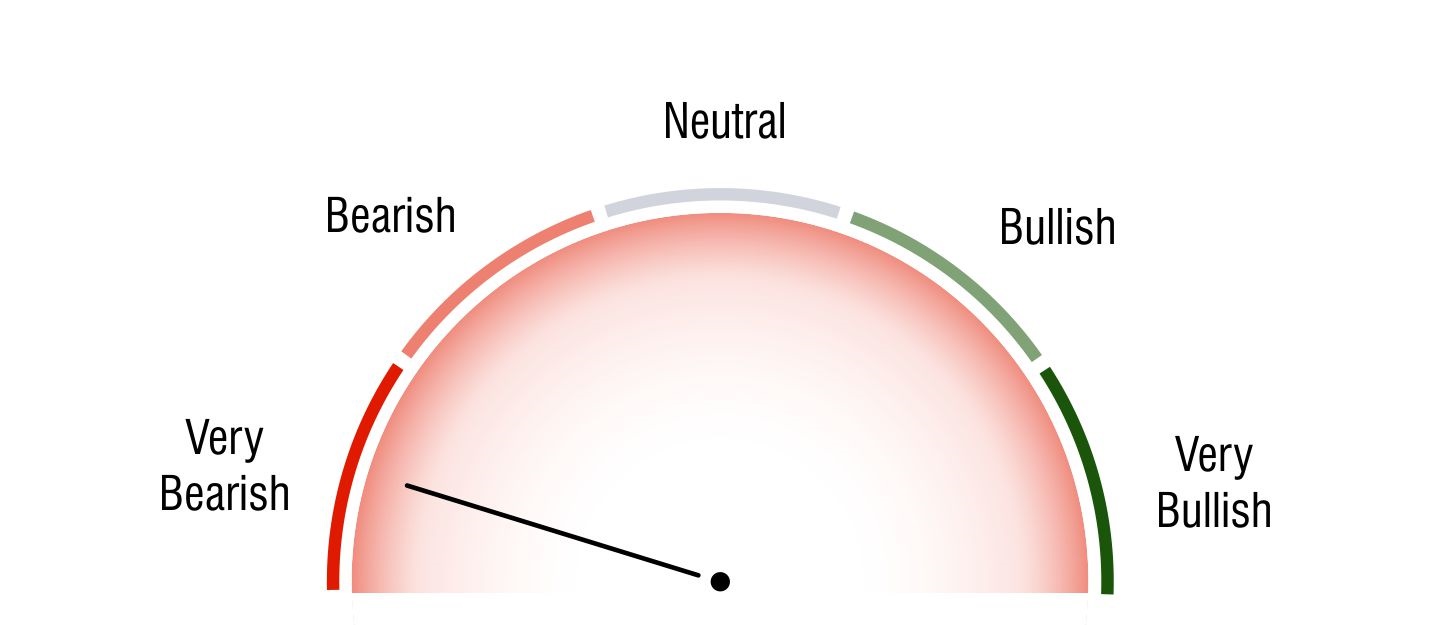

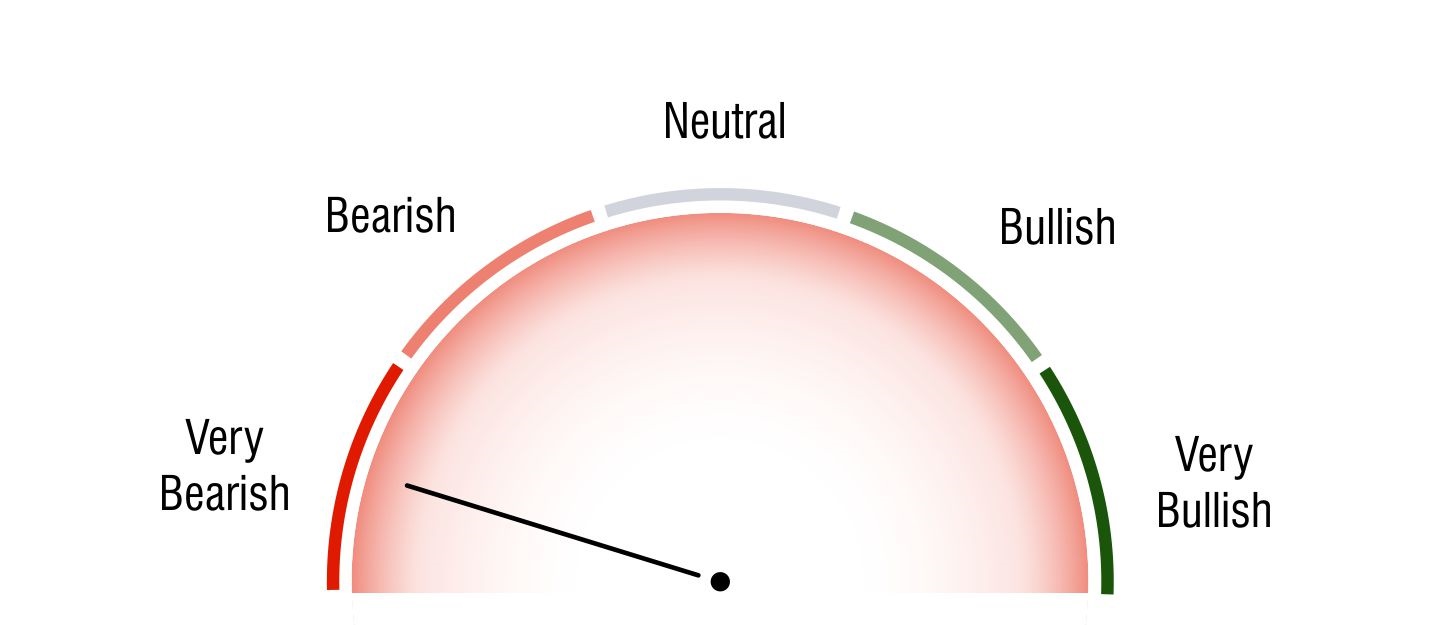

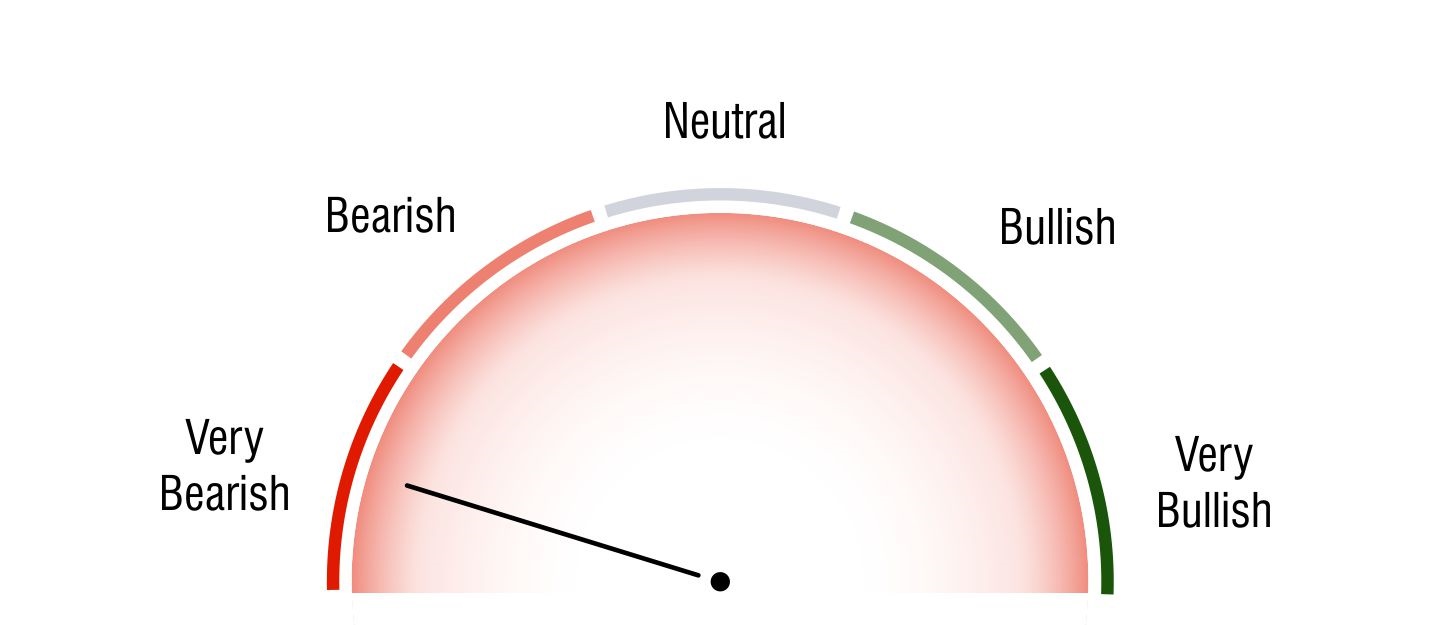

Short Term Investors

Very Bearish

Medium Term Investors

Very Bearish

Long Term Investors

Very Bearish

Moving Averages

5 DMA

Bearish

55.64

10 DMA

Bearish

58.49

20 DMA

Bearish

65.12

50 DMA

Bearish

75.74

100 DMA

Bearish

77.85

200 DMA

Bearish

77.31

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On Jan 10, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 63.1 | 59.8 | 56.75 | - | - |

| R2 | 59.8 | 57.66 | 56.23 | 60.05 | - |

| R1 | 57.51 | 56.35 | 55.72 | 58.01 | 58.65 |

| P | 54.21 | 54.21 | 54.21 | 54.46 | 54.78 |

| S1 | 51.92 | 52.07 | 54.7 | 52.42 | 53.06 |

| S2 | 48.62 | 50.76 | 54.19 | 48.87 | - |

| S3 | 46.33 | 48.62 | 53.67 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Tara Chand Infralogistic Solutions Ltd Quaterly Results

| INCOME | |

| PROFIT | |

| EPS |

Tara Chand Infralogistic Solutions Ltd Quaterly Results

| INCOME | 42.94 | 44.84 | 46.9 | 47.29 | 60.41 | |

| PROFIT | 2.69 | 3.35 | 6.3 | 4.54 | 7.22 | |

| EPS | 1.91 | 2.38 | 4.41 | 2.97 | 4.64 |

Profit & Loss (Figures in Rs. Crores)

Tara Chand Infralogistic Solutions Ltd Profit & Loss

| INCOME | |

| PROFIT | |

| EPS |

Tara Chand Infralogistic Solutions Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 39.62 | 46.5 | 53.03 | 83.43 | 102.7 | 115.32 | 114.52 | 132.52 | 144.65 | 173.68 | |

| PROFIT | 0.69 | 0.9 | 2.27 | 4.61 | 4.75 | 7.97 | 3.14 | -1.9 | 6.41 | 15.15 | |

| EPS | 0.74 | 1.27 | 2.97 | 0.68 | 0.7 | 1.17 | 0.38 | 1.74 | 1.37 | 2.13 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 15.18 | 13.65 | 13.65 | 13.65 | 13.64 | 13.64 | 13.64 | 9.33 | 9.33 | 9.33 |

| Reserves Total | 78.66 | 53.04 | 43.68 | 41.31 | 38.74 | 32.01 | 27.25 | 5.93 | 3.09 | 1.9 |

| Equity Share Warrants | 1.06 | 3.28 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Equity Application Money | 0 | 2.16 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Shareholders Funds | 94.9 | 72.13 | 57.33 | 54.96 | 52.38 | 45.65 | 40.89 | 15.26 | 12.42 | 11.23 |

| Secured Loans | 85.18 | 84.09 | 93.53 | 105.24 | 85.56 | 51.31 | 52.84 | 36.62 | 26.41 | 31.8 |

| Unsecured Loans | 0.05 | 2.93 | 0.25 | 0.06 | 0.38 | 0 | 2.22 | 4.81 | 3.64 | 0.62 |

| Total Debt | 85.23 | 87.02 | 93.78 | 105.3 | 85.94 | 51.31 | 55.06 | 41.43 | 30.05 | 32.42 |

| Other Liabilities | 59.24 | 50.11 | 36.9 | 43.21 | 44.29 | 25.97 | 9.92 | 3.36 | 0.15 | 0.61 |

| Total Liabilities | 239.37 | 209.26 | 188.01 | 203.47 | 182.61 | 122.93 | 105.87 | 60.05 | 42.62 | 44.26 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 298.05 | 236.3 | 201.56 | 199.31 | 171.35 | 112.83 | 87.01 | 56.37 | 28.06 | 30.1 |

| Less : Accumulated Depreciation | 117.63 | 92.49 | 77.99 | 60.12 | 40.41 | 28.12 | 23.02 | 17.67 | 0 | 0 |

| Net Block | 180.42 | 143.81 | 123.57 | 139.19 | 130.94 | 84.71 | 63.99 | 38.7 | 28.06 | 30.1 |

| Capital Work in Progress | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.82 |

| Inventories | 1.97 | 2.98 | 3.63 | 5.34 | 3.37 | 3.25 | 2.09 | 1.43 | 0.75 | 0.47 |

| Sundry Debtors | 52.82 | 53.59 | 62.31 | 62.81 | 43.82 | 35.05 | 28.73 | 14.28 | 10.31 | 12.17 |

| Cash and Bank Balance | 0.2 | 11.55 | 2.91 | 2.67 | 9.21 | 5.4 | 17.22 | 6.2 | 4.33 | 2.22 |

| Loans and Advances | 7.23 | 7.77 | 9.46 | 8.91 | 8.71 | 6.76 | 4.28 | 5.65 | 2.68 | 2.05 |

| Total Current Assets | 62.22 | 75.88 | 78.3 | 79.73 | 65.1 | 50.45 | 52.32 | 27.57 | 18.07 | 16.91 |

| Current Liabilities | 7.75 | 10.82 | 11.22 | 12.37 | 9.26 | 9.8 | 8.39 | 4.79 | 2.85 | 3.27 |

| Provisions | 5 | 2.41 | 0.44 | 0 | 1.55 | 1.36 | 1.27 | 0.83 | 0.47 | 0.23 |

| Total Current Liabilities & Provisions | 12.75 | 13.23 | 11.66 | 12.37 | 10.81 | 11.15 | 9.66 | 5.61 | 3.32 | 3.5 |

| Net Current Assets | 49.47 | 62.65 | 66.64 | 67.36 | 54.29 | 39.3 | 42.67 | 21.96 | 14.74 | 13.41 |

| Deferred Tax Liability | 4.9 | 4.33 | 3.5 | 3.09 | 2.61 | 1.6 | 1.11 | 0.61 | 0.19 | 0.07 |

| Net Deferred Tax | -4.9 | -4.33 | -3.5 | -3.09 | -2.61 | -1.6 | -1.11 | -0.61 | -0.19 | -0.07 |

| Other Assets | 14.38 | 7.11 | 1.28 | 0 | 0 | 0.53 | 0.33 | 0 | 0.01 | 0.01 |

| Total Assets | 239.37 | 209.24 | 188 | 203.46 | 182.62 | 122.94 | 105.88 | 60.04 | 42.62 | 44.26 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 21.71 |

| Depreciation | 29.37 |

| Interest (Net) | 6.74 |

| P/L on Sales of Assets | -1.32 |

| Prov. and W/O (Net) | -5.57 |

| Others | 6.64 |

| Total Adjustments (PBT and Ext... | 29.22 |

| Operating Profit before Workin... | 50.92 |

| Trade and 0ther Receivables | 0.77 |

| Inventories | 1.01 |

| Trade Payables | -2.52 |

| Total Adjustments (OP before W... | -3.01 |

| Cash Generated from/(used in) ... | 47.91 |

| Direct Taxes Paid | -1.68 |

| Total Adjustments(Cash Generat... | -1.68 |

| Cash Flow before Extraordinary... | 46.23 |

| Net Cash from Operating Activi... | 46.23 |

| Purchased of Fixed Assets | -60.1 |

| Sale of Fixed Assets | 4.4 |

| Interest Received | 0.41 |

| Net Cash used in Investing Act... | -55.29 |

| Proceed from 0ther Long Term B... | 1.58 |

| Of the Short Term Borrowings | -3.37 |

| Interest Paid | -7.15 |

| Net Cash used in Financing Act... | -2.29 |

Company Details

Registered Office |

|

| Address | 342 Industrial Area Phase-I, |

| City | Chandigarh |

| State | Chandigarh |

| Pin Code | 160002 |

| Tel. No. | 91-172-2650380 |

| Fax. No. | |

| info@tarachandindia.in | |

| Internet | http://www.tarachandindia.in |

Registrars |

|

| Address | 342 Industrial Area Phase-I |

| City | Chandigarh |

| State | Chandigarh |

| Pin Code | 160002 |

| Tel. No. | 91-172-2650380 |

| Fax. No. | |

| info@tarachandindia.in | |

| Internet | http://www.tarachandindia.in |

Management |

|

| Name | Designation |

| Vinay Kumar | Chairman & Managing Director |

| Ajay Kumar | Whole-time Director |

| Himanshu Aggarwal | Executive Director |

| Prerna Sandeep Agarwal | Director |

| Niranjan Kumar Roy | Independent Director |

| Nishu Kansal | Company Secretary |

| Sant Kumar Joshi | Independent Director |