Star Health & Allied Insurance Company Ltd

NSE :STARHEALTH BSE :543412 Sector : InsuranceBuy, Sell or Hold STARHEALTH? Ask The Analyst

BSE

Apr 22, 00:00

401.55

3.85 (0.97%)

prev close

397.70

OPEN PRICE

397.55

volume

33400

Today's low / high

390.05 / 403.00

52 WK low / high

330.05 / 647.65

bid price (qty)

0 (0)

offer price (qty)

0 (0)

NSE

Apr 22, 00:00

400.80

5.90 (1.49%)

prev close

394.90

open price

394.90

volume

503532

Today's' low / high

390.05 / 402.95

52 WK low / high

327.30 / 647.00

bid price (qty)

0 (0)

offer price (qty)

400.80 (919)

| 22 Apr 400.80 (1.49%) | 21 Apr 394.90 (1.15%) | 17 Apr 390.40 (1.10%) | 16 Apr 386.15 (0.78%) | 15 Apr 383.15 (6.34%) | 11 Apr 360.30 (0.59%) | 09 Apr 358.20 (2.45%) | 08 Apr 349.65 (0.98%) | 07 Apr 346.25 (-0.52%) | 04 Apr 348.05 (-0.73%) | 03 Apr 350.60 (2.19%) | 02 Apr 343.10 (-0.52%) | 01 Apr 344.90 (-3.29%) | 28 Mar 356.65 (-0.46%) | 27 Mar 358.30 (1.49%) | 26 Mar 353.05 (1.74%) | 25 Mar 347.00 (-3.34%) | 24 Mar 359.00 (-1.50%) | 21 Mar 364.45 (1.55%) | 20 Mar 358.90 (0.77%) | 19 Mar 356.15 (0.47%) |

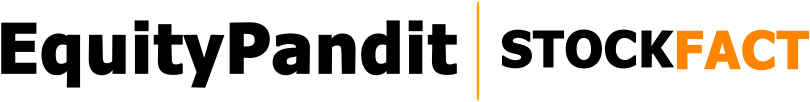

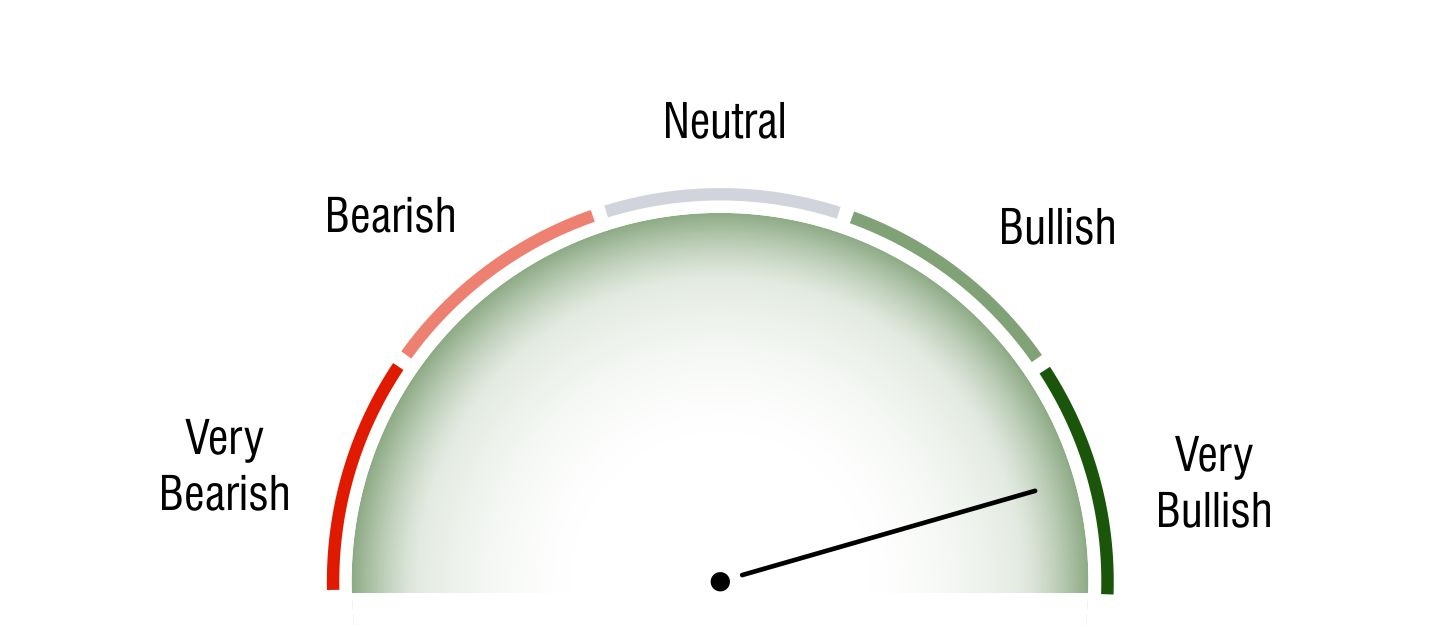

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Neutral

Long Term Investors

Bearish

Moving Averages

5 DMA

Bullish

391.74

10 DMA

Bullish

372.08

20 DMA

Bullish

362.92

50 DMA

Bullish

375.35

100 DMA

Bearish

421.77

200 DMA

Bearish

496.83

Intraday Support and Resistance

(Based on Pivot Points) NSE : 400.80 | BSE : 401.55

Updated On Apr 22, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 418.71 | 410.83 | 404.35 | - | - |

| R2 | 410.83 | 405.9 | 403.17 | 411.55 | - |

| R1 | 405.81 | 402.86 | 401.98 | 407.25 | 408.33 |

| P | 397.93 | 397.93 | 397.93 | 398.65 | 399.19 |

| S1 | 392.91 | 393 | 399.62 | 394.35 | 395.43 |

| S2 | 385.03 | 389.96 | 398.44 | 385.75 | - |

| S3 | 380.01 | 385.03 | 397.25 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Star Health & Allied Insurance Company Ltd Quaterly Results

| INCOME | |

| PROFIT | |

| EPS |

Star Health & Allied Insurance Company Ltd Quaterly Results

| INCOME | 3578.73 | 3691.77 | 3817.07 | 4060.62 | 4147.58 | |

| PROFIT | 289.56 | 142.32 | 318.93 | 111.29 | 215.14 | |

| EPS | 4.95 | 2.43 | 5.45 | 1.9 | 3.66 |

Profit & Loss (Figures in Rs. Crores)

Star Health & Allied Insurance Company Ltd Profit & Loss

| INCOME | |

| PROFIT | |

| EPS |

Star Health & Allied Insurance Company Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 1069.14 | 1595.07 | 2012.1 | 2887.53 | 3775.06 | 4986.55 | 5050.63 | 10610.09 | 12101.86 | 14026.44 | |

| PROFIT | -140.05 | 136.58 | 117.94 | 170.15 | 128.22 | 267.9 | -1082.61 | -1039.31 | 618.78 | 845.15 | |

| EPS | -3.87 | 3.53 | 2.59 | 3.73 | 2.81 | 5.46 | -19.81 | -18.08 | 10.63 | 14.44 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 585.28 | 581.68 | 575.52 | 548.09 | 490.64 | 455.58 | 455.58 | 455.58 | 386.99 | 362.14 |

| Reserves Total | 5,798.7 | 4,861.57 | 4,044.67 | 2,946.76 | 1,153.04 | 422.62 | 504.01 | 333.86 | -26.89 | -220.29 |

| Equity Application Money | 0 | 0 | 0 | 0.29 | 0 | 350 | 0 | 0 | 0 | 0 |

| Total Shareholders Funds | 6,383.98 | 5,443.25 | 4,620.19 | 3,495.14 | 1,643.68 | 1,228.2 | 959.59 | 789.44 | 360.1 | 141.85 |

| Unsecured Loans | 470 | 470 | 720 | 250 | 250 | 250 | 250 | 0 | 0 | 0 |

| Total Loan Funds | 470 | 470 | 720 | 250 | 250 | 250 | 250 | 0 | 0 | 0 |

| Other Liabilities | 61.21 | 14.03 | 10.54 | -3.1 | 3.09 | 0 | 0 | 0 | 0 | 0 |

| Total Liabilities | 6,915.19 | 5,927.28 | 5,350.73 | 3,742.04 | 1,896.77 | 1,478.2 | 1,209.59 | 789.44 | 360.1 | 141.85 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 733.98 | 525.65 | 371.78 | 420.01 | 285.14 | 259.29 | 240.89 | 202.46 | 167.8 | 134.27 |

| Less: Accumulated Depreciation | 364.87 | 308.2 | 258.65 | 236.9 | 195 | 174.7 | 148.55 | 125.49 | 105.58 | 88.09 |

| Net Block | 369.11 | 217.45 | 113.13 | 183.11 | 90.14 | 84.59 | 92.34 | 76.97 | 62.22 | 46.18 |

| Capital Work in Progress | 16.48 | 9.93 | 4 | 19.25 | 11.73 | 13.48 | 4.62 | 6.84 | 3.2 | 12.29 |

| Investments | 15,280.43 | 13,276.06 | 11,373.43 | 6,733.3 | 4,289.95 | 3,030.1 | 2,164.72 | 1,428.48 | 806.71 | 501.84 |

| Cash and Bank Balance | 444.58 | 309.36 | 563.54 | 1,878.99 | 611.44 | 893.02 | 502 | 331.11 | 271.94 | 327.79 |

| Loans and Advances | 1,298.96 | 844.41 | 683.24 | 1,265.02 | 976.74 | 709.27 | 583.5 | 369.22 | 228.04 | 207.69 |

| Total Current Assets | 1,743.55 | 1,153.77 | 1,246.79 | 3,144.02 | 1,588.18 | 1,602.3 | 1,085.49 | 700.33 | 499.98 | 535.48 |

| Current Liabilities | 2,477.85 | 2,030.09 | 1,961.15 | 1,564.3 | 1,179.36 | 900.34 | 537.49 | 278.16 | 238.13 | 209.72 |

| Provisions | 8,374.69 | 7,268.74 | 6,202.17 | 5,194.64 | 3,050.6 | 2,493.93 | 1,600.09 | 1,145.02 | 773.88 | 744.21 |

| Total Current Liabilities & Provisions | 10,852.54 | 9,298.83 | 8,163.32 | 6,758.94 | 4,229.96 | 3,394.27 | 2,137.58 | 1,423.18 | 1,012 | 953.93 |

| Net Current Assets | -9,109 | -8,145.06 | -6,916.53 | -3,614.93 | -2,641.78 | -1,791.97 | -1,052.09 | -722.85 | -512.02 | -418.45 |

| Deferred Tax Assets | 358.18 | 568.9 | 776.71 | 421.31 | 146.73 | 142 | 0 | 0 | 0 | 0 |

| Net Deferred Tax | 358.18 | 568.9 | 776.71 | 421.31 | 146.73 | 142 | 0 | 0 | 0 | 0 |

| Total Assets | 6,915.19 | 5,927.28 | 5,350.74 | 3,742.04 | 1,896.77 | 1,478.2 | 1,209.59 | 789.44 | 360.1 | 141.86 |

| Contingent Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 62.68 | 0 | 0 | 0 |

Cash Flow (Figures in Rs. Crores)

| Direct Taxes Paid | -98.24 |

| Total Adjustments(Cash Generat... | 1,309.96 |

| Cash Flow before Extraordinary... | 1,309.96 |

| Net Cash from Operating Activi... | 1,309.96 |

| Purchased of Fixed Assets | -123.49 |

| Sale of Fixed Assets | 0.9 |

| Purchase of Investments | -1,78,540.66 |

| Sale of Investments | 1,76,509.28 |

| Net Cash used in Investing Act... | -1,176.71 |

| Proceeds from Issue of shares ... | 64.1 |

| Interest Paid | -41.13 |

| Net Cash used in Financing Act... | 22.97 |

Company Details

Registered Office |

|

| Address | 1 New Tank St. Valluvarkottam, High Road Nungambakkam |

| City | Chennai |

| State | Tamil Nadu |

| Pin Code | 600034 |

| Tel. No. | 91-44-2828 8800 |

| Fax. No. | |

| investors@starhealth.in | |

| Internet | http://www.starhealth.in |

Registrars |

|

| Address | 1 New Tank St. Valluvarkottam |

| City | Chennai |

| State | Tamil Nadu |

| Pin Code | 600034 |

| Tel. No. | 91-44-2828 8800 |

| Fax. No. | |

| investors@starhealth.in | |

| Internet | http://www.starhealth.in |

Management |

|

| Name | Designation |

| Sumir Chadha | Nominee |

| DEEPAK RAMINEEDI | Nominee |

| Utpal Seth | Nominee |

| Rohit Bhasin | Independent Director |

| Anisha Motwani | Independent Director |

| Berjis M Desai | Independent Director |

| Rajeev Krishnamuralilal Agarwal | Independent Director |

| Anand Shankar Roy | Managing Director & CEO |

| Rajni Sekhri Sibal | Independent Director |

| Jayashree Sethuraman | Company Sec. & Compli. Officer |

| Rajeev Kher | Independent Director |