QMS Medical Allied Services Ltd

NSE :QMSMEDI BSE :535483 Sector : TradingBuy, Sell or Hold QMSMEDI? Ask The Analyst

BSE

prev close

OPEN PRICE

bid price (qty)

offer price (qty)

volume

Today's low / high

52 WK low / high

NSE

prev close

open price

bid price (qty)

offer price (qty)

volume

Today's' low / high

52 WK low / high

| 30 Apr 107.30 (-0.92%) | 29 Apr 108.30 (-0.51%) | 26 Apr 108.85 (0.74%) | 25 Apr 108.05 (-4.38%) | 24 Apr 113.00 (-1.57%) | 23 Apr 114.80 (3.56%) | 22 Apr 110.85 (3.74%) | 19 Apr 106.85 (3.29%) | 18 Apr 103.45 (-9.17%) | 16 Apr 113.90 (-2.65%) | 15 Apr 117.00 (-0.04%) | 12 Apr 117.05 (-1.51%) | 10 Apr 118.85 (2.19%) | 09 Apr 116.30 (-1.36%) | 08 Apr 117.90 (0.26%) | 05 Apr 117.60 (-2.00%) | 04 Apr 120.00 (0.00%) | 03 Apr 120.00 (1.61%) | 02 Apr 118.10 (-1.17%) | 01 Apr 119.50 (2.09%) | 28 Mar 117.05 (0.91%) |

Price Chart Historical Data Technical Chart

Technical Analysis

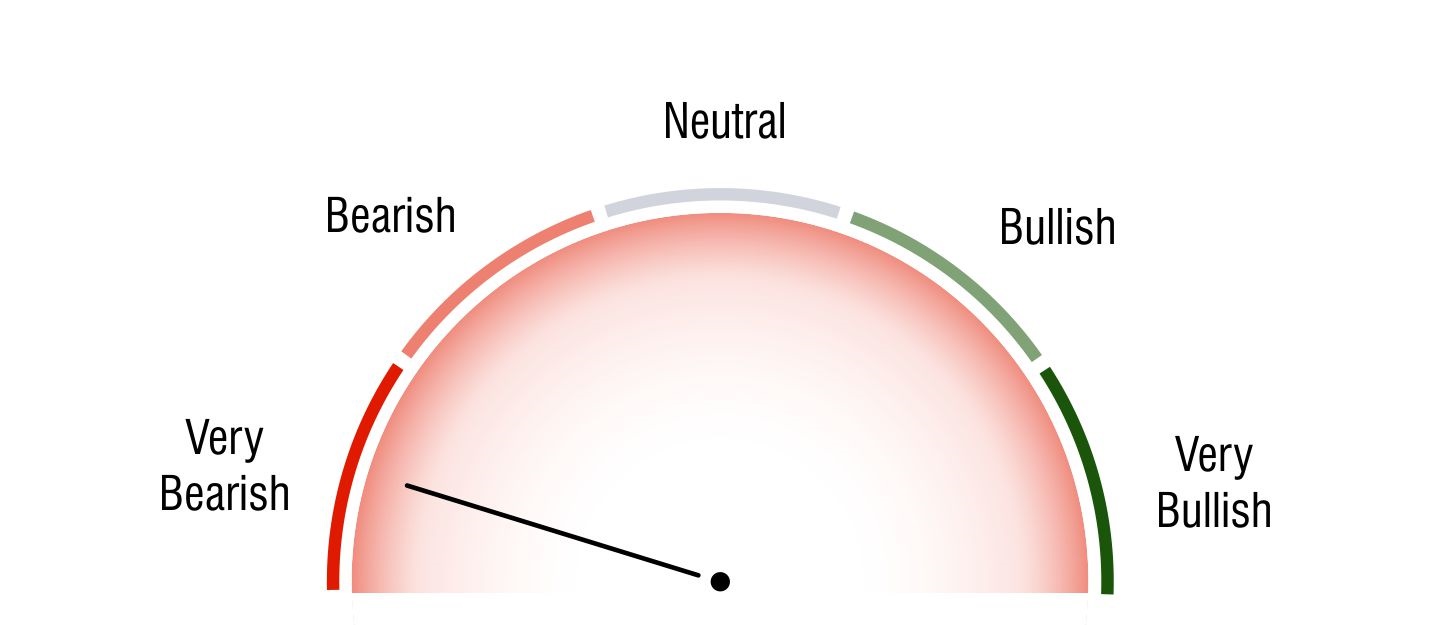

Short Term Investors

Very Bearish

Medium Term Investors

Very Bearish

Long Term Investors

Very Bearish

Moving Averages

5 DMA

Bearish

109.1

10 DMA

Bearish

109.54

20 DMA

Bearish

113.88

50 DMA

Bearish

125.69

100 DMA

Bearish

131.52

200 DMA

Bearish

137.96

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On Apr 30, 2024 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 114.1 | 112.5 | 108.46 | - | - |

| R2 | 112.5 | 110.9 | 108.07 | 112.25 | - |

| R1 | 109.9 | 109.9 | 107.69 | 109.4 | 111.2 |

| P | 108.3 | 108.3 | 108.3 | 108.05 | 108.95 |

| S1 | 105.7 | 106.7 | 106.92 | 105.2 | 107 |

| S2 | 104.1 | 105.7 | 106.53 | 103.85 | - |

| S3 | 101.5 | 104.1 | 106.15 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

QMS Medical Allied Services Ltd Quaterly Results

| INCOME | |||||

| PROFIT | |||||

| EPS |

QMS Medical Allied Services Ltd Quaterly Results

| INCOME | 20.89 | 31.56 | 26.04 | 28.76 | 35.38 |

| PROFIT | 2.51 | 1.57 | 2.46 | 2.56 | 2.44 |

| EPS | 1.43 | 0.88 | 1.38 | 1.43 | 1.37 |

Profit & Loss (Figures in Rs. Crores)

QMS Medical Allied Services Ltd Profit & Loss

| INCOME | |

| PROFIT | |

| EPS |

QMS Medical Allied Services Ltd Profit & Loss

| Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | ||

| INCOME | 4.47 | 56.47 | 79.52 | 126.7 | 151.69 | 110.46 | |

| PROFIT | 0.01 | 3.07 | 6.32 | 10.92 | 9.69 | 6.38 | |

| EPS | 6.6 | 3066.23 | 21 | 29.02 | 28.4 | 3.57 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | |

| SOURCES OF FUNDS : | ||||||

| Share Capital | 17.85 | 3.76 | 3.76 | 3.01 | 0.01 | 0.01 |

| Reserves Total | 52.55 | 27.27 | 16.56 | 6.4 | 3.07 | 0.01 |

| Total Shareholders Funds | 70.4 | 31.03 | 20.32 | 9.41 | 3.08 | 0.02 |

| Secured Loans | 25.52 | 31.38 | 18.05 | 8.99 | 3.76 | 0 |

| Unsecured Loans | 0 | 0.59 | 1.55 | 2.61 | 0.79 | 0.05 |

| Total Debt | 25.52 | 31.97 | 19.6 | 11.6 | 4.55 | 0.05 |

| Other Liabilities | 0.09 | 0 | 0 | 0 | 0 | 0 |

| Total Liabilities | 96.01 | 63 | 39.92 | 21.01 | 7.63 | 0.07 |

| APPLICATION OF FUNDS : | ||||||

| Gross Block | 28.37 | 9.91 | 11.3 | 3.63 | 0.15 | 0 |

| Less : Accumulated Depreciation | 3.01 | 1.94 | 1.13 | 0.39 | 0.03 | 0 |

| Net Block | 25.36 | 7.97 | 10.17 | 3.24 | 0.12 | 0 |

| Capital Work in Progress | 1.15 | 0 | 0 | 0 | 0 | 0 |

| Inventories | 29.93 | 24.25 | 20.31 | 15.69 | 8.95 | 4.39 |

| Sundry Debtors | 39.04 | 42.04 | 22.98 | 11.21 | 8.02 | 0.09 |

| Cash and Bank Balance | 2.37 | 2.16 | 1.38 | 0.66 | 0.14 | 0.03 |

| Loans and Advances | 15.59 | 5.62 | 5.12 | 2.49 | 0.66 | 0.58 |

| Total Current Assets | 86.93 | 74.08 | 49.79 | 30.05 | 17.77 | 5.08 |

| Current Liabilities | 20.16 | 18.61 | 19.14 | 11.84 | 10.04 | 5.01 |

| Provisions | 1.17 | 0.61 | 1.25 | 0.63 | 0.21 | 0.01 |

| Total Current Liabilities & Provisions | 21.33 | 19.22 | 20.39 | 12.47 | 10.25 | 5.02 |

| Net Current Assets | 65.6 | 54.87 | 29.4 | 17.58 | 7.52 | 0.07 |

| Deferred Tax Liability | 0.39 | 0.26 | 0.06 | 0 | 0 | 0 |

| Net Deferred Tax | -0.39 | -0.26 | -0.06 | 0 | 0 | 0 |

| Other Assets | 4.29 | 0.43 | 0.41 | 0.19 | 0 | 0 |

| Total Assets | 96.02 | 63.01 | 39.93 | 21.01 | 7.64 | 0.07 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 6.38 |

| Depreciation | 1.07 |

| Interest (Net) | -0.33 |

| Prov. and W/O (Net) | 2.19 |

| Total Adjustments (PBT and Ext... | 3.07 |

| Operating Profit before Workin... | 9.45 |

| Trade and 0ther Receivables | 3 |

| Inventories | -5.68 |

| Trade Payables | 2.44 |

| Loans and Advances | -0.44 |

| Change in Borrowing | -5.41 |

| Total Adjustments (OP before W... | -14.71 |

| Cash Generated from/(used in) ... | -5.27 |

| Direct Taxes Paid | -2.27 |

| Total Adjustments(Cash Generat... | -2.27 |

| Cash Flow before Extraordinary... | -7.54 |

| Net Cash from Operating Activi... | -7.54 |

| Purchased of Fixed Assets | -1.69 |

| Purchase of Investments | -19.62 |

| Interest Received | 0.62 |

| Net Cash used in Investing Act... | -25.1 |

| Proceeds from Issue of shares ... | 32.99 |

| Proceed from 0ther Long Term B... | 0.75 |

| Of the Long Tem Borrowings | -1.79 |

| Interest Paid | -0.21 |

| Net Cash used in Financing Act... | 31.74 |

Company Details

Registered Office |

|

| Address | A1/A2/B1/B2 Navkala BhartiBldg, Plot No 16 Prabhat Colony |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400055 |

| Tel. No. | 91-22-6288 1111 |

| Fax. No. | |

| contact@qmsmas.com | |

| Internet | http://www.qmsmas.com |

Registrars |

|

| Address | A1/A2/B1/B2 Navkala BhartiBldg |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400055 |

| Tel. No. | 91-22-6288 1111 |

| Fax. No. | |

| contact@qmsmas.com | |

| Internet | http://www.qmsmas.com |

Management |

|

| Name | Designation |

| Mahesh Makhija | Chairperson & M D |

| Diti Makhija | Non-Exec & Non-Independent Dir |

| Guddi Makhija | Whole-time Director |

| Gautam Khanna. | Non-Exec. & Independent Dir. |

| Raju Bhatia | Non-Exec. & Independent Dir. |

| Deepali Malpani | Company Sec. & Compli. Officer |