AAVAS Financiers Ltd

NSE :AAVAS BSE :541988 Sector : FinanceBuy, Sell or Hold AAVAS? Ask The Analyst

BSE

prev close

OPEN PRICE

volume

Today's low / high

52 WK low / high

bid price (qty)

offer price (qty)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 08 Apr 2083.35 (5.28%) | 07 Apr 1978.95 (-3.56%) | 04 Apr 2052.10 (-2.03%) | 03 Apr 2094.60 (0.46%) | 02 Apr 2085.00 (-0.05%) | 01 Apr 2086.05 (0.10%) | 28 Mar 2084.05 (-0.15%) | 27 Mar 2087.20 (3.66%) | 26 Mar 2013.60 (2.89%) | 25 Mar 1957.05 (-2.41%) | 24 Mar 2005.30 (1.22%) | 21 Mar 1981.05 (0.05%) | 20 Mar 1980.00 (3.23%) | 19 Mar 1918.05 (2.84%) | 18 Mar 1865.10 (-2.35%) | 17 Mar 1909.90 (2.00%) | 13 Mar 1872.45 (3.09%) | 12 Mar 1816.25 (2.57%) | 11 Mar 1770.80 (1.05%) | 10 Mar 1752.35 (3.13%) | 07 Mar 1699.20 (-0.40%) |

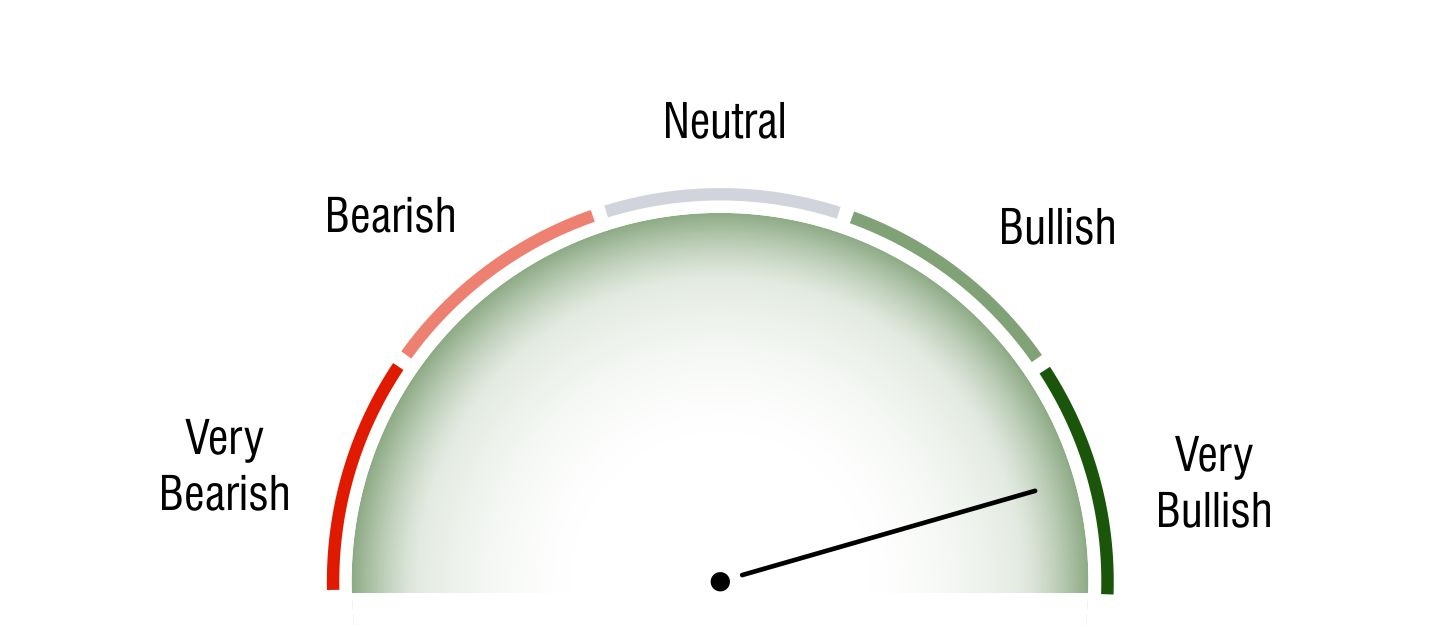

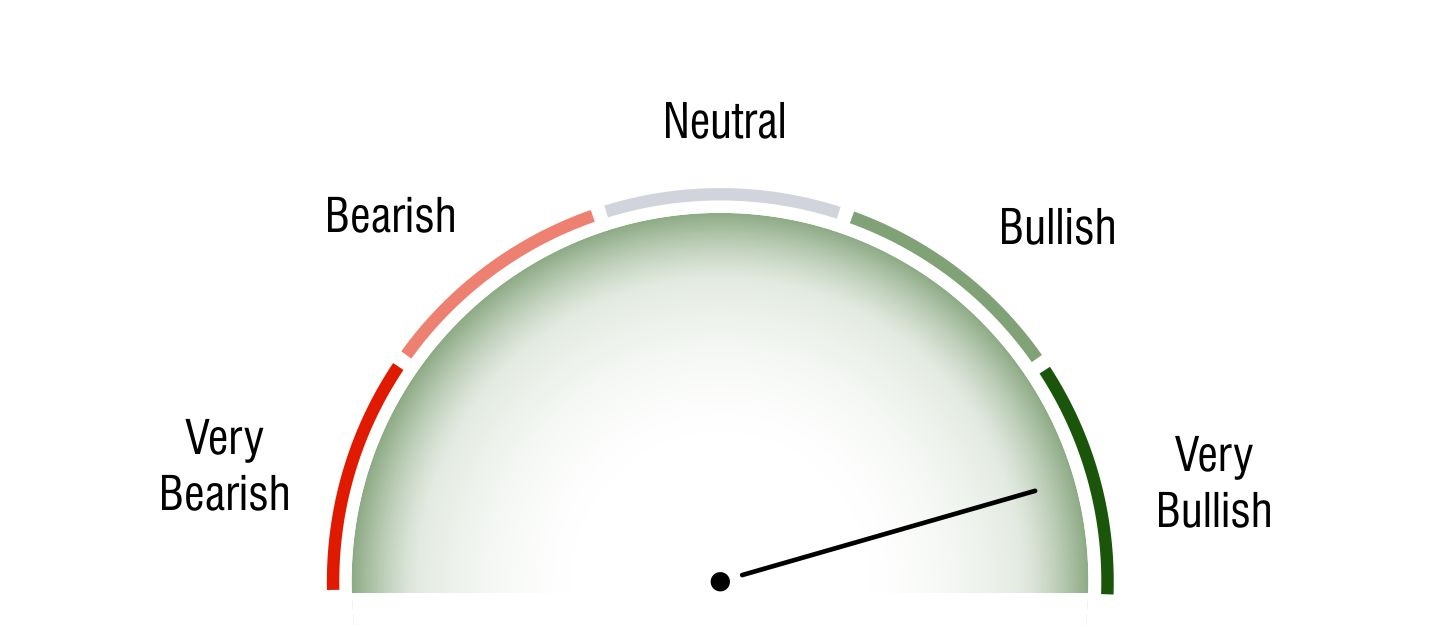

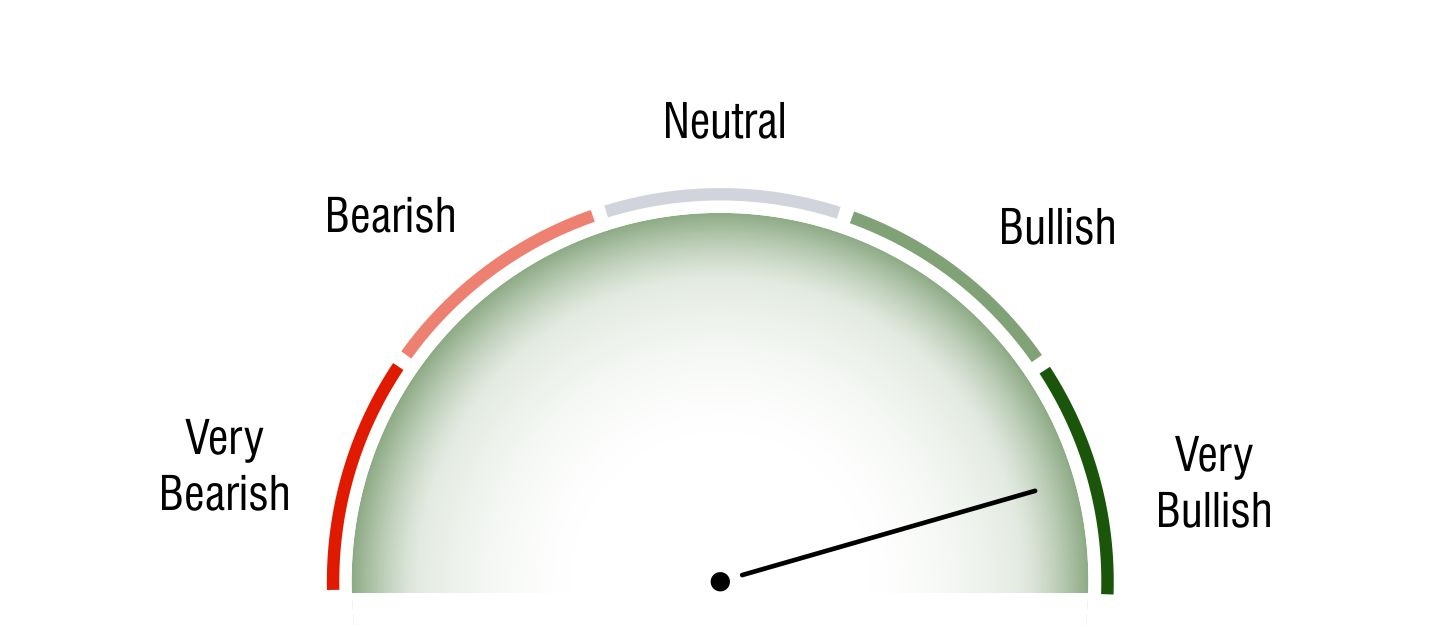

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Very Bullish

Long Term Investors

Very Bullish

Moving Averages

5 DMA

Bullish

2059.53

10 DMA

Bullish

2052.63

20 DMA

Bullish

1970

50 DMA

Bullish

1804.5

100 DMA

Bullish

1736.43

200 DMA

Bullish

1744.36

Intraday Support and Resistance

(Based on Pivot Points) undefined |

Updated On Apr 08, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 2184.15 | 2139.05 | 2103.41 | - | - |

| R2 | 2139.05 | 2111.18 | 2096.72 | 2143.36 | - |

| R1 | 2111.2 | 2093.97 | 2090.04 | 2119.82 | 2125.13 |

| P | 2066.1 | 2066.1 | 2066.1 | 2070.41 | 2073.06 |

| S1 | 2038.25 | 2038.23 | 2076.66 | 2046.87 | 2052.18 |

| S2 | 1993.15 | 2021.02 | 2069.98 | 1997.46 | - |

| S3 | 1965.3 | 1993.15 | 2063.29 | - | - |

Key Metrics

EPS

71.13

P/E

29.28

P/B

4.07

Dividend Yield

0%

Market Cap

16,490 Cr.

Face Value

10

Book Value

511.46

ROE

13.93%

EBITDA Growth

407.02 Cr.

Debt/Equity

3.16

Shareholding History

Quarterly Result (Figures in Rs. Crores)

AAVAS Financiers Ltd Quaterly Results

| Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | ||

| INCOME | 450.4 | 467.02 | 497.62 | 509.26 | 546.8 | |

| PROFIT | 126.83 | 109.83 | 121.66 | 116.72 | 142.48 | |

| EPS | 16.05 | 13.89 | 15.38 | 14.75 | 18 |

AAVAS Financiers Ltd Quaterly Results

| Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | ||

| INCOME | 509.2 | 546.8 | 542.56 | 580.45 | 597.92 | |

| PROFIT | 116.65 | 142.62 | 126.1 | 147.91 | 146.42 | |

| EPS | 14.74 | 18.02 | 15.93 | 18.69 | 18.5 |

Profit & Loss (Figures in Rs. Crores)

AAVAS Financiers Ltd Profit & Loss

| Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 494.48 | 711.17 | 903.35 | 1105.52 | 1305.65 | 1610.6 | 2020.7 | |

| PROFIT | 93.03 | 176.02 | 249.04 | 288.85 | 355.17 | 429.42 | 490.45 | |

| EPS | 0 | 22.54 | 31.8 | 36.8 | 45 | 54.35 | 62 |

AAVAS Financiers Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 103.76 | 190.9 | 305.49 | 494.45 | 710.97 | 903.09 | 1105.33 | 1305.56 | 1610.14 | 2020.3 | |

| PROFIT | 19.08 | 32.78 | 57.14 | 93.08 | 175.9 | 249.12 | 289.43 | 356.79 | 429.85 | 490.45 | |

| EPS | 5.8 | 8.54 | 9.82 | 13.46 | 22.52 | 31.81 | 36.88 | 45.2 | 54.4 | 62 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | |

| SOURCES OF FUNDS : | |||||||

| Share Capital | 79.14 | 79.06 | 78.94 | 78.5 | 78.32 | 78.11 | 69.17 |

| Reserves Total | 3,694.18 | 3,190.54 | 2,727.09 | 2,322.3 | 2,019.57 | 1,758.91 | 1,120.67 |

| Equity Application Money | 0 | 0.07 | 0.41 | 0 | 0.03 | 0 | 0 |

| Total Shareholders Funds | 3,773.32 | 3,269.67 | 2,806.44 | 2,400.8 | 2,097.92 | 1,837.02 | 1,189.84 |

| Secured Loans | 11,878.3 | 9,233.24 | 7,315.85 | 6,046.71 | 5,053.7 | 3,355.27 | 2,652.9 |

| Unsecured Loans | 520 | 654.04 | 696.13 | 331.01 | 328.47 | 297.98 | 102.15 |

| Total Loan Funds | 12,398.3 | 9,887.28 | 8,011.98 | 6,377.72 | 5,382.17 | 3,653.25 | 2,755.05 |

| Other Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 6.9 |

| Total Liabilities | 16,171.62 | 13,156.95 | 10,818.42 | 8,778.52 | 7,480.09 | 5,490.27 | 3,951.79 |

| APPLICATION OF FUNDS : | |||||||

| Loan / Non-Current Assets | 14,004.37 | 11,476.27 | 9,053.42 | 7,523.29 | 6,180.8 | 4,724.49 | 3,333.42 |

| Gross Block | 254.04 | 187.89 | 148.41 | 117.93 | 99.71 | 43.38 | 29.6 |

| Less: Accumulated Depreciation | 138.04 | 109.52 | 82.25 | 59.67 | 39.81 | 20.56 | 11.17 |

| Net Block | 116 | 78.37 | 66.16 | 58.26 | 59.9 | 22.82 | 18.43 |

| Capital Work in Progress | 11.21 | 20.37 | 2.1 | 0.41 | 0.71 | 0.09 | 0.03 |

| Investments | 182.16 | 110.72 | 52.52 | 0 | 0 | 0 | 0 |

| Sundry Debtors | 12.22 | 1.22 | 0 | 0 | 0 | 0 | 0 |

| Cash and Bank Balance | 1,797.82 | 1,392.83 | 1,545.73 | 1,125.17 | 1,196.73 | 683.82 | 569.46 |

| Loans and Advances | 395.69 | 329.82 | 297.55 | 252.13 | 218.9 | 195.68 | 108.77 |

| Total Current Assets | 2,205.73 | 1,723.88 | 1,843.28 | 1,377.3 | 1,415.62 | 879.5 | 678.23 |

| Current Liabilities | 279.18 | 196.82 | 160.43 | 148.71 | 138 | 89.45 | 73.2 |

| Provisions | 8.4 | 6.6 | 4.07 | 3.72 | 7.28 | 4.43 | 3.7 |

| Total Current Liabilities & Provisions | 287.58 | 203.42 | 164.5 | 152.43 | 145.28 | 93.88 | 76.91 |

| Net Current Assets | 1,918.15 | 1,520.46 | 1,678.79 | 1,224.87 | 1,270.34 | 785.62 | 601.32 |

| Deferred Tax Assets | 26.49 | 24.95 | 29.24 | 24 | 15.21 | 10.75 | 27.37 |

| Deferred Tax Liability | 86.74 | 74.2 | 63.82 | 52.29 | 46.88 | 53.5 | 38.72 |

| Net Deferred Tax | -60.25 | -49.25 | -34.58 | -28.29 | -31.67 | -42.75 | -11.35 |

| Other Assets | 0 | 0 | 0 | 0 | 0 | 0 | 9.95 |

| Total Assets | 16,171.63 | 13,156.93 | 10,818.41 | 8,778.54 | 7,480.08 | 5,490.27 | 3,951.8 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 79.14 | 79.06 | 78.94 | 78.5 | 78.32 | 78.11 | 69.17 | 58.16 | 38.38 | 32.92 |

| Reserves Total | 3,694.18 | 3,190.54 | 2,729.3 | 2,322.9 | 2,019.58 | 1,758.85 | 1,120.73 | 508.16 | 165.44 | 68.52 |

| Total Shareholders Funds | 3,773.32 | 3,269.67 | 2,808.65 | 2,401.4 | 2,097.93 | 1,836.96 | 1,189.9 | 566.32 | 203.82 | 101.44 |

| Secured Loans | 11,878.3 | 9,233.24 | 7,315.85 | 6,046.71 | 5,053.7 | 3,355.27 | 2,652.9 | 1,763.39 | 1,416.77 | 650.4 |

| Unsecured Loans | 520 | 654.04 | 696.13 | 331.01 | 328.47 | 297.98 | 102.15 | 30 | 30 | 53.85 |

| Total Loan Funds | 12,398.3 | 9,887.28 | 8,011.98 | 6,377.72 | 5,382.17 | 3,653.25 | 2,755.05 | 1,793.39 | 1,446.77 | 704.25 |

| Other Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 6.9 | 13.84 | 18.79 | 8.58 |

| Total Liabilities | 16,171.62 | 13,156.95 | 10,820.63 | 8,779.12 | 7,480.1 | 5,490.21 | 3,951.85 | 2,373.55 | 1,669.38 | 814.27 |

| APPLICATION OF FUNDS : | ||||||||||

| Loan / Non-Current Assets | 14,004.37 | 11,476.27 | 9,053.42 | 7,523.29 | 6,180.8 | 4,724.49 | 3,333.42 | 0 | 0 | 0 |

| Gross Block | 254.02 | 187.87 | 148.4 | 117.92 | 99.7 | 43.38 | 29.6 | 15.72 | 8.42 | 6.92 |

| Less: Accumulated Depreciation | 138.03 | 109.51 | 82.24 | 59.66 | 39.81 | 20.56 | 11.17 | 5.55 | 2.78 | 1.5 |

| Net Block | 115.99 | 78.36 | 66.16 | 58.26 | 59.89 | 22.82 | 18.43 | 10.17 | 5.64 | 5.42 |

| Capital Work in Progress | 11.21 | 20.37 | 2.1 | 0.41 | 0.71 | 0.09 | 0.03 | 0.14 | 0 | 0 |

| Investments | 182.16 | 123.08 | 67.52 | 4.5 | 4.5 | 4.5 | 4.5 | 0.78 | 0 | 0 |

| Sundry Debtors | 12.22 | 1.22 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash and Bank Balance | 1,797.82 | 1,381.63 | 1,530.23 | 1,120.96 | 1,192.06 | 679.15 | 564.96 | 275.77 | 234.9 | 11.12 |

| Loans and Advances | 395.69 | 329.6 | 300.96 | 252.63 | 219.1 | 195.78 | 108.81 | 103.48 | 68.08 | 45.94 |

| Total Current Assets | 2,205.73 | 1,712.45 | 1,831.19 | 1,373.59 | 1,411.16 | 874.93 | 673.77 | 379.25 | 302.98 | 57.06 |

| Current Liabilities | 279.18 | 196.81 | 160.38 | 148.67 | 137.96 | 89.44 | 73.19 | 70.27 | 38.78 | 36.85 |

| Provisions | 8.4 | 6.6 | 4.03 | 3.72 | 7.28 | 4.43 | 3.7 | 0.68 | 0.34 | 0.23 |

| Total Current Liabilities & Provisions | 287.58 | 203.42 | 164.4 | 152.4 | 145.25 | 93.87 | 76.9 | 70.95 | 39.12 | 37.08 |

| Net Current Assets | 1,918.15 | 1,509.03 | 1,666.78 | 1,221.2 | 1,265.91 | 781.06 | 596.88 | 308.3 | 263.86 | 19.99 |

| Deferred Tax Assets | 26.51 | 24.02 | 28.46 | 23.77 | 15.17 | 10.75 | 27.37 | 3.66 | 3.02 | 1.62 |

| Deferred Tax Liability | 86.76 | 74.2 | 63.82 | 52.29 | 46.88 | 53.5 | 38.72 | 9.83 | 5.31 | 2.66 |

| Net Deferred Tax | -60.25 | -50.18 | -35.36 | -28.52 | -31.71 | -42.75 | -11.35 | -6.17 | -2.29 | -1.04 |

| Other Assets | 0 | 0 | 0 | 0 | 0 | 0 | 9.95 | 2,060.34 | 1,402.16 | 789.89 |

| Total Assets | 16,171.63 | 13,156.93 | 10,820.62 | 8,779.13 | 7,480.1 | 5,490.21 | 3,951.86 | 2,373.56 | 1,669.37 | 814.27 |

| Contingent Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7.17 | 0 | 0 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 625.37 |

| Depreciation | 32.66 |

| P/L on Sales of Invest | -0.33 |

| Prov. and W/O (Net) | 25.8 |

| Fin. Lease and Rental Charges | 6.28 |

| Others | -0.05 |

| Total Adjustments (PBT and Ext... | 4.51 |

| Operating Profit before Workin... | 629.88 |

| Loans and Advances | -2,546.36 |

| Total Adjustments (OP before W... | -2,485.92 |

| Cash Generated from/(used in) ... | -1,856.03 |

| Direct Taxes Paid | -130.56 |

| Total Adjustments(Cash Generat... | -130.56 |

| Cash Flow before Extraordinary... | -1,986.59 |

| Net Cash from Operating Activi... | -1,986.59 |

| Purchased of Fixed Assets | -32.74 |

| Sale of Fixed Assets | 1.34 |

| Purchase of Investments | -71.43 |

| Sale of Investments | 16.58 |

| Cancellation of Investment in ... | 11.76 |

| Net Cash used in Investing Act... | -647.78 |

| Proceeds from Issue of shares ... | 2.25 |

| Proceed from 0ther Long Term B... | 4,509.73 |

| Of the Long Tem Borrowings | -2,013.88 |

| Of Financial Liabilities | -20.77 |

| Net Cash used in Financing Act... | 2,477.28 |

| Net Profit before Tax and Extr... | 624.45 |

| Depreciation | 32.66 |

| P/L on Sales of Invest | 0.6 |

| Prov. and W/O (Net) | 25.8 |

| Fin. Lease and Rental Charges | 6.28 |

| Total Adjustments (PBT and Ext... | 5.43 |

| Operating Profit before Workin... | 629.88 |

| Loans and Advances | -2,546.36 |

| Total Adjustments (OP before W... | -2,485.92 |

| Cash Generated from/(used in) ... | -1,856.03 |

| Direct Taxes Paid | -130.56 |

| Total Adjustments(Cash Generat... | -130.56 |

| Cash Flow before Extraordinary... | -1,986.59 |

| Net Cash from Operating Activi... | -1,986.59 |

| Purchased of Fixed Assets | -32.74 |

| Sale of Fixed Assets | 1.34 |

| Purchase of Investments | -71.43 |

| Sale of Investments | 16.58 |

| Cancellation of Investment in ... | 11.76 |

| Net Cash used in Investing Act... | -646.8 |

| Proceeds from Issue of shares ... | 2.25 |

| Proceed from 0ther Long Term B... | 4,509.73 |

| On Redemption of Debenture | -0.05 |

| Of the Long Tem Borrowings | -2,013.88 |

| Of Financial Liabilities | -20.77 |

| Net Cash used in Financing Act... | 2,477.28 |

Company Details

Registered Office |

|

| Address | 201-202 2nd Floor Southend, Square Mansarvor Industrial Ar |

| City | Jaipur |

| State | Rajasthan |

| Pin Code | 302020 |

| Tel. No. | 91-141-6618800 |

| Fax. No. | 91-141-6618861 |

| ipo@aavas.in | |

| Internet | http://www.aavas.in |

Registrars |

|

| Address | 201-202 2nd Floor Southend |

| City | Jaipur |

| State | Rajasthan |

| Pin Code | 302020 |

| Tel. No. | 91-141-6618800 |

| Fax. No. | 91-141-6618861 |

| ipo@aavas.in | |

| Internet | http://www.aavas.in |

Management |

|

| Name | Designation |

| KALPANAIYER | Independent Director |

| Sandeep Tandon | Chairperson and Independent Director |

| Ramachandra Kasargod Kamath | Nominee |

| Vivek Vig | Nominee |

| NISHANT SHARMA | Nominee |

| Manas Tandon | Nominee |

| Soumya Rajan | Independent Director |

| Sachinderpalsingh Jitendrasingh Bhinder | Managing Director & CEO |

| Rahul Mehta | Nominee |

| Saurabh Sharma | Company Sec. & Compli. Officer |