BSE

prev close

OPEN PRICE

bid price (qty)

offer price (qty)

volume

Today's low / high

52 WK low / high

NSE

prev close

open price

bid price (qty)

offer price (qty)

volume

Today's' low / high

52 WK low / high

| 03 May 33.63 (-0.36%) | 02 May 33.75 (9.97%) | 30 Apr 30.69 (10.00%) | 29 Apr 27.90 (3.33%) | 26 Apr 27.00 (3.85%) | 25 Apr 26.00 (2.60%) | 24 Apr 25.34 (-9.50%) | 23 Apr 28.00 (0.00%) | 22 Apr 28.00 (1.82%) | 18 Apr 27.50 (-3.51%) | 16 Apr 28.50 (-9.03%) | 04 Apr 31.33 (-0.06%) | 28 Mar 31.35 (-4.97%) | 27 Mar 32.99 (-3.28%) | 26 Mar 34.11 (-2.54%) | 20 Mar 35.00 (4.73%) | 19 Mar 33.42 (5.00%) | 18 Mar 31.83 (4.98%) | 15 Mar 30.32 (4.99%) | 13 Mar 28.88 (-5.00%) | 12 Mar 30.40 (0.00%) |

Price Chart Historical Data Technical Chart

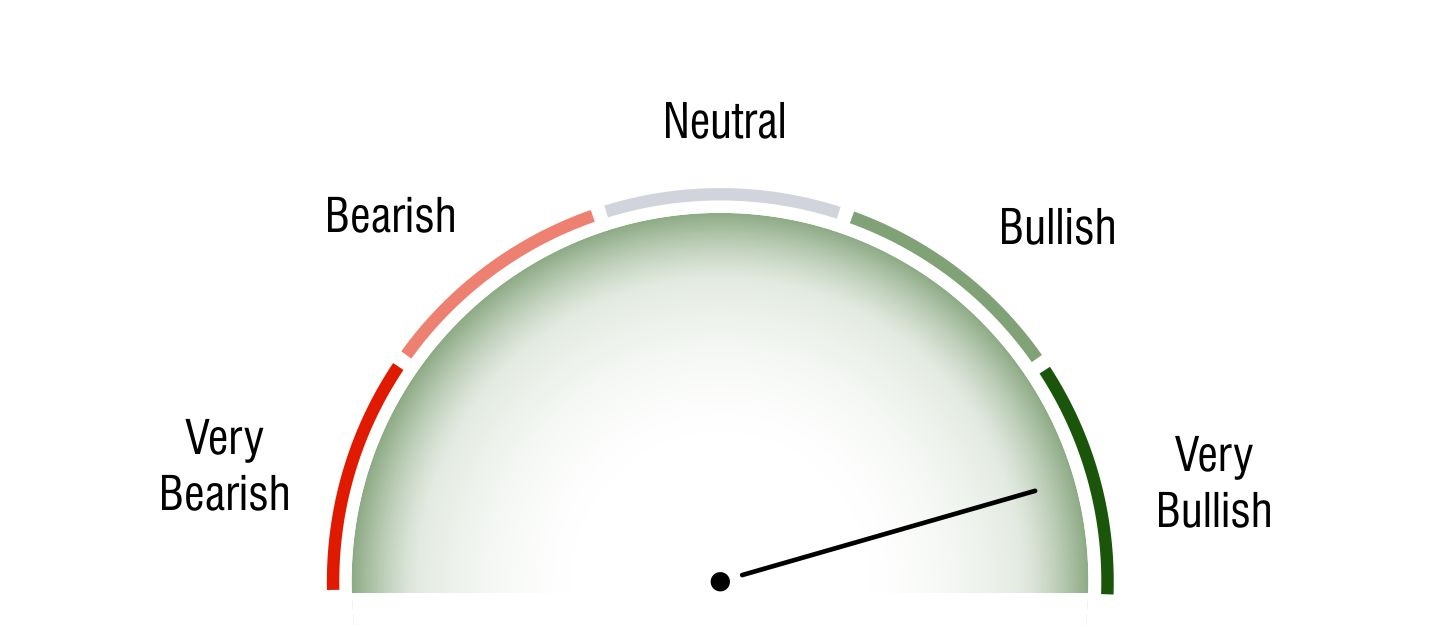

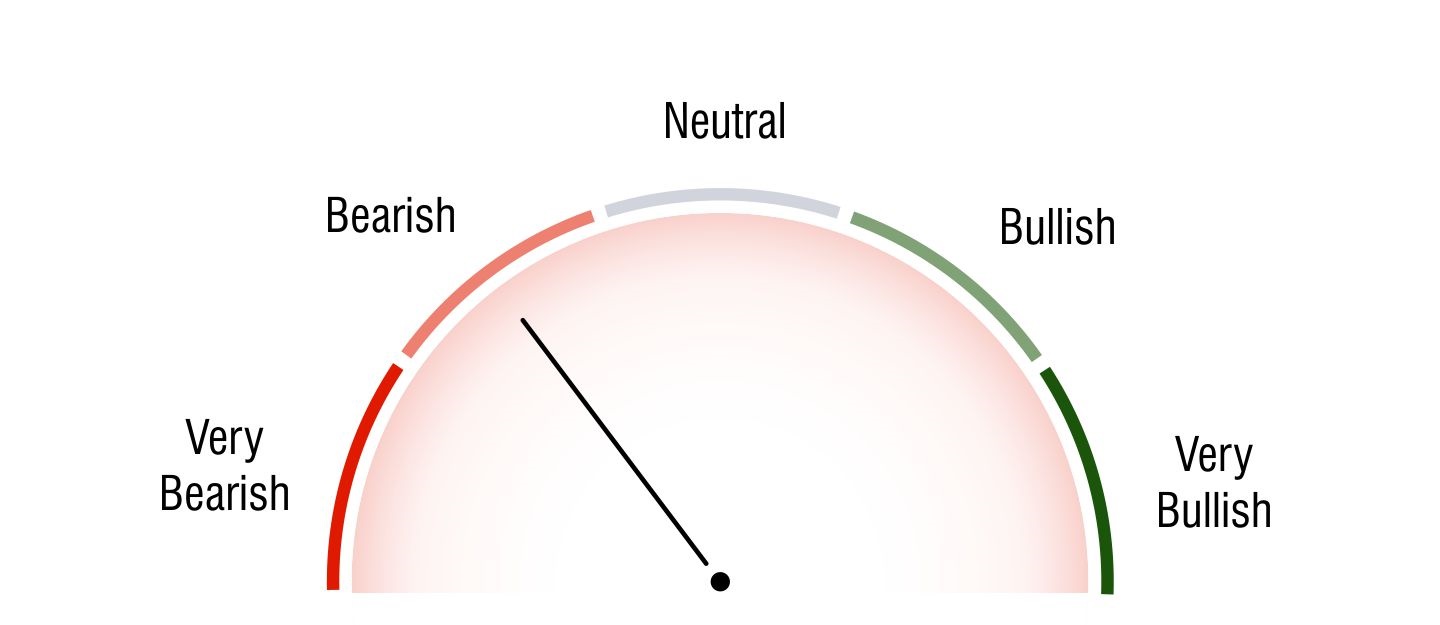

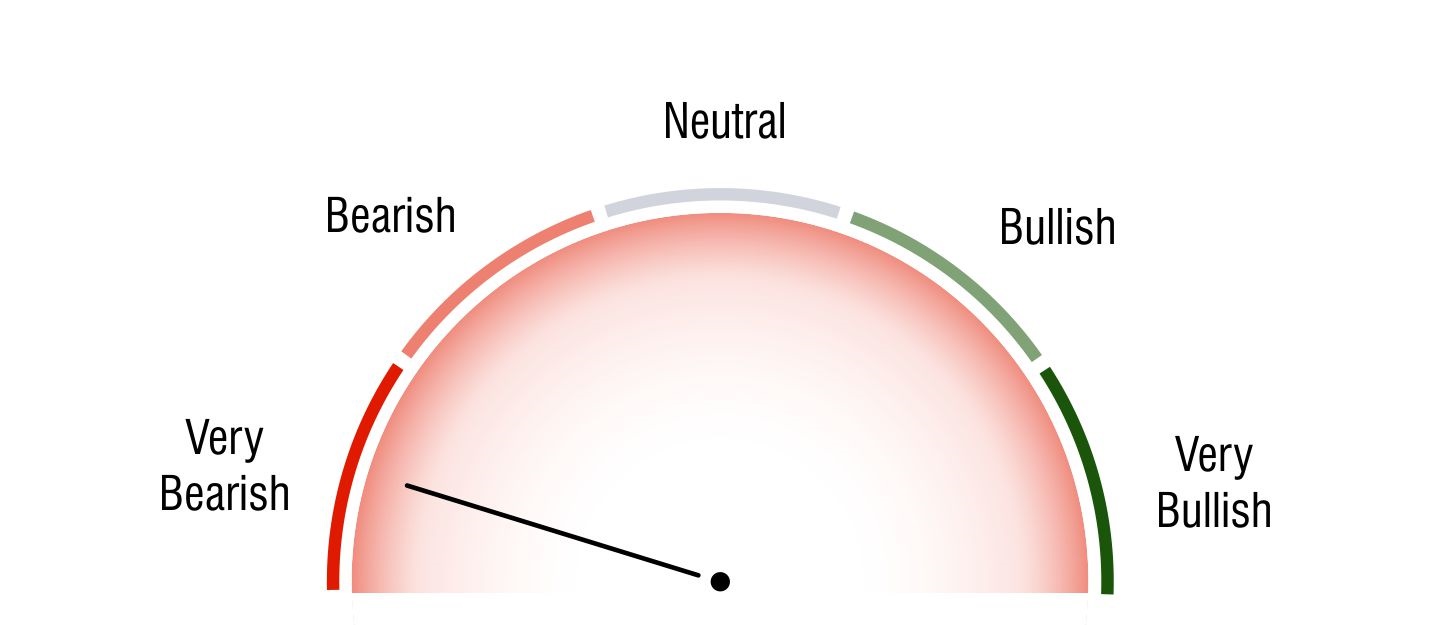

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Bearish

Long Term Investors

Very Bearish

Moving Averages

5 DMA

Bullish

30.59

10 DMA

Bullish

28.78

20 DMA

Bullish

30.28

50 DMA

Bearish

38.78

100 DMA

Bearish

49.57

200 DMA

Bearish

54.55

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On Jan 01, 1970 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 0 | 0 | 0 | - | - |

| R2 | 0 | 0 | 0 | 0 | - |

| R1 | 0 | 0 | 0 | 0 | 0 |

| P | 0 | 0 | 0 | 0 | 0 |

| S1 | 0 | 0 | 0 | 0 | 0 |

| S2 | 0 | 0 | 0 | 0 | - |

| S3 | 0 | 0 | 0 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

S. V. J. Enterprises Ltd Quaterly Results

| Jun 2022 | Sep 2022 | ||||

| INCOME | 1.04 | 1.86 | |||

| PROFIT | 0.29 | 0.49 | |||

| EPS | 0.97 | 1.26 |

S. V. J. Enterprises Ltd Quaterly Results

| Jun 2022 | Sep 2022 | ||||

| INCOME | 1.43 | 1.55 | 1.93 | 1.38 | 1.27 |

| PROFIT | 0.21 | 0.22 | 0.21 | 0.22 | 0.23 |

| EPS | 0.54 | 0.39 | 0.37 | 0.4 | 0.42 |

Profit & Loss (Figures in Rs. Crores)

S. V. J. Enterprises Ltd Profit & Loss

| Mar 2020 | Mar 2021 | Mar 2022 | ||

| INCOME | 0.84 | 1.58 | 5.09 | |

| PROFIT | 0 | 0.23 | 0.72 | |

| EPS | 0 | 0 | 0 |

S. V. J. Enterprises Ltd Profit & Loss

| Mar 2022 | Mar 2023 | ||

| INCOME | 5.09 | 6.45 | |

| PROFIT | 0.72 | 0.7 | |

| EPS | 16.85 | 1.25 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2022 | Mar 2021 | Mar 2020 | |

| SOURCES OF FUNDS : | |||

| Share Capital | 0.43 | 0.43 | 0.43 |

| Reserves Total | 2.62 | 1.9 | 1.67 |

| Total Shareholders Funds | 3.05 | 2.33 | 2.1 |

| Secured Loans | 0.75 | 0.62 | 0.44 |

| Unsecured Loans | 1.37 | 0.83 | 0.18 |

| Total Debt | 2.12 | 1.45 | 0.62 |

| Other Liabilities | 0.57 | 0.57 | 0.95 |

| Total Liabilities | 5.74 | 4.35 | 3.67 |

| APPLICATION OF FUNDS : | |||

| Gross Block | 2.01 | 2.01 | 1.15 |

| Less: Accumulated Depreciation | 1.09 | 0.9 | 0.68 |

| Net Block | 0.92 | 1.11 | 0.47 |

| Capital Work in Progress | 0.42 | 0.24 | 0 |

| Investments | 0.29 | 0.29 | 0.18 |

| Inventories | 0.43 | 0.32 | 0.27 |

| Sundry Debtors | 0.86 | 0.46 | 0.18 |

| Cash and Bank Balance | 1.91 | 0.65 | 0.61 |

| Loans and Advances | 0.91 | 0.87 | 1.02 |

| Total Current Assets | 4.11 | 2.3 | 2.08 |

| Current Liabilities | 0.76 | 0.55 | 0.09 |

| Provisions | 0.28 | 0.08 | 0 |

| Total Current Liabilities & Provisions | 1.04 | 0.63 | 0.09 |

| Net Current Assets | 3.07 | 1.67 | 1.99 |

| Deferred Tax Assets | 0.01 | 0.01 | 0.01 |

| Net Deferred Tax | 0.01 | 0.01 | 0.01 |

| Other Assets | 1.02 | 1.02 | 1.02 |

| Total Assets | 5.74 | 4.35 | 3.67 |

| Mar 2023 | Mar 2022 | |

| SOURCES OF FUNDS : | ||

| Share Capital | 5.57 | 0.43 |

| Reserves Total | 8.95 | 2.62 |

| Total Shareholders Funds | 14.52 | 3.05 |

| Unsecured Loans | 1.53 | 1.37 |

| Total Debt | 1.53 | 1.37 |

| Other Liabilities | 0 | 0.57 |

| Total Liabilities | 16.05 | 4.99 |

| APPLICATION OF FUNDS : | ||

| Gross Block | 3.34 | 2.3 |

| Less : Accumulated Depreciation | 1.34 | 1.09 |

| Net Block | 2 | 1.21 |

| Capital Work in Progress | 0.46 | 0.42 |

| Investments | 2.02 | 1.02 |

| Inventories | 1.38 | 0.43 |

| Sundry Debtors | 2.99 | 0.86 |

| Cash and Bank Balance | 4.02 | 1.91 |

| Loans and Advances | 4.98 | 0.91 |

| Total Current Assets | 13.37 | 4.11 |

| Current Liabilities | 0.86 | 0.19 |

| Provisions | 0.91 | 1.59 |

| Total Current Liabilities & Provisions | 1.77 | 1.78 |

| Net Current Assets | 11.6 | 2.33 |

| Deferred Tax Liability | 0.04 | 0 |

| Net Deferred Tax | -0.04 | 0 |

| Total Assets | 16.05 | 4.99 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 0.99 |

| Depreciation | 0.19 |

| Interest (Net) | 0.01 |

| Total Adjustments (PBT and Ext... | 0.2 |

| Operating Profit before Workin... | 1.19 |

| Trade and 0ther Receivables | -0.39 |

| Inventories | -0.11 |

| Trade Payables | -0.07 |

| Loans and Advances | -0.04 |

| Total Adjustments (OP before W... | -0.34 |

| Cash Generated from/(used in) ... | 0.85 |

| Direct Taxes Paid | -0.08 |

| Total Adjustments(Cash Generat... | -0.08 |

| Cash Flow before Extraordinary... | 0.78 |

| Net Cash from Operating Activi... | 0.78 |

| as [Capital WIP | -0.18 |

| Interest Received | 0.05 |

| Net Cash used in Investing Act... | -0.14 |

| Proceed from 0ther Long Term B... | 0.68 |

| Interest Paid | -0.05 |

| Net Cash used in Financing Act... | 0.63 |

| Net Profit before Tax and Extr... | 1 |

| Depreciation | 0.25 |

| Interest (Net) | -0.08 |

| Others | 0.12 |

| Total Adjustments (PBT and Ext... | 0.17 |

| Operating Profit before Workin... | 1.16 |

| Trade and 0ther Receivables | -2.14 |

| Inventories | -0.95 |

| Trade Payables | 0.67 |

| Loans and Advances | -4.06 |

| Total Adjustments (OP before W... | -7.15 |

| Cash Generated from/(used in) ... | -5.99 |

| Direct Taxes Paid | -0.27 |

| Total Adjustments(Cash Generat... | -0.27 |

| Cash Flow before Extraordinary... | -6.26 |

| Net Cash from Operating Activi... | -6.26 |

| Purchased of Fixed Assets | -1.07 |

| Purchase of Investments | -1 |

| Net Cash used in Investing Act... | -2.07 |

| Proceeds from Issue of shares ... | 10.77 |

| Proceed from 0ther Long Term B... | 0.16 |

| Of the Long Tem Borrowings | -0.57 |

| Interest Paid | -0.04 |

| Net Cash used in Financing Act... | 10.43 |

Company Details

Registered Office |

|

| Address | 002 A-Wing Sonam Palace CHS, Old Golden Nest Phase-I NGN Rd |

| City | Thane |

| State | Maharashtra |

| Pin Code | 401105 |

| Tel. No. | 91-98690 57304 |

| Fax. No. | |

| info@svjenterprises.co.in | |

| Internet | http://www.svjenterprises.co.in |

Registrars |

|

| Address | 002 A-Wing Sonam Palace CHS |

| City | Thane |

| State | Maharashtra |

| Pin Code | 401105 |

| Tel. No. | 91-98690 57304 |

| Fax. No. | |

| info@svjenterprises.co.in | |

| Internet | http://www.svjenterprises.co.in |

Management |

|

| Name | Designation |

| Saanvi Chanorahaskargutkar | Managing Director |

| Suresh Ramchandra Jha | Director |

| Satish Kumar Dogra | Independent Director |

| Zahuralam Noor Alam Shaikh | Independent Director |

| Akshita Agrawal | Company Sec. & Compli. Officer |