Autoriders International Ltd

BSE :512277 Sector : LogisticsBuy, Sell or Hold ? Ask The Analyst

BSE

prev close

OPEN PRICE

volume

Today's low / high

52 WK low / high

bid price (qty)

offer price (qty)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 31 Dec 282.25 (4.98%) | 30 Dec 268.85 (5.00%) | 27 Dec 256.05 (4.98%) | 26 Dec 243.90 (4.99%) | 24 Dec 232.30 (4.99%) | 23 Dec 221.25 (4.98%) | 20 Dec 210.75 (4.98%) | 18 Dec 200.75 (4.99%) | 17 Dec 191.20 (5.00%) | 16 Dec 182.10 (4.99%) | 13 Dec 173.45 (4.99%) | 12 Dec 165.20 (4.99%) | 10 Dec 157.35 (4.97%) | 09 Dec 149.90 (4.97%) | 30 Aug 142.80 (5.00%) | 29 Aug 136.00 (4.99%) | 28 Aug 129.53 (4.99%) | 27 Aug 123.37 (5.00%) | 26 Aug 117.50 (5.00%) | 23 Aug 111.91 (4.99%) | 22 Aug 106.59 (4.99%) |

Price Chart Historical Data Technical Chart

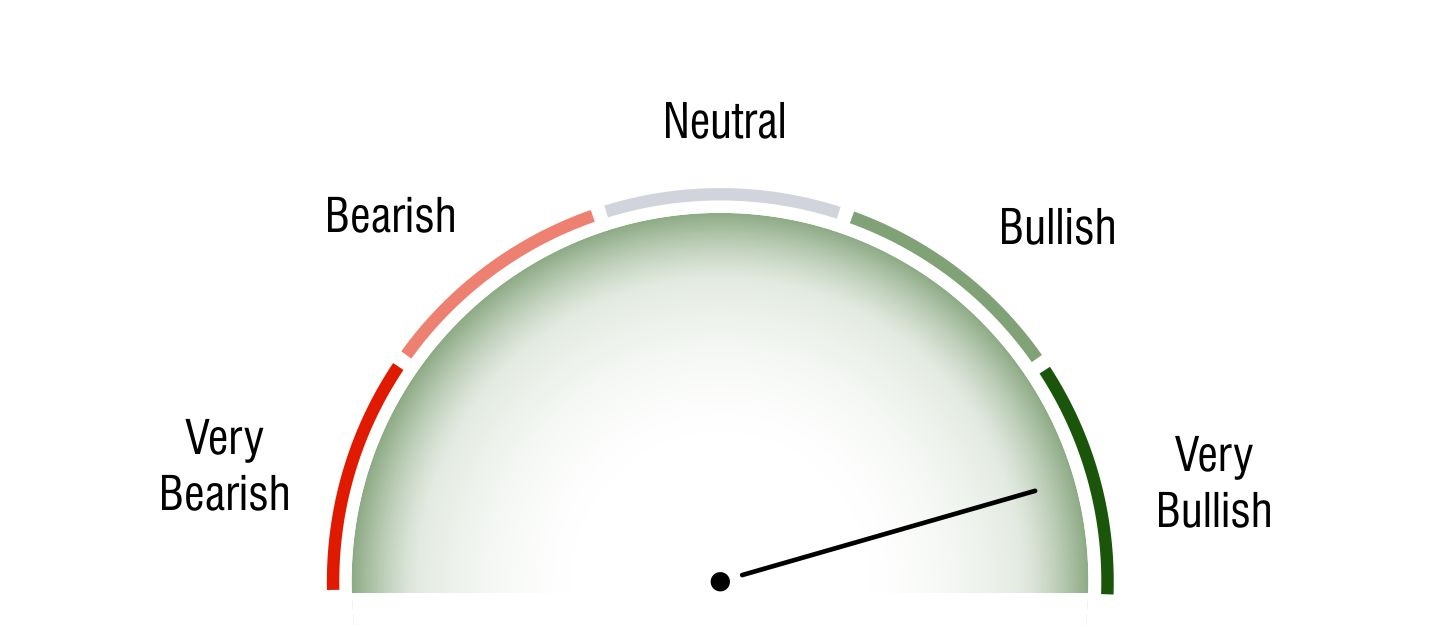

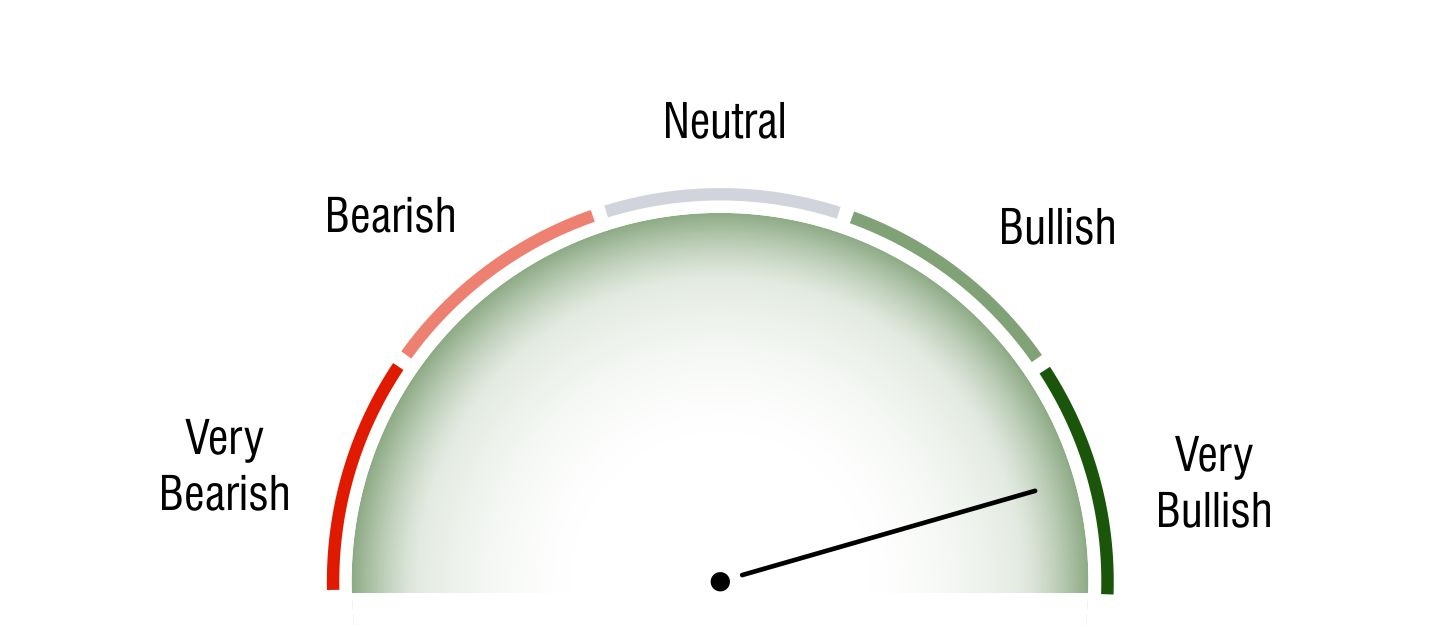

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Very Bullish

Long Term Investors

Neutral

Moving Averages

5 DMA

Bullish

256.67

10 DMA

Bullish

228.94

20 DMA

Bullish

184.82

50 DMA

Bullish

0

100 DMA

Bullish

0

200 DMA

Bullish

0

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On Jan 01, 1970 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 0 | 0 | 0 | - | - |

| R2 | 0 | 0 | 0 | 0 | - |

| R1 | 0 | 0 | 0 | 0 | 0 |

| P | 0 | 0 | 0 | 0 | 0 |

| S1 | 0 | 0 | 0 | 0 | 0 |

| S2 | 0 | 0 | 0 | 0 | - |

| S3 | 0 | 0 | 0 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Autoriders International Ltd Quaterly Results

| INCOME | |

| PROFIT | |

| EPS |

Autoriders International Ltd Quaterly Results

| INCOME | 20.76 | 21.46 | 21.69 | 19.87 | 22.18 | |

| PROFIT | 2.98 | 3.2 | 0.27 | 1.39 | 2.68 | |

| EPS | 60.8 | 65.28 | 4.22 | 28.42 | 54.68 |

Profit & Loss (Figures in Rs. Crores)

Autoriders International Ltd Profit & Loss

| INCOME | |

| PROFIT | |

| EPS |

Autoriders International Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 53.96 | 63.79 | 61.65 | 65.96 | 67.14 | 59.37 | 21.21 | 33.91 | 71.17 | 84.03 | |

| PROFIT | 0.68 | 0.97 | 0.87 | 0.12 | 0.94 | 1.59 | -2.47 | 3.01 | 6.65 | 9.35 | |

| EPS | 19.47 | 35.25 | 46.48 | 4.1 | 21.2 | 43.3 | -40.92 | 60 | 137.96 | 192.65 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.25 | 0.25 | 0.25 |

| Reserves Total | 31.92 | 22.56 | 15.87 | 12.85 | 14.97 | 13.07 | 12.02 | 12.06 | 10.92 | 10.06 |

| Total Shareholders Funds | 32.41 | 23.05 | 16.36 | 13.34 | 15.46 | 13.56 | 12.51 | 12.31 | 11.17 | 10.31 |

| Secured Loans | 14.12 | 18 | 10.74 | 6.85 | 18.26 | 16.8 | 15.59 | 16.92 | 9.9 | 5.11 |

| Unsecured Loans | 14.38 | 13.26 | 10.04 | 8.16 | 2.74 | 0 | 0.84 | 1.14 | 8.5 | 8.47 |

| Total Debt | 28.5 | 31.26 | 20.78 | 15.01 | 21 | 16.8 | 16.43 | 18.06 | 18.4 | 13.58 |

| Other Liabilities | 1.2 | 0.9 | 0.39 | 2.47 | 3.13 | 3.28 | 2.64 | 1.87 | 0 | 0 |

| Total Liabilities | 62.11 | 55.21 | 37.53 | 30.82 | 39.59 | 33.64 | 31.58 | 32.24 | 29.57 | 23.89 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 66.73 | 53.56 | 33.65 | 28.48 | 36.65 | 35.03 | 32.03 | 28.4 | 37.91 | 28.61 |

| Less : Accumulated Depreciation | 22.14 | 15.1 | 9.43 | 9.1 | 12.19 | 12.86 | 11.33 | 5.98 | 14.34 | 10.77 |

| Net Block | 44.59 | 38.46 | 24.22 | 19.38 | 24.46 | 22.17 | 20.7 | 22.42 | 23.57 | 17.84 |

| Capital Work in Progress | 1.25 | 4.74 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Investments | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Sundry Debtors | 13.99 | 14.41 | 9.06 | 5.79 | 10.8 | 13.68 | 14.35 | 11.8 | 12.97 | 10.36 |

| Cash and Bank Balance | 4.3 | 2.58 | 1.86 | 3.71 | 5.12 | 2.69 | 2.49 | 2.47 | 2.23 | 1.28 |

| Loans and Advances | 1.52 | 1.27 | 0.82 | 0.68 | 0.81 | 0.96 | 1.75 | 1.59 | 0.75 | 1.31 |

| Total Current Assets | 19.81 | 18.26 | 11.74 | 10.18 | 16.73 | 17.33 | 18.59 | 15.86 | 15.94 | 12.95 |

| Current Liabilities | 5.76 | 7.37 | 3.62 | 2.39 | 5.44 | 7.32 | 8.8 | 6.76 | 10.42 | 7.39 |

| Provisions | 0.4 | 0.35 | 0.29 | 0.25 | 0 | 0 | 0.24 | 0.26 | 0.21 | 0.14 |

| Total Current Liabilities & Provisions | 6.16 | 7.72 | 3.91 | 2.64 | 5.44 | 7.32 | 9.04 | 7.01 | 10.63 | 7.52 |

| Net Current Assets | 13.65 | 10.54 | 7.83 | 7.54 | 11.29 | 10.01 | 9.55 | 8.85 | 5.31 | 5.43 |

| Deferred Tax Liability | 2.79 | 3.69 | 2.23 | 2.1 | 2.56 | 1.86 | 1.86 | 2.09 | 2.26 | 1.4 |

| Net Deferred Tax | -2.79 | -3.69 | -2.23 | -2.1 | -2.56 | -1.86 | -1.86 | -2.09 | -2.26 | -1.4 |

| Other Assets | 5.4 | 5.15 | 7.7 | 5.99 | 6.39 | 3.31 | 3.18 | 3.05 | 2.95 | 2.01 |

| Total Assets | 62.11 | 55.21 | 37.53 | 30.82 | 39.59 | 33.64 | 31.58 | 32.24 | 29.58 | 23.88 |

| Contingent Liabilities | 14.58 | 0 | 14.58 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 11.09 |

| Depreciation | 10.19 |

| Interest (Net) | 2.7 |

| Prov. and W/O (Net) | 0.05 |

| Total Adjustments (PBT and Ext... | 12.88 |

| Operating Profit before Workin... | 23.97 |

| Trade and 0ther Receivables | 0.11 |

| Trade Payables | -1.42 |

| Total Adjustments (OP before W... | -1.31 |

| Cash Generated from/(used in) ... | 22.66 |

| Direct Taxes Paid | -2.62 |

| Total Adjustments(Cash Generat... | -2.62 |

| Cash Flow before Extraordinary... | 20.04 |

| Net Cash from Operating Activi... | 20.04 |

| Purchased of Fixed Assets | -13.8 |

| Sale of Fixed Assets | 2.73 |

| Capital WIP | -1.25 |

| Interest Received | 0.12 |

| Net Cash used in Investing Act... | -13.9 |

| Proceed from 0ther Long Term B... | 13.69 |

| Of the Long Tem Borrowings | -13.81 |

| Dividend Paid | -0.02 |

| Interest Paid | -2.82 |

| Net Cash used in Financing Act... | -2.96 |

Company Details

Registered Office |

|

| Address | 4A Vikas Centre, 104 S V Road Santacruz (W) |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400054 |

| Tel. No. | 91-022-56944058/56944059 |

| Fax. No. | |

| complianceofficer@autoriders.in; ho@autoriders.in | |

| Internet | http://www.autoriders.in |

Registrars |

|

| Address | 4A Vikas Centre |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400054 |

| Tel. No. | 91-022-56944058/56944059 |

| Fax. No. | |

| complianceofficer@autoriders.in; ho@autoriders.in | |

| Internet | http://www.autoriders.in |

Management |

|

| Name | Designation |

| Maneka Vijay Mulchandani | Executive Director |

| Chintan Patel | Chairman & MD & CEO |

| Pravav Kapur | Independent Director |

| Anil Kulkarni | Independent Director |

| JANAK PATEL. | Independent Director |