Hyundai launches new generation of the Creta in India on March 17, 2020. The cars made its debut at 2020 Auto Expo and at that point in time, we only got to see what it looked like a room outside. According to designing, the new Creta is definitely several notches higher than its predecessor.

The tailgate is sculpted with sharp lines and the rear number plate housing has moved up. There’s of course, the signature cascading grille which is flanked by DRLs and the LED lamps are easily identifiable. Moreover, the next-gen Creta has grown in dimensions but retains the overall curvy silhouette. The 2020 Creta is based on Hyundai’s latest sensuous sportiness design language.

As far as engine options go, the next generation of Hyundai Creta will have the same power trains as the Kia Seltos. So, expect a BS6 compliant range 1.5-litre petrol and a 1.5-litre diesel, as well as the 140 bhp, 1.4-litre turbo GDI petrol with an optional 7-Speed DCT (dual-clutch transmission). The three engine types will come with a 6-speed manual gearbox. Also, the diesel gets an option of 6-speed torque convertor automatic. The new-gen Hyundai Creta also get a slightly larger screen as well. The layout of the portrait mode of the screen will also pair up with Hyundai’s Bluelink connected car app and telematics solution. This model all have the embedded sim card or eSIM to access all data features including emergency response and concierge services.

Read EquityPandit’s Nifty Outlook for the Week

Oil Prices Rise After Steep Drop in US Crude Inventories

On Wednesday, Oil prices have extended gains from the previous session after industry data indicated US crude stocks fell much more than expected last week, reinforcing bullish views on fuel demand in the world’s largest economy.

US West Texas Intermediate (WTI) crude futures rose 48 cents, or 0.7 per cent, to $66.17 a barrel at 0440 GMT, after climbing to $66.58, a level not seen since March 8. Brent crude futures were up 49 cents, or 0.7 per cent, at $69.37 barrel after touching a more than the seven-week high of $69.78 earlier in the session. Both benchmark contracts rose nearly 2 per cent on Tuesday ahead of data from the American Petroleum Institute (API) industry group.

“Crude oil prices appear to be supported by a large draw in crude and gasoline inventories, according to API figures,” said Margaret Yang, a strategist at Singapore-based DailyFX. “The energy demand outlook is brightened by eased lockdown measures in parts of the US and UK, which helped to offset concerns over lower demand from India and Japan. The upcoming summer driving season may further boost fuel demand and support oil prices.”

API figures showed crude stocks fell by 7.7 million barrels in the week ended April 30, according to two market sources. That was more than triple the drawdown expected by analysts polled by Reuters. The rise in oil prices to nearly two-month highs has been supported by Covid-19 vaccine rollouts in the United States and Europe, paving the way for pandemic lockdowns to be lifted and air travel to pick up.

So far that has more than offset a drop in fuel demand in India, which is battling a surge in infections. “However, if we were to eventually see a national lockdown imposed, this would likely hit sentiment,” ING Economics analysts said of the situation in India.

Oil Prices Falls on Build in US Crude Stocks

Oil prices fell in early trading session on Wednesday after industry data showed that the US crude oil stocks rose last week as investors expected a decline. Oil fell further after US President Donald Trump threatened not to sign an $892 billion coronavirus relief bill, saying that he wants Congress to increase the amount in the stimulus checks.

US West Texas Intermediate (WTI) Crude Futures fell 46 cents about 1 per cent to $46.56 a barrel at 0142 GMT, while Brent Crude Futures slipped 46 cents about 0.9 per cent to $49.62 a barrel. Both WTI and Brent Crude Futures contract nearly fell 2 per cent on Tuesday, a staright second session of decline with Brent managed to settle above $50, before the release of data from the American Petroleum Institute (API).

API data shows that crude inventories increased by 2.7 million barrels in the week to December 18, as compared with the expectations of analysts in a Reuters poll for a decline of 3.2 million barrels. Distillate stock, which includes oil and petroleum products rose by 1 million barrels against analysts’ expectations for a reduction of up to 904,000 barrels. However, gasoline stocks declined by 224,000 barrels as compared with the expected increase of 1.2 million barrels.

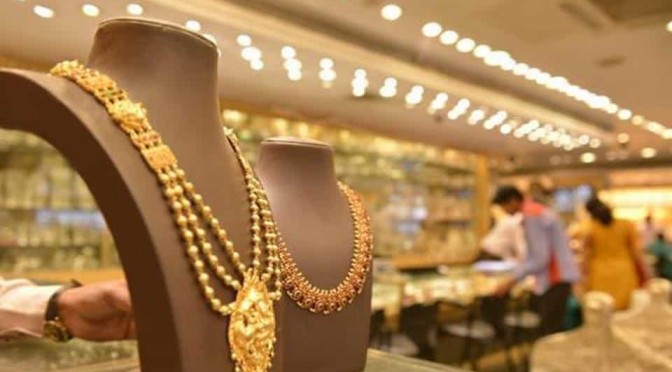

Gold Prices Surged, Silver Gained 3% or Rs 2,000

Gold and Silver prices on Monday surged in Indian markets following the increase in global markets. On MCX, Gold Futures February Contract soared 0.75 per cent to Rs 50,678 per 10 gram while silver futures gained 3 per cent about Rs 2,000 to Rs 69,874 per kg.

In international markets, gold prices gained after the top US lawmakers agreed on a COVID-19 economic relief package of $900 billion. The House leaders informed lawmakers that they will be voting on the legislation on Monday and the Senate would also be likely to vote on Monday. Spot gold jumped 0.4 per cent to $1,888.76 per ounce and silver rose 0.9 per cent to $26.01 per ounce while platinum was high 0.1 per cent at $1,036.75 and palladium slipped 0.1 per cent to $2,358.71.

Last week, physical gold was sold at a discount in India, the first time in six weeks as recovery in the domestic prices affected demand. Reuters reported that this week dealers were offering a discount of up to $1 an ounce on domestic prices, down from the past week’s premium of $2.5 an ounce.

Submission of Bids for Commercial Coal Mining Blocks Last Today

On Wednesday the government will open bids which are received for the commercial coal mining blocks. Jindal Steel & Power Ltd., Vedanta Group, Adani Group and JSW Steel are among the companies that have an eye on the coal blocks with which India will go commercial for coal mining with private players.

The Supreme Court has refused the plea made by the Jharkhand government to continue with the auction process, said people directly aware of the matter.

The coal ministry on Monday said that 278 tender documents are being purchased by the prospective bidders for 38 coal blocks on auction. An official in a statement said, “In the present tranche of coal block auctions, 278 tender documents have been purchased by the prospective bidders in respect of 38 coal mines. The nominated authority will receive the bids till 2 pm on September 29 and bid opening will be taken up at 10 am on September 30, 2020”.

Earlier, the coal ministry had announced the revised list of mines to 38 blocks from 41 mines, after the opposition from the Chhattisgarh government. Dolesara, Jarekela and Jharpalam-Tangarghat are three blocks that were added and the five blocks (Morga South, Fatehpur, Madanpur (North), Morga-II, and Sayang) in the eco-sensitive zone of Hasdeo Arand were withdrawn. The ministry also withdrew the Bander mine in Chandrapur district of Maharashtra as it lies in the eco-sensitive Tadoba Andhari Tiger Reserve zone.(Morga SouthAdani Group and JSW Steeland Sayang)FatehpurJindal Steel & Power Ltd.Madanpur (North)Morga-IIVedanta Group

Gold Collapses at Rs 6500 Decline Following Record Highs; Silver Plunges

Persisting struggle in domestic gold and silver rates was evident as MCX data depicted gold futures drop 0.4% to Rs49,460 per 10 gram, following previous week’s drop and silver plunge 1% to Rs58,473 per kg.

The previous week saw gold tumble Rs 2000 per 10gram domestically, with silver plunging Rs 9000 kilogram-wise. Since August 7th’s record with Rs 56200, gold lessened nearly Rs 6500 per 10 gram. Gold faces pressure with a resurgent US dollar, still deemed desirable as a safe haven asset while international markets avert risks. Global risk sentiment has become fragile with impending COVID-19 cases particularly in Europe with worries about new lockdowns despite counties still to resort to large-scale ones. Internationally, gold rates became consistent following the previous week’s statistics. Spot gold was little altered at $1,860.19 per ounce as the US dollar rally took a pause. The dollar index decreased 0.14% against rivals, after hitting a two-month high last week.

Other metals performed as follows, silver gained 0.3% to $22.93 per ounce, platinum increased 0.4% to $850.74 and palladium benefitted 0.1% to $2,217.87.

Gold traders shifted to the sidelines prior to Tuesday’s primary US presidential debate between President Donald Trump and Democratic opponent Joe Biden. Asian stock markets were mostly higher today after data over the weekend indicated gains at industrial companies in China grew for a fourth consecutive month in August.

Gold investors kept an eye out for any breakthrough following discussions for further stimulus in the US. Over the weekend, US House Speaker Nancy Pelosi said a deal could be reached with the White House on a coronavirus relief package and that talks were continuing.

ETF investors stayed on the sidelines even with prices declining. Holdings in SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, dropped 0.02% to 1,266.84 tonnes on Friday.

Speculators lowered their bullish positions in COMEX gold and silver contracts in the week to September 22, the US Commodity Futures Trading Commission (CFTC) said on Friday.