Presenting the Union Budget for 2021-22, Finance Minister Nirmala Sitharaman said that the Budget proposals for this financial year rest on six pillars — health and well-being, physical and financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation and R&D, and ‘Minimum Government, Maximum Governance’.

Significant announcements included a slew of hikes in customs duty to benefit Make in India, proposal to disinvest two more PSBs and a general insurance company, and numerous infrastructure pledges to poll-bound States. Fiscal deficit stands at 9.5% of the GDP, and is estimated to be 6.8 per cent in 2021-22. Personal income tax slabs remain as is.

Here are the highlights of this year’s budget:

Health and Sanitation

- A new scheme, titled PM AtmaNirbharSwasthya Bharat Yojana, to be launched to develop primary, secondary and tertiary healthcare

- Mission POSHAN 2.0 to improve nutritional outcomes across 112 aspirational districts

- Operationalisation of 17 new public health units at points of entry

- Modernising of existing health units at 32 airports, 15 seaports and land ports

- Jal Jeevan Mission Urban aimed at better water supply nationwide

- Strengthening of Urban Swachh Bharat Mission

Education

- 100 new Sainik Schools to be set up

- 750 Eklavya schools to be set up in tribal areas

- A Central University to come up in Ladakh

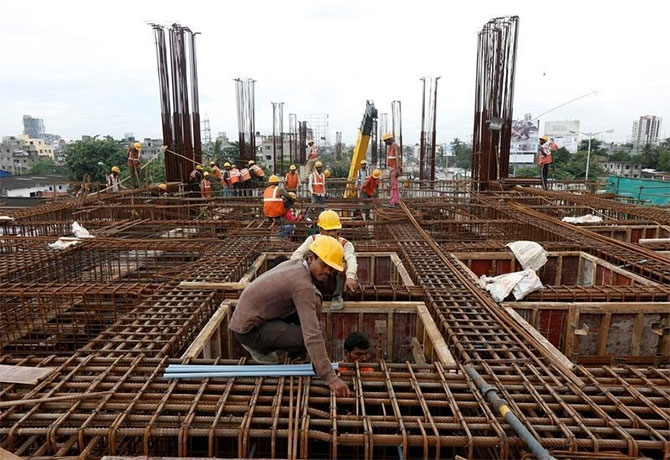

Infrastructure

- Vehicle scrapping policy to phase out old and unfit vehicles – all vehicles to undergo fitness test in automated fitness centres every 20 years (personal vehicles), every 15 years (commercial vehicles)

- Highway and road works announced in Kerala, Tamil Nadu, West Bengal and Assam

- National Asset Monetising Pipeline launched to monitor asset monetisation process

- National Rail Plan created to bring a future ready Railway system by 2030

- 100% electrification of Railways to be completed by 2023

- Metro services announced in 27 cities, plus additional allocations for Kochi Metro, Chennai Metro Phase 2, Bengaluru Metro Phase 2A and B, Nashik and Nagpur Metros

- National Hydrogen Mission to be launched to generate hydrogen from green power sources

- Recycling capacity of ports to be doubled by 2024

- Gas pipeline project to be set up in Jammu and Kashmir

- Pradhan MantriUjjwalaYojana (LPG scheme) to be extended to cover 1 crore more beneficiaries

Tax

- No IT filing for people above 75 years who get pension and earn interest from deposits

- Reopening window for IT assessment cases reduced from 6 to 3 years. However, in case of serious tax evasion cases (Rs50 lakh or more), it can go up to 10 years

- Affordable housing projects to get a tax holiday for one year

- Compliance burden of small trusts whose annual receipts does not exceed Rs. 5 crore to be eased

- Duty of copper scrap reduced to 2.5 per cent

- Custom duty on gold and silver to be rationalised

- Duty on naphtha reduced to 2.5 per cent

- Duty on solar inverters raised from 5 per cent to 20 per cent, and on solar lanterns from 5 per cent to 15 per cent

- All nylon products charged with 5 per cent customs duty

- Tunnel boring machines to attract customs duty of 7 per cent

- Customs duty on cotton raised from 0 to 10 per cent

- Agriculture infrastructure and development cess proposed on certain items including urea, apples, crude soyabean and sunflower oil, crude palm oil, kabulichana and peas

Economy and Finance

- Fiscal deficit stands at 9.5 per cent of the GDP; estimated to be 6.8 per cent in 2021-22

- Proposal to allow States to raise borrowings up to 4 per cent of GSDP this year

- A Unified Securities Market Code to be created, consolidating provisions of the Sebi Act, Depositories Act, and two other laws

- Proposal to increase FDI limit from 49 per cent to 74 per cent

- An asset reconstruction company will be set up to take over stressed loans

- Deposit insurance increased from Rs 1 lakh to Rs 5 lakh for bank depositors

- Proposal to decriminalise Limited Liability Partnership Act of 2008

- Two PSU bank and one general insurance firm to be disinvested this year

- An IPO of LIC to debut this fiscal

- Strategic sale of BPCL, IDBI Bank, Air India to be completed

Agriculture

- Agriculture infrastructure fund to be made available for APMCs for augmenting their infrastructure

- 1,000 more Mandis to be integrated into the E-NAM market place

- Five major fishing hubs, including Chennai, Kochi and Paradip, to be developed

- A multipurpose seaweed park to be established in Tamil Nadu

Employment

- A portal to be launched to maintain information on gig workers and construction workers

- Social security to be extended to gig and platform workers

- Margin capital required for loans via Stand-up India scheme reduced from 25% to 15% for SCs, STs and women

Live

Live