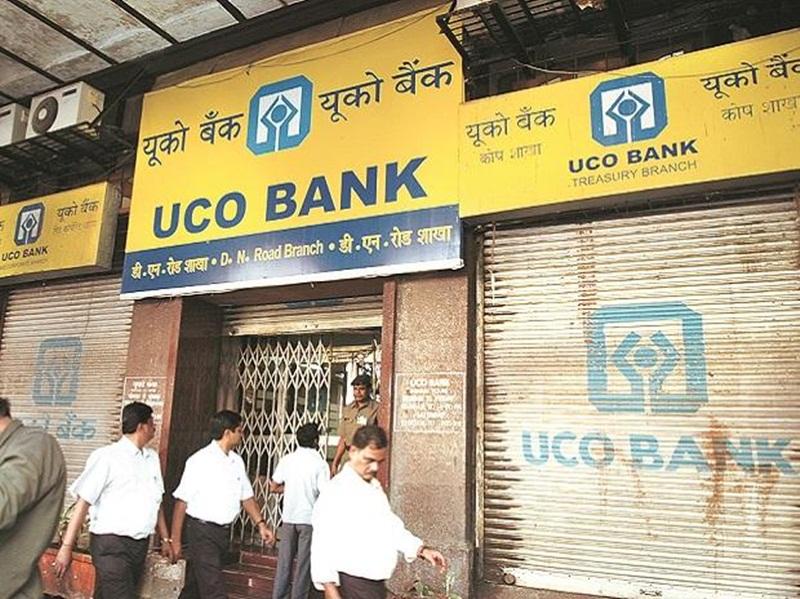

UCO Bank zoomed 16 per cent to Rs 14.85 apiece in the intra-day deals on Thursday after the Reserve Bank of India (RBI) removed the public sector lender from its PCA (Prompt Corrective Action) framework citing improvement in its financial and credit profile.

The stock witnessed a massive volume of 2.87 million shares in just the first 15 minutes of trade, as against the 2-week daily average volume of 0.4 million shares on the BSE. At 10:05 am, the stock was up 10 per cent at Rs 14.14 on the BSE against a 0.17 per cent decline in the S&P BSE Sensex.

- New Wildfire Warnings and Power Shutdowns as Winds Increase in Southern California

- Meta Warns India’s Antitrust Ruling Could Impact Features and Business

- India’s Trade Deficit Shrinks to $21.94 Billion in December

- What To Expect From Stallion India Fluorochemicals IPO: Latest GMP & Share Price

- Persistent Systems Shares Surge 5% on Launching ContractAssIst

“UCO Bank’s performance was reviewed by the Board of Financial Supervision, which noted that as per bank’s FY21 earnings, the bank is not in breach of the PCA parameters. Further, the bank has provided a written commitment to comply with the norms of Minimum Regulatory Capital, Net NPA and Leverage ratio on an ongoing basis,” the RBI said in a statement on Wednesday.