Tata Steel Long Products announced that it acquired shares worth Rs 300 crore in Neelachal Ispat Nigam Ltd (NINL), an indirect subsidiary of the corporation.

On February 21, Tata Steel assured 4,68,75,000 equity shares of Rs 10 each at a premium of Rs 54 per share, amounting to Rs 300 crore. This is the company’s first tranche outlay in Neelachal Ispat.

On February 21, the company acquired 4,68,75,000 equity shares of the face value of Rs 10 each at a premium of Rs 54 per share of NINL for an aggregate value of Rs 300 crore, being Tranche 1 of the investment in the equity shares of NINL.

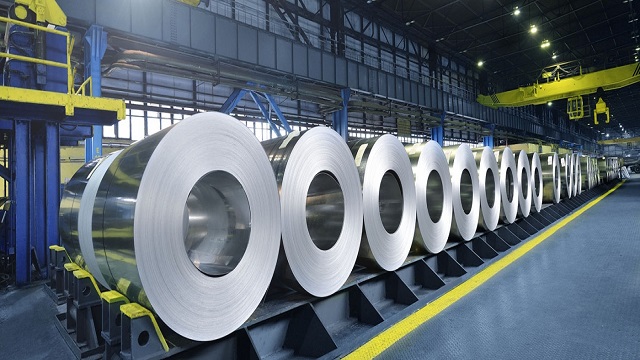

With this acquisition, Tata Steel’s shareholding in Neelachal Ispat increased to 5.23% from 1.88%. As a major speciality steel plant in India in the SBQ segment with an annual capacity of 1 million tons, Tata Steel Long Products is predicted to boost yearly production through Neelchal Ispat’s acquisition.

The funding will be operated towards the working capital and capex obligation of Neelchal Ispat, counting the start-up of the iron and steel plant at Kalinganagar, refund of liabilities, and other universal corporate tenacities.

Tata Steel succumbed to the highest bid of Rs 12,100 crore for a 93.71% stake in the civic sector iron and steel production corporation, the Ministry of Finance said on January 31.

Neelchal Ispat has a 1.1 MTPA combined iron and steel plant at Kalinganagar Odisha, along with iron ore mines with a standby of 90 MT. It had a revenue of Rs 257.58 crore in FY 2021-22.

At 10:21 am, shares of Tata Steel Long Products traded 1.95% upper at Rs 665.60 per share on the BSE.

Live

Live