In the previous session, the Nifty ended August derivative series around 17500 level. The Nifty opened on a positive note and made a day high near 17726. After that the Index slipped into negative territory. At the end of the session, the index saw more selling pressure. As per the candle chart technique, the index formed a Bearish candle on the chart which indicates more weakness in the market.

Look at the below research report of ‘Stocks to Buy for Friday, August 26, 2022’ before the market opens.

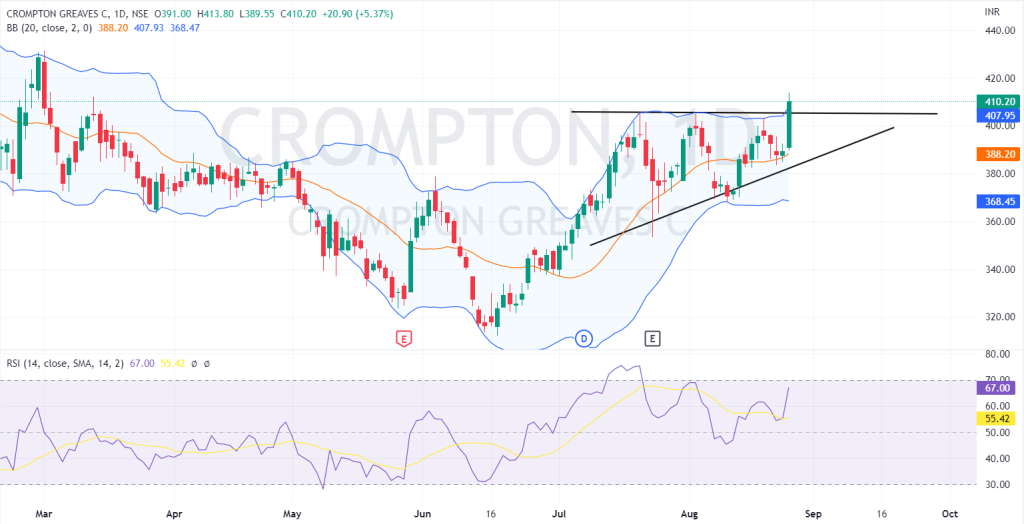

Crompton Greaves Consumer Electricals Ltd.

CROMPTON stock prices are moving in the form of ‘Ascending Triangle Pattern’ in an ongoing trend. The ascending triangle is a bullish continuation pattern and consists of a rising lower trend line and a flat upper trend line which acts as resistance. The higher lows formation shows that the buying pressure has increased. In the previous session, stock has given a breakout from the upper resistance line on the daily chart.

Prices are comfortably close above the Middle Band Bollinger which suggests a bullish trend is intact and we can expect upside momentum to continue from support levels. In addition, the Relative Strength Index (RSI) on the daily chart is 67 which indicates bullishness. In short, the trend for CROMPTON looks to be positive now. A throwback can be expected near 406 levels. Use dips as a buying opportunity for a move towards 430/450 levels as long as we do not see any closing below 384 levels.

Check More Analysis on CROMPTON at: Crompton Greaves Consumer Electricals Ltd