TV18 Broadcast Ltd

NSE :TV18BRDCST BSE :532800 Sector : Media - Print/Television/RadioBuy, Sell or Hold TV18BRDCST? Ask The Analyst

BSE

prev close

OPEN PRICE

volume

Today's low / high

52 WK low / high

bid price (qty)

offer price (qty)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 15 Oct 45.27 (6.74%) | 14 Oct 42.41 (-3.28%) | 11 Oct 43.85 (5.71%) | 10 Oct 41.48 (-1.07%) | 09 Oct 41.93 (1.80%) | 08 Oct 41.19 (1.48%) | 07 Oct 40.59 (-4.13%) | 04 Oct 42.34 (-2.64%) | 03 Oct 43.49 (-3.10%) | 01 Oct 44.88 (0.74%) | 30 Sep 44.55 (-0.42%) | 27 Sep 44.74 (-1.21%) | 26 Sep 45.29 (1.46%) | 25 Sep 44.64 (-1.09%) | 24 Sep 45.13 (-0.86%) | 23 Sep 45.52 (-1.17%) | 20 Sep 46.06 (1.57%) | 19 Sep 45.35 (-4.65%) | 18 Sep 47.56 (-2.38%) | 17 Sep 48.72 (-1.85%) | 16 Sep 49.64 (4.18%) |

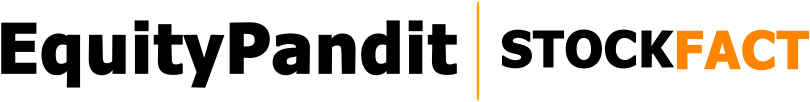

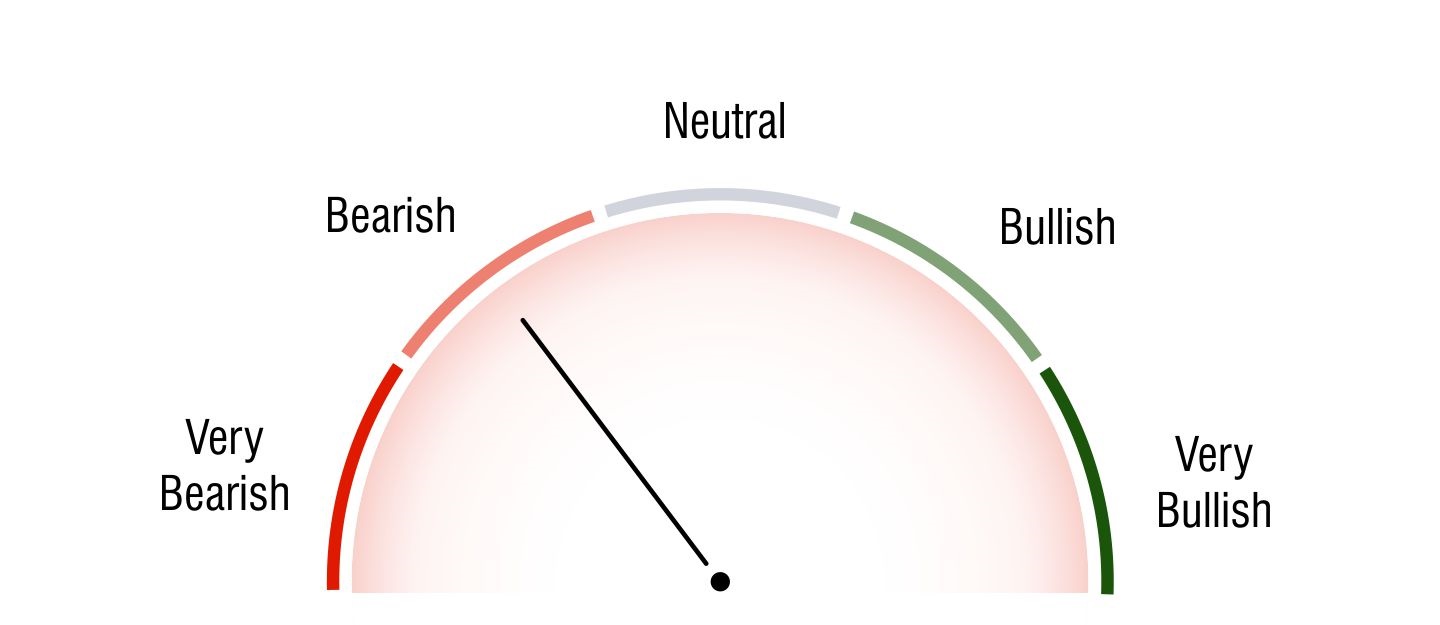

Technical Analysis

Short Term Investors

Neutral

Medium Term Investors

Bearish

Long Term Investors

Bullish

Moving Averages

5 DMA

Bullish

43.06

10 DMA

Bullish

42.78

20 DMA

Bullish

44.27

50 DMA

Bearish

46.48

100 DMA

Bullish

44.9

200 DMA

Bullish

0

Intraday Support and Resistance

(Based on Pivot Points) undefined |

Updated On Oct 15, 2024 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 49.83 | 47.89 | 46.16 | - | - |

| R2 | 47.89 | 46.65 | 45.87 | 48.05 | - |

| R1 | 46.58 | 45.88 | 45.57 | 46.9 | 47.24 |

| P | 44.64 | 44.64 | 44.64 | 44.8 | 44.97 |

| S1 | 43.33 | 43.4 | 44.97 | 43.65 | 43.99 |

| S2 | 41.39 | 42.63 | 44.67 | 41.55 | - |

| S3 | 40.08 | 41.39 | 44.38 | - | - |

Key Metrics

EPS

0.25

P/E

181.36

P/B

2.48

Dividend Yield

0%

Market Cap

7,761 Cr.

Face Value

2

Book Value

18.25

ROE

2.7%

EBITDA Growth

63.88 Cr.

Debt/Equity

0.55

Shareholding History

Quarterly Result (Figures in Rs. Crores)

TV18 Broadcast Ltd Quaterly Results

| Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | ||

| INCOME | 3395.53 | 2004.61 | 1857.11 | 2509.56 | 3243.36 | |

| PROFIT | 44.33 | -28.92 | -12.29 | -51.73 | -50.09 | |

| EPS | 0.26 | -0.17 | -0.07 | -0.3 | -0.29 |

TV18 Broadcast Ltd Quaterly Results

| Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | ||

| INCOME | 352.11 | 370.88 | 412.09 | 471.27 | 397.68 | |

| PROFIT | -20.6 | -8.56 | 16.25 | 27.68 | 6.97 | |

| EPS | -0.12 | -0.05 | 0.09 | 0.16 | 0.04 |

Profit & Loss (Figures in Rs. Crores)

TV18 Broadcast Ltd Profit & Loss

| Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | ||

| INCOME | 2000.55 | 2369.73 | 959.23 | 1022.74 | 1573.31 | 5013.89 | 5295.7 | 4619.47 | 5657.1 | 6084.98 | |

| PROFIT | 126.33 | -140.99 | 194.99 | 6.67 | 9.6 | 165.49 | 256.58 | 455.56 | 585.98 | 116.15 | |

| EPS | 0.5 | 0 | 0.63 | 0 | 0.05 | 1.23 | 2.43 | 4.35 | 5.4 | 0.75 |

TV18 Broadcast Ltd Profit & Loss

| Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | ||

| INCOME | 531.45 | 620.7 | 656.6 | 704.06 | 971.52 | 1093.37 | 1212.31 | 1151.67 | 1312.67 | 1328.62 | |

| PROFIT | 85.74 | 19.22 | 125.13 | 101.41 | -58.71 | 85.05 | 32.19 | 90.62 | 172.79 | 57.81 | |

| EPS | 0.35 | 0.09 | 0.73 | 0.59 | 0 | 0.5 | 0.13 | 0.53 | 1.01 | 0.34 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.33 |

| Reserves Total | 4,335.64 | 4,436.8 | 3,848.46 | 3,390.73 | 3,155.33 | 2,997.34 | 2,987.94 | 3,709.72 | 3,104.96 | 3,067.53 |

| Total Shareholders Funds | 4,678.51 | 4,779.67 | 4,191.33 | 3,733.6 | 3,498.2 | 3,340.21 | 3,330.81 | 4,052.59 | 3,447.83 | 3,409.86 |

| Minority Interest | 1,516.59 | 1,505.84 | 1,163.14 | 870.65 | 696.85 | 653.55 | 13.06 | 15.98 | 22.74 | 90.86 |

| Secured Loans | 2,086.56 | 1.75 | 65.45 | 840.41 | 164 | 346.32 | 11.69 | 47.51 | 363.9 | 426.15 |

| Unsecured Loans | 2,299.26 | 787.04 | 964.1 | 934.77 | 1,455.83 | 655.29 | 261.17 | 182.95 | 137.28 | 64.18 |

| Total Debt | 4,385.82 | 788.79 | 1,029.55 | 1,775.18 | 1,619.83 | 1,001.61 | 272.86 | 230.46 | 501.18 | 490.33 |

| Other Liabilities | 128.08 | 103.52 | 88.69 | 156.25 | 62.57 | 55.06 | 32.45 | 26.36 | 24.46 | 22 |

| Total Liabilities | 10,709 | 7,177.82 | 6,472.71 | 6,535.68 | 5,877.45 | 5,050.43 | 3,649.18 | 4,325.39 | 3,996.21 | 4,013.05 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 3,293.54 | 3,047.06 | 3,084.13 | 3,066.86 | 2,935.08 | 2,901.39 | 1,482.19 | 1,425.54 | 2,512.18 | 2,794.97 |

| Less: Accumulated Depreciation | 839.38 | 772.96 | 762.99 | 706.7 | 683.27 | 612.82 | 365.03 | 405.27 | 525.2 | 643.38 |

| Net Block | 2,454.16 | 2,274.1 | 2,321.14 | 2,360.16 | 2,251.81 | 2,288.57 | 1,117.16 | 1,020.27 | 1,986.98 | 2,151.59 |

| Capital Work in Progress | 912.36 | 258.96 | 125.79 | 86.66 | 47.3 | 25.34 | 4.39 | 15.09 | 9.41 | 3.42 |

| Investments | 646.73 | 580.24 | 489.42 | 419.65 | 380.33 | 352.65 | 1,824.86 | 2,513.39 | 514.46 | 499.58 |

| Inventories | 5,849.34 | 2,579.84 | 1,884.1 | 2,031.1 | 1,898.94 | 1,340.76 | 0 | 2.42 | 406.51 | 332.25 |

| Sundry Debtors | 1,231.13 | 1,090.85 | 1,228.7 | 1,491.08 | 1,229.46 | 1,210.55 | 245.59 | 279.12 | 537.54 | 485.63 |

| Cash and Bank Balance | 227.37 | 334.09 | 326.09 | 114.48 | 179.89 | 177.41 | 11.65 | 33.49 | 167.68 | 288.38 |

| Loans and Advances | 2,088.91 | 1,622.14 | 1,261.91 | 1,244.39 | 1,156.01 | 832.52 | 496.3 | 650.72 | 792.98 | 648.54 |

| Total Current Assets | 9,396.75 | 5,626.92 | 4,700.8 | 4,881.05 | 4,464.3 | 3,561.24 | 753.54 | 965.75 | 1,904.71 | 1,754.79 |

| Current Liabilities | 2,980.76 | 1,957.85 | 1,735.35 | 1,863.18 | 1,994.25 | 1,715.55 | 317.72 | 420.77 | 696.99 | 684.19 |

| Provisions | 19.2 | 17.07 | 14.09 | 10 | 10.23 | 5.7 | 2.66 | 2.23 | 42.25 | 11.34 |

| Total Current Liabilities & Provisions | 2,999.96 | 1,974.92 | 1,749.44 | 1,873.18 | 2,004.48 | 1,721.25 | 320.38 | 423 | 739.25 | 695.53 |

| Net Current Assets | 6,396.79 | 3,652 | 2,951.36 | 3,007.87 | 2,459.82 | 1,839.99 | 433.16 | 542.74 | 1,165.46 | 1,059.26 |

| Deferred Tax Assets | 147.75 | 152.1 | 73.37 | 339.92 | 49.01 | 34.15 | 53.55 | 49.15 | 28.82 | 28.42 |

| Deferred Tax Liability | 206.67 | 195.96 | 57.63 | 290.91 | 0 | 2.62 | 2.61 | 0.75 | 20.88 | 23.78 |

| Net Deferred Tax | -58.92 | -43.86 | 15.74 | 49.01 | 49.01 | 31.53 | 50.94 | 48.4 | 7.94 | 4.64 |

| Other Assets | 357.88 | 456.38 | 569.26 | 612.33 | 689.18 | 512.35 | 218.67 | 185.49 | 311.97 | 294.56 |

| Total Assets | 10,709 | 7,177.82 | 6,472.71 | 6,535.68 | 5,877.45 | 5,050.43 | 3,649.18 | 4,325.38 | 3,996.22 | 4,013.05 |

| Contingent Liabilities | 230.9 | 241.85 | 3,387.62 | 3,374.07 | 3,404.16 | 274.53 | 3,576.35 | 3,561.72 | 3,841.58 | 3,917.13 |

| Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.87 | 342.33 |

| Reserves Total | 2,758.93 | 2,700.66 | 2,525.59 | 2,435.32 | 2,420.52 | 2,344.13 | 3,354.27 | 3,254.75 | 3,146.13 | 3,131.22 |

| Total Shareholders Funds | 3,101.8 | 3,043.53 | 2,868.46 | 2,778.19 | 2,763.39 | 2,687 | 3,697.14 | 3,597.62 | 3,489 | 3,473.55 |

| Secured Loans | 0 | 0 | 0 | 0 | 0 | 67.73 | 11.69 | 47.51 | 107.06 | 144.73 |

| Unsecured Loans | 653.21 | 707.41 | 831.17 | 834.77 | 864.83 | 355.29 | 225 | 175 | 125 | 46.38 |

| Total Debt | 653.21 | 707.41 | 831.17 | 834.77 | 864.83 | 423.02 | 236.69 | 222.51 | 232.06 | 191.11 |

| Other Liabilities | 52.53 | 46.88 | 47.56 | 106.37 | 42.18 | 36.36 | 18.94 | 14.66 | 13.3 | 13.3 |

| Total Liabilities | 3,807.54 | 3,797.82 | 3,747.19 | 3,719.33 | 3,670.4 | 3,146.38 | 3,952.77 | 3,834.79 | 3,734.36 | 3,677.96 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 1,609.24 | 1,427.88 | 1,430.25 | 1,435.77 | 1,415.98 | 1,424.12 | 378.61 | 324.45 | 315.83 | 307.82 |

| Less : Accumulated Depreciation | 391.82 | 361.26 | 338.07 | 302.6 | 358.67 | 356.46 | 291.03 | 280.78 | 271.6 | 197.78 |

| Net Block | 1,217.42 | 1,066.62 | 1,092.18 | 1,133.17 | 1,057.31 | 1,067.66 | 87.58 | 43.67 | 44.23 | 110.04 |

| Capital Work in Progress | 56.58 | 0 | 1.12 | 1.13 | 13.65 | 0.04 | 0.92 | 11.47 | 0.13 | 0 |

| Investments | 1,405.81 | 1,403.43 | 1,401.65 | 1,398.96 | 1,397.95 | 1,414.57 | 3,392.33 | 3,337.7 | 3,272.63 | 3,258.46 |

| Sundry Debtors | 424.88 | 494.02 | 480.62 | 504.7 | 331.6 | 275 | 180.27 | 180.47 | 162.94 | 169.04 |

| Cash and Bank Balance | 9.64 | 48.47 | 124.63 | 8.66 | 4.65 | 2.58 | 7.44 | 13.1 | 18.28 | 39.23 |

| Loans and Advances | 944.76 | 924.65 | 801.13 | 769.54 | 702.56 | 401.16 | 234.7 | 391.15 | 264.14 | 120.32 |

| Total Current Assets | 1,379.28 | 1,467.14 | 1,406.38 | 1,282.9 | 1,038.81 | 678.74 | 422.41 | 584.71 | 445.36 | 328.59 |

| Current Liabilities | 341.11 | 234.86 | 340.05 | 433.41 | 245.53 | 282 | 189.83 | 348.6 | 135.6 | 112.43 |

| Provisions | 8.94 | 7.58 | 7.28 | 5.07 | 5.41 | 2.63 | 0.63 | 0.51 | 0.45 | 0.86 |

| Total Current Liabilities & Provisions | 350.05 | 242.44 | 347.33 | 438.48 | 250.94 | 284.63 | 190.46 | 349.1 | 136.05 | 113.29 |

| Net Current Assets | 1,029.23 | 1,224.7 | 1,059.05 | 844.42 | 787.87 | 394.11 | 231.95 | 235.61 | 309.3 | 215.3 |

| Deferred Tax Assets | 77.11 | 91.34 | 151.66 | 244.51 | 44.17 | 26.82 | 48.21 | 43.22 | 0 | 0 |

| Deferred Tax Liability | 139.99 | 139.41 | 140.76 | 200.34 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Deferred Tax | -62.88 | -48.07 | 10.9 | 44.17 | 44.17 | 26.82 | 48.21 | 43.22 | 0 | 0 |

| Other Assets | 161.38 | 151.14 | 182.29 | 297.48 | 369.45 | 243.18 | 191.78 | 163.13 | 108.06 | 94.17 |

| Total Assets | 3,807.54 | 3,797.82 | 3,747.19 | 3,719.33 | 3,670.4 | 3,146.38 | 3,952.77 | 3,834.8 | 3,734.36 | 3,677.97 |

| Contingent Liabilities | 48.68 | 37.54 | 3,151.6 | 3,151.6 | 3,181.28 | 3,195.17 | 36.75 | 37.6 | 3,550.21 | 3,564.86 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 126.76 |

| Depreciation | 122.59 |

| Interest (Net) | 80.67 |

| Dividend Received | 0.27 |

| P/L on Sales of Assets | -0.03 |

| Prov. and W/O (Net) | -1.78 |

| P/L in Forex | -6.18 |

| Others | -0.37 |

| Total Adjustments (PBT and Ext... | 145.36 |

| Operating Profit before Workin... | 272.12 |

| Trade and 0ther Receivables | -844.3 |

| Inventories | -3,269.5 |

| Trade Payables | 993.02 |

| Total Adjustments (OP before W... | -3,120.78 |

| Cash Generated from/(used in) ... | -2,848.66 |

| Direct Taxes Paid | 130.58 |

| Total Adjustments(Cash Generat... | 130.58 |

| Cash Flow before Extraordinary... | -2,718.08 |

| Net Cash from Operating Activi... | -2,718.08 |

| Purchased of Fixed Assets | -726.54 |

| Sale of Fixed Assets | 0.12 |

| Purchase of Investments | -1,546.12 |

| Sale of Investments | 1,531.4 |

| Interest Received | 33.26 |

| Net Cash used in Investing Act... | -705.5 |

| Proceed from Short Tem Borrowi... | 3,465.85 |

| Of the Long Tem Borrowings | -0.19 |

| Of Financial Liabilities | -38.72 |

| Interest Paid | -109.61 |

| Net Cash used in Financing Act... | 3,316.96 |

| Net Profit before Tax and Extr... | 52.93 |

| Depreciation | 56.22 |

| Interest (Net) | 2.82 |

| Dividend Received | 0.27 |

| P/L on Sales of Assets | -0.03 |

| Prov. and W/O (Net) | 5.33 |

| P/L in Forex | -0.25 |

| Total Adjustments (PBT and Ext... | 63.1 |

| Operating Profit before Workin... | 116.03 |

| Trade and 0ther Receivables | 38.66 |

| Trade Payables | 53.2 |

| Total Adjustments (OP before W... | 91.86 |

| Cash Generated from/(used in) ... | 207.89 |

| Direct Taxes Paid | 16.52 |

| Total Adjustments(Cash Generat... | 16.52 |

| Cash Flow before Extraordinary... | 224.41 |

| Net Cash from Operating Activi... | 224.41 |

| Purchased of Fixed Assets | -79.12 |

| Sale of Fixed Assets | 0.02 |

| Purchase of Investments | -889.05 |

| Sale of Investments | 889.77 |

| Interest Received | 33 |

| Net Cash used in Investing Act... | -46.46 |

| Of the Short Term Borrowings | -165.15 |

| Of Financial Liabilities | -13.45 |

| Interest Paid | -37.79 |

| Net Cash used in Financing Act... | -216.39 |

Company Details

Registered Office |

|

| Address | First Floor Empire Complex 414, SenapatiBapat Marg Lower Parel |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400013 |

| Tel. No. | 91-22-40019000/6666 7777 |

| Fax. No. | 91-22-2496 8238 |

| investors.tv18@nw18.com | |

| Internet | http://www.nw18.com |

Registrars |

|

| Address | First Floor Empire Complex 414 |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400013 |

| Tel. No. | 91-22-40019000/6666 7777 |

| Fax. No. | 91-22-2496 8238 |

| investors.tv18@nw18.com | |

| Internet | http://www.nw18.com |

Management |

|

| Name | Designation |

| Adil Zainulbhai | Chairman & Independent Directo |

| Dhruv Kaji | Independent Director |

| PMS Prasad | Director |

| Jyoti Deshpande | Director |

| Rahul Joshi | Managing Director |

| Renuka Ramnath | Independent Director |

| Ratnesh Rukhariyar | Company Sec. & Compli. Officer |