Indian Overseas Bank

NSE :IOB BSE :532388 Sector : BanksBuy, Sell or Hold IOB? Ask The Analyst

BSE

prev close

OPEN PRICE

volume

Today's low / high

52 WK low / high

bid price (qty)

offer price (qty)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 15 Apr 35.43 (1.43%) | 11 Apr 34.93 (-0.71%) | 09 Apr 35.18 (-1.81%) | 08 Apr 35.83 (2.87%) | 07 Apr 34.83 (-5.43%) | 04 Apr 36.83 (-2.20%) | 03 Apr 37.66 (0.61%) | 02 Apr 37.43 (-0.72%) | 01 Apr 37.70 (-3.26%) | 28 Mar 38.97 (-6.66%) | 27 Mar 41.75 (-1.79%) | 26 Mar 42.51 (-0.61%) | 25 Mar 42.77 (-3.82%) | 24 Mar 44.47 (2.09%) | 21 Mar 43.56 (1.30%) | 20 Mar 43.00 (-1.89%) | 19 Mar 43.83 (3.30%) | 18 Mar 42.43 (3.24%) | 17 Mar 41.10 (-1.06%) | 13 Mar 41.54 (-1.31%) | 12 Mar 42.09 (-1.20%) |

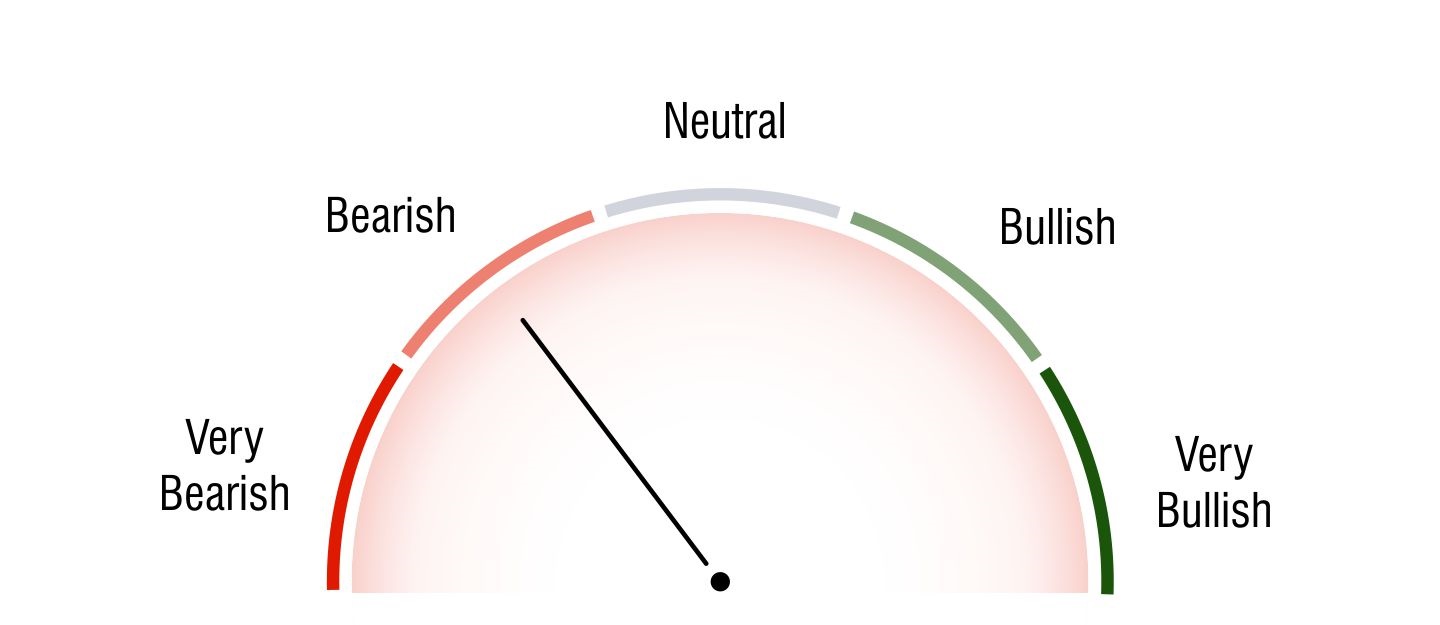

Technical Analysis

Short Term Investors

Bearish

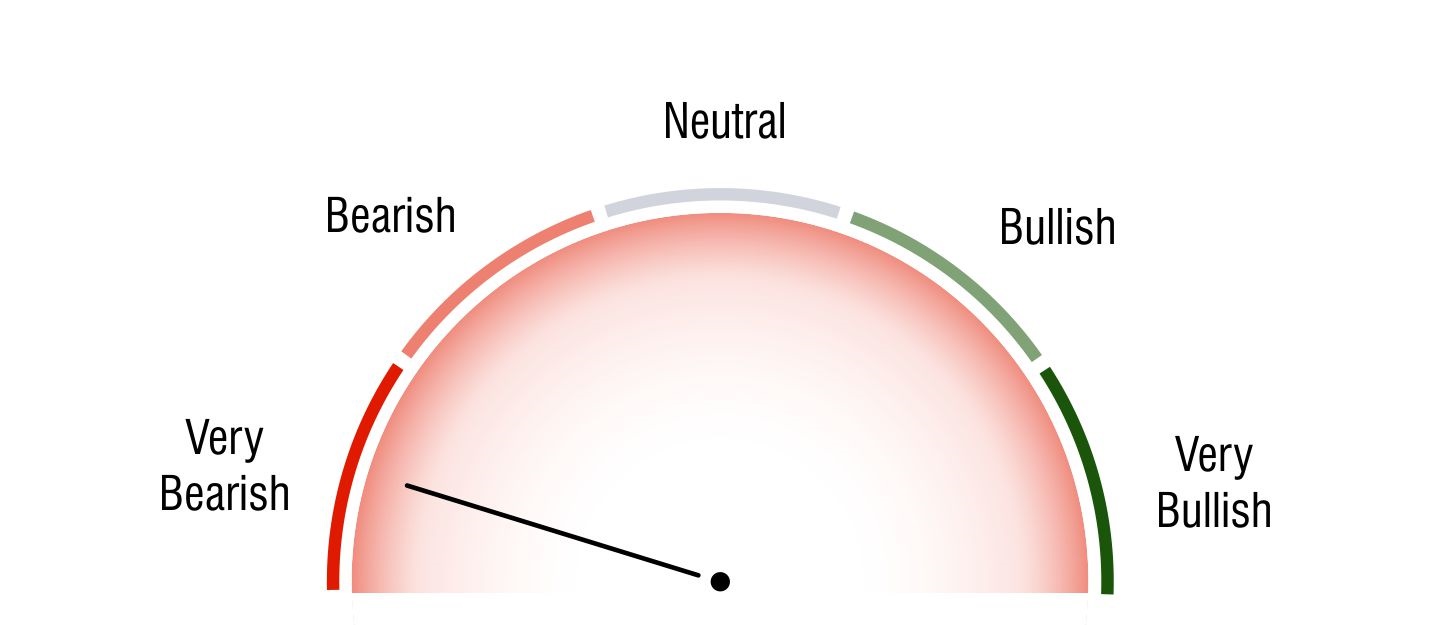

Medium Term Investors

Very Bearish

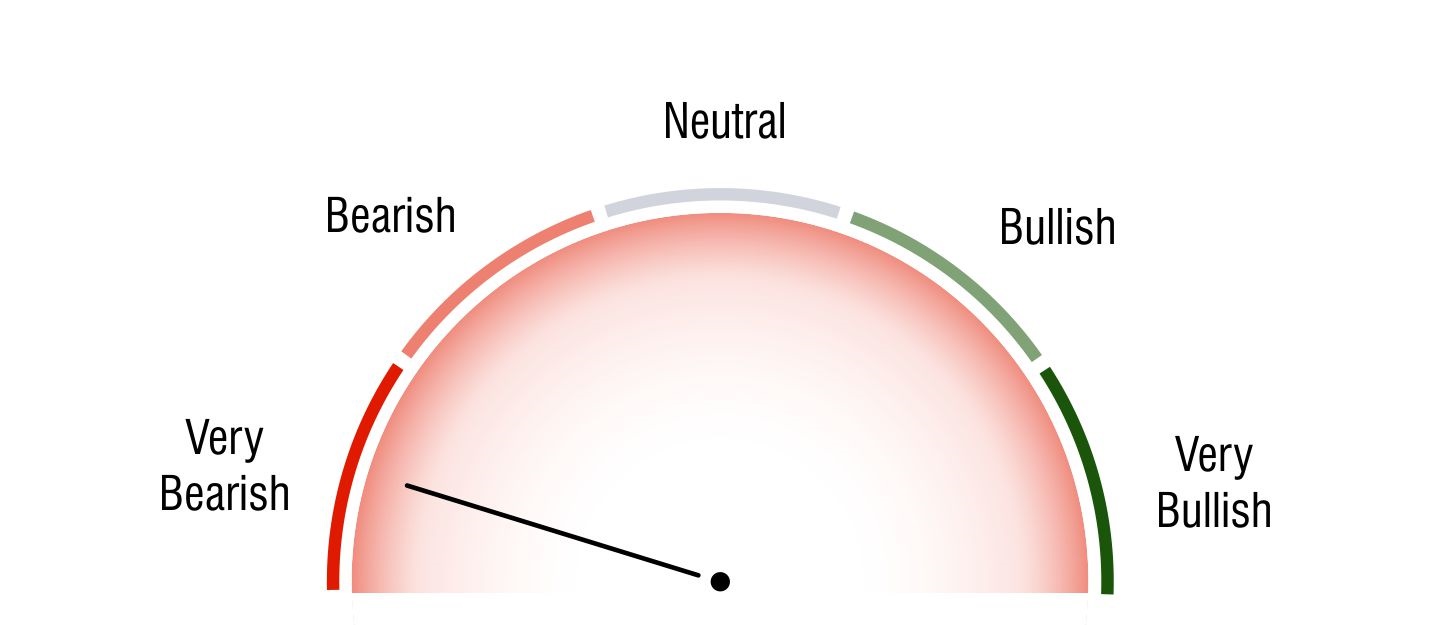

Long Term Investors

Very Bearish

Moving Averages

5 DMA

Bullish

35.27

10 DMA

Bearish

36.5

20 DMA

Bearish

39.6

50 DMA

Bearish

43.88

100 DMA

Bearish

48.2

200 DMA

Bearish

53.69

Intraday Support and Resistance

(Based on Pivot Points) undefined |

Updated On Apr 15, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 36.46 | 36.13 | 35.62 | - | - |

| R2 | 36.13 | 35.87 | 35.55 | 36.13 | - |

| R1 | 35.78 | 35.71 | 35.49 | 35.78 | 35.96 |

| P | 35.45 | 35.45 | 35.45 | 35.45 | 35.54 |

| S1 | 35.1 | 35.19 | 35.37 | 35.1 | 35.28 |

| S2 | 34.77 | 35.03 | 35.31 | 34.77 | - |

| S3 | 34.42 | 34.77 | 35.24 | - | - |

Key Metrics

EPS

1.61

P/E

22.1

P/B

2.45

Dividend Yield

0%

Market Cap

68,226 Cr.

Face Value

10

Book Value

14.53

ROE

6.84%

EBITDA Growth

5,561.92 Cr.

Debt/Equity

0

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Indian Overseas Bank Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 7442.66 | 9112.67 | 7587.47 | 8489.9 | 8415.34 | |

| PROFIT | 724.14 | 810.42 | 648.66 | 779.62 | 875.27 | |

| EPS | 0.38 | 0.43 | 0.34 | 0.41 | 0.46 |

Indian Overseas Bank Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 7437.17 | 9106.26 | 7568 | 8484.14 | 8409.25 | |

| PROFIT | 722.56 | 808.1 | 632.81 | 777.16 | 873.66 | |

| EPS | 0.38 | 0.43 | 0.33 | 0.42 | 0.46 |

Profit & Loss (Figures in Rs. Crores)

Indian Overseas Bank Profit & Loss

| Mar 2002 | Mar 2003 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 3706.71 | 4009.75 | 22461.21 | 21641.17 | 23523.42 | 29730.97 | |

| PROFIT | 231.05 | 416.97 | 756.9 | 1708.12 | 2102.57 | 2663.94 | |

| EPS | 5.19 | 9.37 | 0.46 | 0.9 | 1.11 | 1.41 |

Indian Overseas Bank Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 26076.93 | 26045.55 | 23091.24 | 21661.65 | 21837.58 | 20765.79 | 22524.55 | 21632.89 | 23509.08 | 29705.99 | |

| PROFIT | -443.31 | -2898.58 | -3417.88 | -6301.27 | -3838.22 | -8533.03 | 830.02 | 1708.39 | 2097.37 | 2653.9 | |

| EPS | 0 | 0 | 0 | 0 | 0 | -5.19 | 0.51 | 0.9 | 1.11 | 1.4 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2003 | Mar 2002 | |

| SOURCES OF FUNDS : | ||||||

| Capital | 18,902.41 | 18,902.41 | 18,902.41 | 16,646.79 | 444.8 | 444.8 |

| Reserves Total | 8,659.04 | 5,973.63 | 3,695.34 | 451.89 | 1,094.54 | 654.01 |

| Deposits | 2,86,121.48 | 2,60,973.59 | 2,62,213.76 | 2,40,352.78 | 36,698.59 | 31,808.48 |

| Borrowings | 30,387.17 | 20,803.77 | 3,070.64 | 3,671.58 | 355.96 | 180.08 |

| Other Liabilities & Provisions | 7,799.23 | 6,784.66 | 11,147.82 | 13,106.28 | 2,641.78 | 2,389.29 |

| TOTAL LIABILITIES | 3,51,869.33 | 3,13,438.06 | 2,99,029.97 | 2,74,229.32 | 41,235.67 | 35,476.66 |

| APPLICATION OF FUNDS : | ||||||

| Cash & Balances with RBI | 16,905.54 | 17,149.92 | 22,749.65 | 12,189.21 | 2,687.94 | 2,212.54 |

| Balances with Banks & money at Call | 1,909.36 | 3,670.65 | 14,201.61 | 18,793.23 | 906.2 | 1,412.08 |

| Investments | 99,193.92 | 93,642.52 | 97,640.79 | 95,484.88 | 18,656.78 | 15,014.54 |

| Advances | 2,13,330.13 | 1,78,067.68 | 1,44,253.56 | 1,27,741.42 | 17,380.35 | 15,162.34 |

| Fixed Assets | 3,740.19 | 3,710.74 | 3,366.04 | 2,918.97 | 382.89 | 386.76 |

| Other Assets | 16,790.19 | 17,196.56 | 16,818.33 | 17,101.61 | 1,221.51 | 1,288.4 |

| TOTAL ASSETS | 3,51,869.33 | 3,13,438.07 | 2,99,029.98 | 2,74,229.32 | 41,235.67 | 35,476.66 |

| Contingent Liabilities | 1,95,641.16 | 1,96,078.99 | 97,952.08 | 68,239.11 | 7,001.33 | 5,386.85 |

| Bills for collection | 19,119.01 | 19,547.86 | 17,216.22 | 15,547.89 | 0 | 0 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 18,902.41 | 18,902.41 | 18,902.41 | 16,436.99 | 16,436.99 | 9,141.65 | 4,890.77 | 2,454.73 | 1,807.27 | 1,235.35 |

| Reserves Total | 9,039.89 | 6,360.53 | 4,097.98 | 507.82 | -282.01 | 7,218.23 | 8,383.21 | 11,289.82 | 13,858.55 | 14,405.67 |

| Deposits | 2,85,905.38 | 2,60,883.29 | 2,62,158.92 | 2,40,288.3 | 2,22,951.88 | 2,22,534.08 | 2,16,831.81 | 2,11,342.63 | 2,24,514.24 | 2,53,451.02 |

| Borrowings | 30,387.17 | 20,803.77 | 3,070.64 | 3,671.58 | 5,419.73 | 6,146.04 | 9,228.08 | 16,097.67 | 27,183.31 | 10,830.11 |

| Other Liabilities & Provisions | 7,798.77 | 6,783.98 | 11,147.21 | 13,105.67 | 16,200.24 | 4,968.36 | 8,634.16 | 5,982.64 | 7,073.4 | 5,714.83 |

| Total Liabilities | 3,52,033.62 | 3,13,733.98 | 2,99,377.16 | 2,74,010.36 | 2,60,726.83 | 2,50,008.36 | 2,47,968.03 | 2,47,167.49 | 2,74,436.77 | 2,85,636.98 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 16,904.57 | 17,148.1 | 22,748.99 | 12,188.25 | 3,155.22 | 10,292.53 | 11,579.45 | 11,499.97 | 14,033.5 | 12,637.77 |

| Balances with Banks & money at Call | 1,649.86 | 3,458.73 | 14,024.2 | 18,588.08 | 20,905.43 | 20,598.97 | 14,965.54 | 11,723.07 | 8,212.74 | 12,260.77 |

| Investments | 99,632.08 | 94,170.41 | 98,179.31 | 95,494.22 | 79,416.08 | 66,932.27 | 68,645.94 | 71,654.12 | 79,189.55 | 79,298.1 |

| Advances | 2,13,318.81 | 1,78,052.57 | 1,44,243.52 | 1,27,720.65 | 1,21,333.41 | 1,32,597.63 | 1,32,488.81 | 1,40,458.62 | 1,60,860.67 | 1,71,756.02 |

| Fixed Assets | 3,739.76 | 3,709.98 | 3,364.9 | 2,918.78 | 3,127.34 | 3,336.9 | 2,893.43 | 3,054.33 | 3,270.46 | 2,507.06 |

| Other Assets | 16,788.55 | 17,194.2 | 16,816.24 | 17,100.36 | 32,789.35 | 16,250.05 | 17,394.85 | 8,777.38 | 8,869.84 | 7,177.25 |

| Total Assets | 3,52,033.63 | 3,13,733.99 | 2,99,377.16 | 2,74,010.34 | 2,60,726.83 | 2,50,008.35 | 2,47,968.02 | 2,47,167.49 | 2,74,436.76 | 2,85,636.97 |

| Contingent Liabilities | 1,95,641.16 | 1,96,078.99 | 97,952.08 | 68,219.37 | 71,001.22 | 56,596.78 | 58,343.93 | 68,137.77 | 75,858.73 | 83,531.49 |

| Bills for collection | 19,119.01 | 19,547.86 | 17,216.22 | 15,547.89 | 15,348.25 | 15,203.63 | 15,239.38 | 14,109.56 | 19,123.34 | 14,916.55 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 3,422.74 |

| Depreciation | 973.38 |

| Interest (Net) | 227.69 |

| P/L on Sales of Assets | -2.21 |

| Prov. and W/O (Net) | 2,775.97 |

| Total Adjustments (PBT and Ext... | 3,224.9 |

| Operating Profit before Workin... | 6,647.64 |

| Loans and Advances | -37,978.12 |

| Investments | -5,483.76 |

| Change in Borrowing | 9,883.39 |

| Change in Deposits | 25,147.89 |

| Total Adjustments (OP before W... | -7,183.59 |

| Cash Generated from/(used in) ... | -535.95 |

| Direct Taxes Paid | -583 |

| Total Adjustments(Cash Generat... | -583 |

| Cash Flow before Extraordinary... | -1,118.95 |

| Net Cash from Operating Activi... | -1,118.95 |

| Purchased of Fixed Assets | -365.26 |

| Sale of Fixed Assets | 5.97 |

| Net Cash used in Investing Act... | -359.29 |

| On Redemption of Debenture | -527.69 |

| Net Cash used in Financing Act... | -527.69 |

| Net Profit before Tax and Extr... | 3,412.54 |

| Depreciation | 972.86 |

| Interest (Net) | 227.69 |

| P/L on Sales of Assets | -2.21 |

| Prov. and W/O (Net) | 2,776 |

| Total Adjustments (PBT and Ext... | 3,224.42 |

| Operating Profit before Workin... | 6,636.96 |

| Loans and Advances | -37,981.85 |

| Investments | -5,394.04 |

| Change in Borrowing | 9,883.39 |

| Change in Deposits | 25,022.09 |

| Total Adjustments (OP before W... | -7,219.38 |

| Cash Generated from/(used in) ... | -582.42 |

| Direct Taxes Paid | -583 |

| Total Adjustments(Cash Generat... | -583 |

| Cash Flow before Extraordinary... | -1,165.42 |

| Net Cash from Operating Activi... | -1,165.42 |

| Purchased of Fixed Assets | -365.26 |

| Sale of Fixed Assets | 5.97 |

| Net Cash used in Investing Act... | -359.29 |

| On Redemption of Debenture | -527.69 |

| Net Cash used in Financing Act... | -527.69 |

Company Details

Registered Office |

|

| Address | 763 Anna Salai, |

| City | Chennai |

| State | Tamil Nadu |

| Pin Code | 600002 |

| Tel. No. | 91-44-28519491/28415702/28889392 |

| Fax. No. | 91-44-28585675 |

| investor@iobnet.co.in; investorcomp@iobnet.co.in | |

| Internet | http://www.iob.in |

Registrars |

|

| Address | 763 Anna Salai |

| City | Chennai |

| State | Tamil Nadu |

| Pin Code | 600002 |

| Tel. No. | 91-44-28519491/28415702/28889392 |

| Fax. No. | 91-44-28585675 |

| investor@iobnet.co.in; investorcomp@iobnet.co.in | |

| Internet | http://www.iob.in |

Management |

|

| Name | Designation |

| Ajay Kumar Srivastava | Managing Director & CEO |

| DEEPAK SHARMA | Non Official Director |

| Suresh Kumar Rungta | Non Official Director |

| B Chandra Reddy | Non-official Director |

| Sanjaya Rastogi | Director (Shareholder) |

| Joydeep Dutta Roy | Executive Director |

| Kartikeya Misra | Nominee (Govt) |

| Sonali Sen Gupta | Nominee (RBI) |

| Dhanaraj T | Executive Director |