A B Infrabuild Ltd

NSE :ABINFRA BSE :544281 Sector : Infrastructure Developers & OperatorsBuy, Sell or Hold ABINFRA? Ask The Analyst

BSE

prev close

OPEN PRICE

bid price (qty)

offer price (qty)

volume

Today's low / high

52 WK low / high

NSE

prev close

open price

bid price (qty)

offer price (qty)

volume

Today's' low / high

52 WK low / high

| 20 Dec 93.00 (-2.04%) | 19 Dec 94.94 (-1.11%) | 18 Dec 96.01 (4.00%) | 17 Dec 92.32 (-2.82%) | 16 Dec 95.00 (-1.58%) | 13 Dec 96.53 (-4.92%) | 12 Dec 101.53 (1.55%) | 11 Dec 99.98 (1.51%) | 10 Dec 98.49 (-1.99%) | 09 Dec 100.49 (-1.29%) | 06 Dec 101.80 (0.80%) | 05 Dec 100.99 (-0.40%) | 04 Dec 101.40 (1.74%) | 03 Dec 99.67 (-0.39%) | 02 Dec 100.06 (4.61%) | 29 Nov 95.65 (1.97%) | 28 Nov 93.80 (1.96%) | 27 Nov 92.00 (2.00%) | 26 Nov 90.20 (-1.96%) | 25 Nov 92.00 (-0.27%) | 22 Nov 92.25 (-0.49%) |

Price Chart Historical Data Technical Chart

Technical Analysis

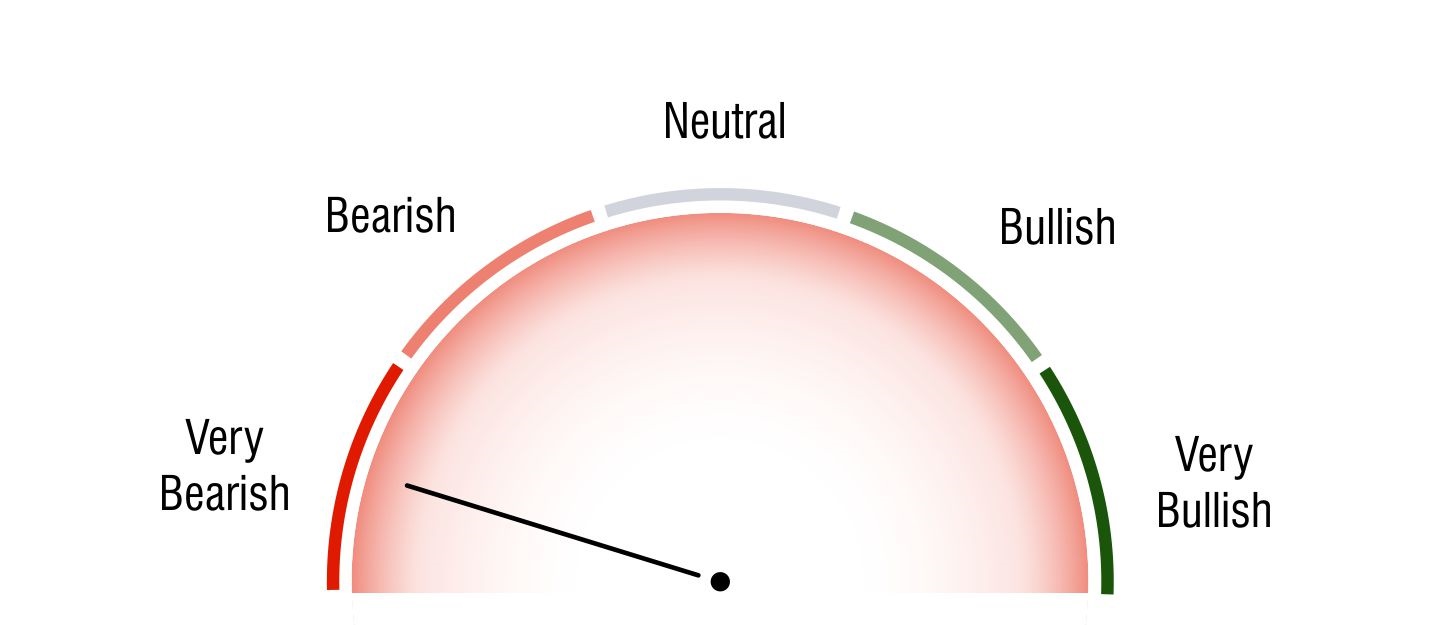

Short Term Investors

Very Bearish

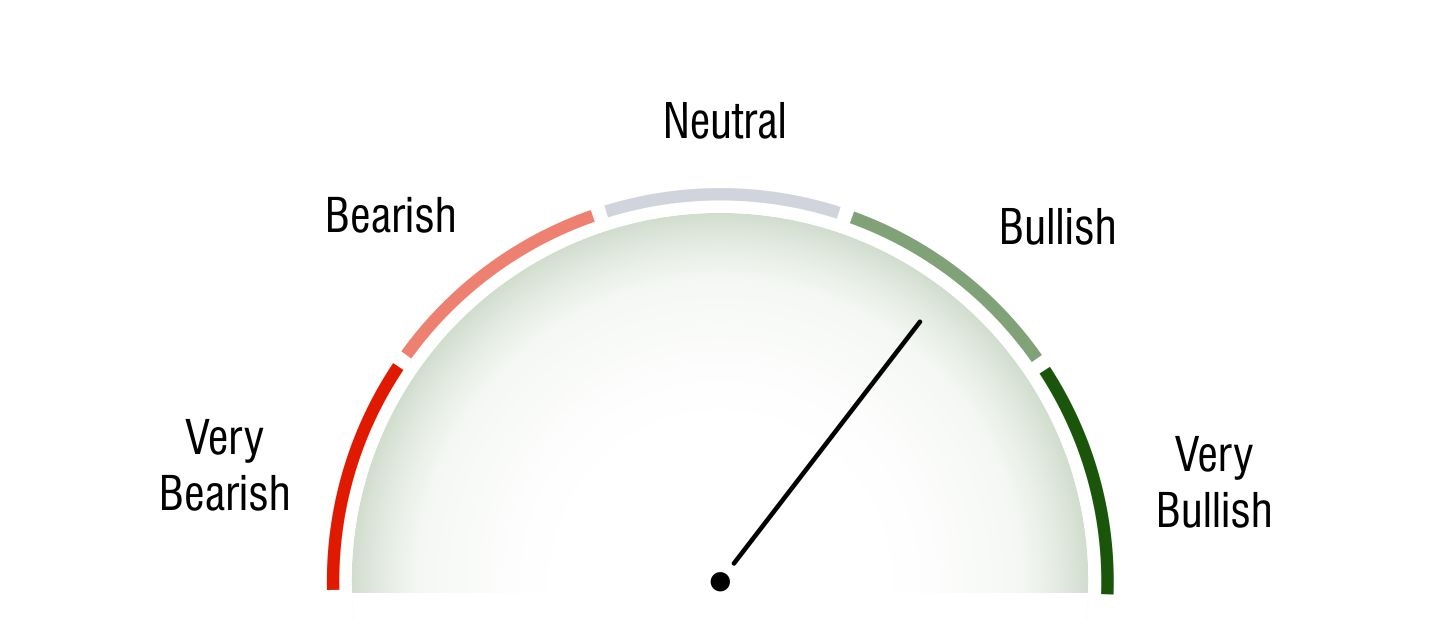

Medium Term Investors

Bullish

Long Term Investors

Neutral

Moving Averages

5 DMA

Bearish

94.18

10 DMA

Bearish

96.79

20 DMA

Bearish

97.46

50 DMA

Bullish

0

100 DMA

Bullish

0

200 DMA

Bullish

0

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On Dec 20, 2024 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 99 | 97 | 94.1 | - | - |

| R2 | 97 | 95.47 | 93.73 | 97 | - |

| R1 | 95 | 94.53 | 93.37 | 95 | 96 |

| P | 93 | 93 | 93 | 93 | 93.5 |

| S1 | 91 | 91.47 | 92.63 | 91 | 92 |

| S2 | 89 | 90.53 | 92.27 | 89 | - |

| S3 | 87 | 89 | 91.9 | - | - |

Key Metrics

Shareholding History

Quarterly Result (Figures in Rs. Crores)

A B Infrabuild Ltd Quaterly Results

| INCOME | |||||

| PROFIT | |||||

| EPS |

A B Infrabuild Ltd Quaterly Results

| INCOME | 80.62 | 54.06 | 54.13 | 14.33 | 47.9 |

| PROFIT | 6.39 | 3.3 | 4.15 | 0.54 | 3.74 |

| EPS | 5.38 | 0.66 | 0.92 | 0.12 | 0.81 |

Profit & Loss (Figures in Rs. Crores)

A B Infrabuild Ltd Profit & Loss

| INCOME | |

| PROFIT | |

| EPS |

A B Infrabuild Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 88.8 | 72.25 | 81.89 | 69.45 | 63.81 | 63.19 | 66.24 | 61.25 | 132.73 | 182.36 | |

| PROFIT | 0.78 | 0.33 | 0.18 | 2.95 | 2.86 | 3.1 | 1.54 | 0.51 | 6 | 11.71 | |

| EPS | 3.13 | 1.31 | 0.63 | 12.08 | 3.36 | 1.89 | -1.62 | 0.63 | 5.48 | 2.38 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 44.22 | 12.67 | 12.67 | 12.67 | 12.67 | 8.24 | 2.5 | 2.5 | 2.5 | 2.5 |

| Reserves Total | 36.39 | 22.65 | 15.12 | 14.18 | 16.41 | 6.27 | 8.68 | 5.53 | 5.37 | 5.05 |

| Equity Share Warrants | 0.94 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Shareholders Funds | 81.55 | 35.32 | 27.79 | 26.85 | 29.08 | 14.51 | 11.18 | 8.03 | 7.87 | 7.55 |

| Secured Loans | 42.86 | 30.98 | 27.22 | 23.14 | 20.34 | 22.41 | 22.57 | 28.54 | 30.74 | 30.94 |

| Unsecured Loans | -1.75 | 1.33 | 2.89 | 1.69 | 2.7 | 2.68 | 4.17 | 6.84 | 2.91 | 9.57 |

| Total Debt | 41.11 | 32.31 | 30.11 | 24.83 | 23.04 | 25.09 | 26.74 | 35.38 | 33.65 | 40.51 |

| Other Liabilities | 0 | 0 | 0 | 0.04 | 0.06 | 0.08 | 0.08 | 0.08 | 0.07 | 0.05 |

| Total Liabilities | 122.66 | 67.63 | 57.9 | 51.72 | 52.18 | 39.68 | 38 | 43.49 | 41.59 | 48.11 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 41.81 | 5.09 | 3.87 | 2.17 | 4.61 | 5.96 | 8.77 | 11.48 | 11.21 | 12.18 |

| Less : Accumulated Depreciation | 5.59 | 2.14 | 1.63 | 1.1 | 3.62 | 3.97 | 4.65 | 7.63 | 6.8 | 6.58 |

| Net Block | 36.22 | 2.95 | 2.24 | 1.07 | 0.99 | 1.99 | 4.12 | 3.85 | 4.41 | 5.6 |

| Capital Work in Progress | 1.08 | 2.37 | 0 | 0.67 | 0 | 0 | 0 | 0 | 0 | 0 |

| Investments | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 | 0.18 |

| Inventories | 50.51 | 52.74 | 45.87 | 49.68 | 45.92 | 46.69 | 39.15 | 30.61 | 22 | 24.04 |

| Sundry Debtors | 20.96 | 32.3 | 27.35 | 36.09 | 38.33 | 15.77 | 19.5 | 23.04 | 17.71 | 23.93 |

| Cash and Bank Balance | 10.04 | 1.81 | 2.34 | 2.11 | 2.88 | 4.24 | 5.69 | 5.8 | 5.63 | 7.44 |

| Loans and Advances | 34.47 | 26.05 | 21.73 | 19.89 | 13.49 | 3.16 | 5.03 | 2.55 | 2.73 | 2.25 |

| Total Current Assets | 115.98 | 112.89 | 97.29 | 107.76 | 100.62 | 69.86 | 69.37 | 62 | 48.06 | 57.67 |

| Current Liabilities | 29.6 | 54.56 | 44.94 | 61.15 | 58.48 | 39.78 | 42.81 | 31.41 | 21.04 | 23.35 |

| Provisions | 4.38 | 3.05 | 0.25 | 0.58 | 1.16 | 1.95 | 1.52 | 0.47 | 0.33 | 1.2 |

| Total Current Liabilities & Provisions | 33.98 | 57.61 | 45.2 | 61.72 | 59.64 | 41.73 | 44.33 | 31.88 | 21.37 | 24.55 |

| Net Current Assets | 82 | 55.28 | 52.1 | 46.04 | 40.98 | 28.13 | 25.04 | 30.12 | 26.7 | 33.12 |

| Deferred Tax Assets | 0.87 | 0.9 | 1.42 | 1.5 | 0.62 | 0.54 | 0.43 | 0.5 | 0.31 | 0.17 |

| Net Deferred Tax | 0.87 | 0.9 | 1.42 | 1.5 | 0.62 | 0.54 | 0.43 | 0.5 | 0.31 | 0.17 |

| Other Assets | 2.3 | 5.96 | 1.97 | 2.27 | 9.42 | 8.85 | 8.23 | 8.85 | 9.99 | 9.05 |

| Total Assets | 122.65 | 67.63 | 57.91 | 51.72 | 52.19 | 39.68 | 38 | 43.5 | 41.59 | 48.12 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 15.59 |

| Depreciation | 3.49 |

| Interest (Net) | 4.78 |

| Prov. and W/O (Net) | 0.01 |

| Total Adjustments (PBT and Ext... | 8.28 |

| Operating Profit before Workin... | 23.88 |

| Trade and 0ther Receivables | 11.34 |

| Inventories | 2.22 |

| Trade Payables | -23.18 |

| Loans and Advances | 1.17 |

| Total Adjustments (OP before W... | -10.21 |

| Cash Generated from/(used in) ... | 13.66 |

| Direct Taxes Paid | -3.66 |

| Total Adjustments(Cash Generat... | -3.66 |

| Cash Flow before Extraordinary... | 10 |

| Total Extraordinary Items | -0.21 |

| Net Cash from Operating Activi... | 9.8 |

| Purchased of Fixed Assets | -35.48 |

| Purchase of Investments | -8.05 |

| Sale of Investments | 3.66 |

| Interest Received | 0.43 |

| Net Cash used in Investing Act... | -39.44 |

| Proceeds from Issue of shares ... | 35.01 |

| Proceed from 0ther Long Term B... | 9.16 |

| Of the Short Term Borrowings | -1.08 |

| Interest Paid | -5.21 |

| Net Cash used in Financing Act... | 37.87 |

Company Details

Registered Office |

|

| Address | 104 Shubhangan CHS Ltd Gore(W0, Jawahar Nagar Nr Rly Crossing |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400062 |

| Tel. No. | 91-22-2871 2113/14 |

| Fax. No. | |

| cs@abinfrabuild.com | |

| Internet | http://www.abinfrabuild.com |

Registrars |

|

| Address | 104 Shubhangan CHS Ltd Gore(W0 |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400062 |

| Tel. No. | 91-22-2871 2113/14 |

| Fax. No. | |

| cs@abinfrabuild.com | |

| Internet | http://www.abinfrabuild.com |

Management |

|

| Name | Designation |

| Amit Bholanath Mishra | Executive Director & MD |

| Shreeprakash D Singh | E D & Wholetime Director |

| Bharat Kumar Parmar | E D & Wholetime Director |

| Mukesh Pandey | E D & Wholetime Director |

| Udayan Anantrao Chindarkar | Independent Non Exe. Director |

| Vanita Vinodbhai Bhuva | Independent Non Exe. Director |

| Archana Rakesh Pandey | Independent Director |