BSE

prev close

OPEN PRICE

bid price (qty)

offer price (qty)

volume

Today's low / high

52 WK low / high

NSE

prev close

open price

bid price (qty)

offer price (qty)

volume

Today's' low / high

52 WK low / high

| 18 May 126.10 (0.80%) | 17 May 125.10 (-0.04%) | 16 May 125.15 (0.68%) | 15 May 124.30 (-1.15%) | 14 May 125.75 (2.15%) | 13 May 123.10 (-0.65%) | 10 May 123.90 (1.43%) | 09 May 122.15 (-2.12%) | 08 May 124.80 (2.04%) | 07 May 122.30 (-3.78%) | 06 May 127.10 (-6.41%) | 03 May 135.80 (-1.63%) | 02 May 138.05 (-2.13%) | 30 Apr 141.05 (2.77%) | 29 Apr 137.25 (0.59%) | 26 Apr 136.45 (0.40%) | 25 Apr 135.90 (2.18%) | 24 Apr 133.00 (0.11%) | 23 Apr 132.85 (-0.19%) | 22 Apr 133.10 (3.78%) | 19 Apr 128.25 (-1.00%) |

Price Chart Historical Data Technical Chart

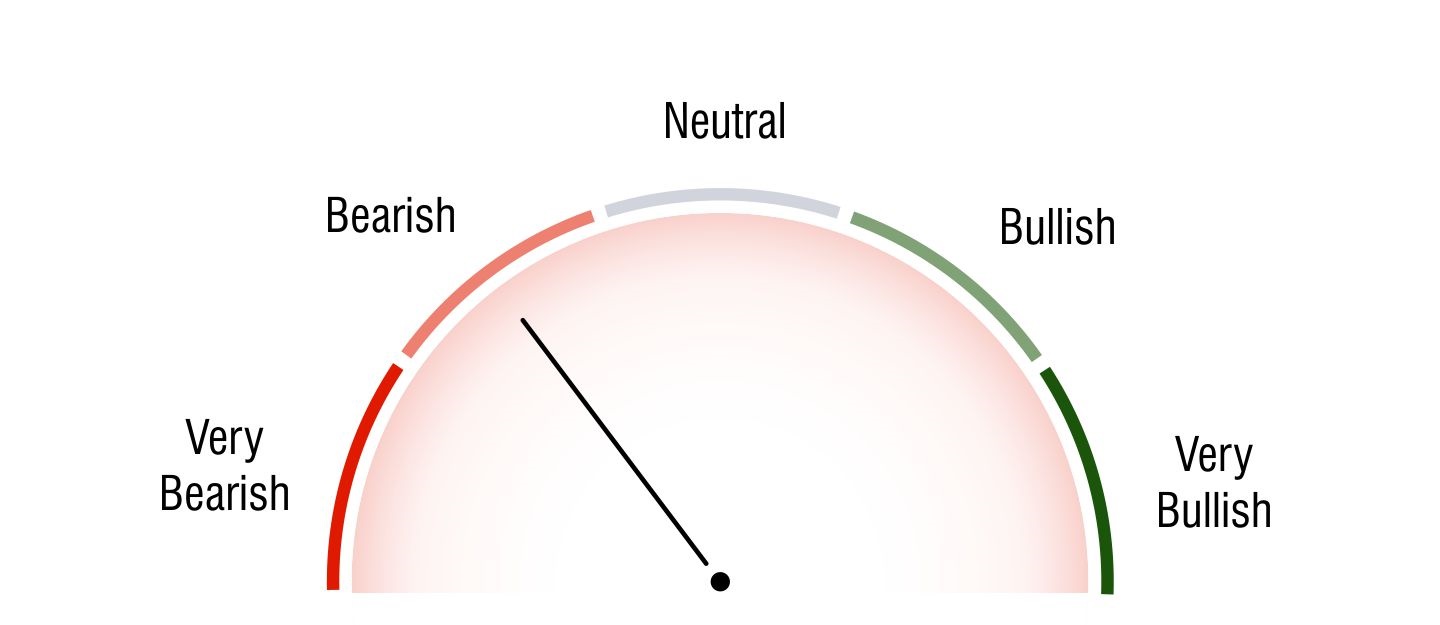

Technical Analysis

Short Term Investors

Bearish

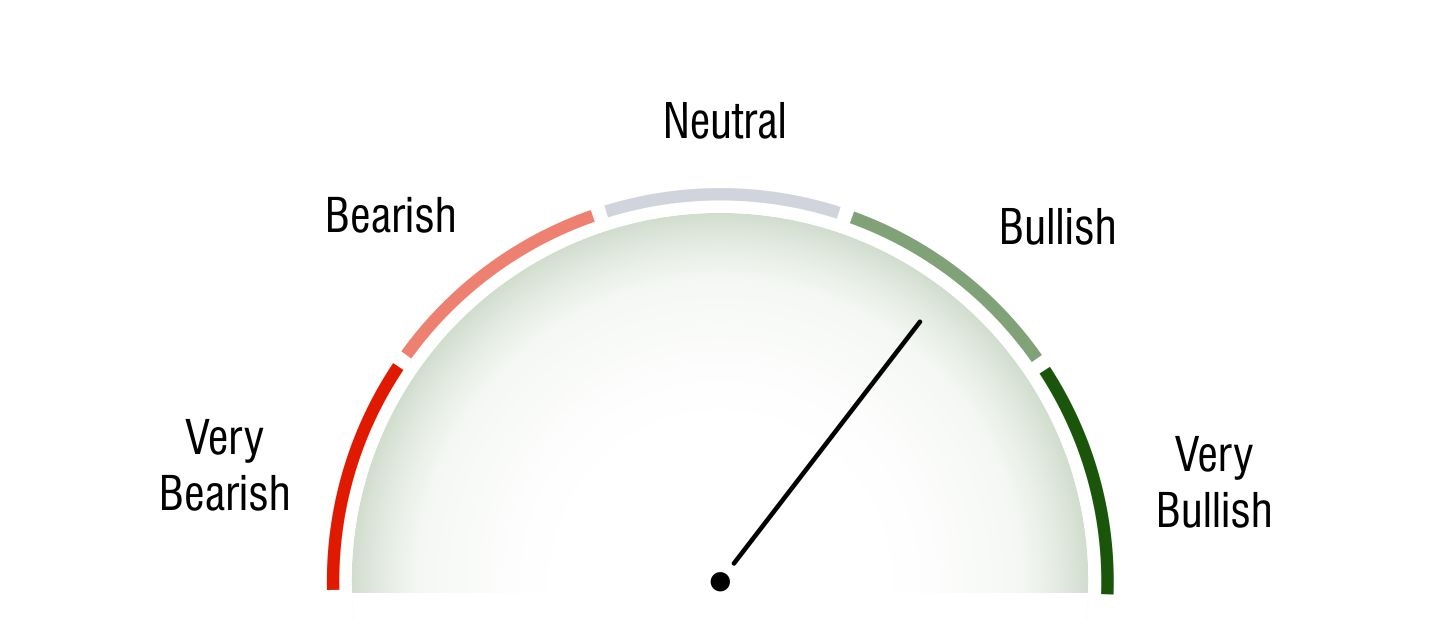

Medium Term Investors

Neutral

Long Term Investors

Bullish

Moving Averages

5 DMA

Bullish

125.24

10 DMA

Bullish

124.24

20 DMA

Bearish

129.65

50 DMA

Bearish

128.07

100 DMA

Bullish

119.3

200 DMA

Bullish

96.49

Intraday Support and Resistance

(Based on Pivot Points) |

Updated On May 18, 2024 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 128 | 127.3 | 126.46 | - | - |

| R2 | 127.3 | 126.8 | 126.34 | 127.33 | - |

| R1 | 126.7 | 126.5 | 126.22 | 126.76 | 127 |

| P | 126 | 126 | 126 | 126.03 | 126.15 |

| S1 | 125.4 | 125.5 | 125.98 | 125.46 | 125.7 |

| S2 | 124.7 | 125.2 | 125.86 | 124.73 | - |

| S3 | 124.1 | 124.7 | 125.74 | - | - |

Key Metrics

EPS

7.49

P/E

16.84

P/B

1.42

Dividend Yield

1.19%

Market Cap

1,38,849 Cr.

Face Value

2

Book Value

89.02

ROE

3.63%

EBITDA Growth

23,144.79 Cr.

Debt/Equity

0

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Punjab National Bank Quaterly Results

| Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | |

| INCOME | 28132.23 | 29033.11 | 29857.05 | 30527.38 | 32976.47 |

| PROFIT | 1864.34 | 1342.05 | 1990.18 | 2432.77 | 3342.2 |

| EPS | 1.69 | 1.22 | 1.81 | 2.21 | 3.04 |

Punjab National Bank Quaterly Results

| Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | |

| INCOME | 27268.95 | 28579.27 | 29383.2 | 29961.65 | 32361.04 |

| PROFIT | 1158.61 | 1255.41 | 1756.13 | 2222.81 | 3010.27 |

| EPS | 1.05 | 1.14 | 1.59 | 2.02 | 2.73 |

Profit & Loss (Figures in Rs. Crores)

Punjab National Bank Profit & Loss

| Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | ||

| INCOME | 49668.43 | 54884.42 | 56903.5 | 57225.66 | 57608.19 | 59514.52 | 64306.13 | 94712.1 | 88571.12 | 99374.32 | |

| PROFIT | 3613.86 | 3396.52 | -3692.15 | 1181.79 | -12115.98 | -9588.49 | 438.45 | 2574.71 | 3846.34 | 3345.87 | |

| EPS | 19.2 | 18.02 | -18.66 | 4.23 | -45.59 | -21.78 | 0.54 | 2.57 | 3.55 | 3.05 |

Punjab National Bank Profit & Loss

| Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | ||

| INCOME | 47799.96 | 52206.09 | 53424.4 | 56227.36 | 56876.64 | 58687.66 | 63074.16 | 92740.71 | 87199.5 | 97286.64 | |

| PROFIT | 3339.47 | 3058.96 | -3976.9 | 1319.42 | -12285.41 | -9993.86 | 294.52 | 2034.37 | 3442.61 | 2504.64 | |

| EPS | 18.12 | 16.51 | -20.24 | 6.23 | 0 | 0 | 0.5 | 1.93 | 3.14 | 2.28 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 2,202.2 | 2,202.2 | 2,095.54 | 1,347.51 | 920.81 | 552.11 | 425.59 | 392.72 | 370.91 | 362.07 |

| Reserves Total | 1,00,678.3 | 95,379.72 | 90,438.8 | 62,528.86 | 45,163.56 | 40,965.19 | 42,989.75 | 41,411.53 | 41,668.53 | 37,731.15 |

| Minority Interest | 459.38 | 473.47 | 486.79 | 360.69 | 287.7 | 308.53 | 780.63 | 728.65 | 548.95 | 423.11 |

| Deposits | 12,90,347.07 | 11,54,234.46 | 11,13,716.86 | 7,10,254.37 | 6,81,874.18 | 6,48,439.01 | 6,29,650.86 | 5,70,382.64 | 5,37,758.12 | 4,76,325.31 |

| Borrowings | 70,148.62 | 59,371.67 | 52,298.14 | 62,512.41 | 46,827.97 | 65,329.66 | 43,336.01 | 81,673.74 | 36,692.07 | 43,911.53 |

| Other Liabilities & Provisions | 31,062.63 | 28,809.92 | 22,041.21 | 14,931.68 | 15,484.14 | 23,111.1 | 16,769.26 | 18,704.18 | 19,428.25 | 16,418.16 |

| TOTAL LIABILITIES | 14,94,898.2 | 13,40,471.44 | 12,81,077.34 | 8,51,935.52 | 7,90,558.36 | 7,78,705.6 | 7,33,952.1 | 7,13,293.46 | 6,36,466.83 | 5,75,171.33 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 78,213.52 | 86,127.84 | 44,267.27 | 38,603.79 | 32,338.32 | 29,028.91 | 25,410.36 | 26,492.19 | 24,435.78 | 22,406.14 |

| Balances with Banks & money at Call | 79,114.96 | 48,066.04 | 69,067.16 | 39,151.96 | 44,957.65 | 68,459.24 | 65,968.73 | 52,557.19 | 33,823.44 | 24,459.85 |

| Investments | 4,16,913.84 | 3,88,585.82 | 4,04,368.96 | 2,53,782.47 | 2,10,578.31 | 2,04,418.68 | 1,91,527.16 | 1,65,126.48 | 1,56,761.66 | 1,49,224.7 |

| Advances | 8,37,458.98 | 7,33,765.83 | 6,79,345.77 | 4,76,853.34 | 4,62,416.23 | 4,38,825.78 | 4,24,230.49 | 4,46,083.03 | 4,04,614.06 | 3,66,073.21 |

| Fixed Assets | 12,083.96 | 10,696.21 | 11,048.7 | 7,261.98 | 6,246.22 | 6,370.99 | 6,297.76 | 5,308.12 | 3,655.77 | 3,490.44 |

| Other Assets | 71,112.94 | 73,229.7 | 72,979.48 | 36,281.98 | 34,021.63 | 31,602 | 20,517.6 | 17,726.45 | 13,176.12 | 9,516.99 |

| TOTAL ASSETS | 14,94,898.2 | 13,40,471.44 | 12,81,077.34 | 8,51,935.52 | 7,90,558.36 | 7,78,705.6 | 7,33,952.1 | 7,13,293.46 | 6,36,466.83 | 5,75,171.33 |

| Contingent Liabilities | 6,45,263.22 | 6,06,685.43 | 3,85,387.96 | 2,13,299.33 | 3,07,895.89 | 3,08,790.2 | 3,38,851.04 | 3,39,168.05 | 2,82,956.16 | 2,21,673.88 |

| Bills for collection | 34,377.6 | 37,786.05 | 40,493.76 | 28,052.6 | 27,866.28 | 27,898.25 | 25,805.94 | 23,255.66 | 19,640.62 | 20,325.97 |

| Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 2,202.2 | 2,202.2 | 2,095.54 | 1,347.51 | 920.81 | 552.11 | 425.59 | 392.72 | 370.91 | 362.07 |

| Reserves Total | 97,653.46 | 93,284.69 | 88,841.77 | 61,009.97 | 43,866.32 | 40,522.19 | 41,671.87 | 37,917.42 | 38,708.61 | 35,533.25 |

| Deposits | 12,81,163.1 | 11,46,218.45 | 11,06,332.47 | 7,03,846.32 | 6,76,030.14 | 6,42,226.19 | 6,21,704.02 | 5,53,051.13 | 5,19,308.94 | 4,63,027.05 |

| Borrowings | 51,291.73 | 45,681.41 | 42,840.31 | 50,225.43 | 39,325.92 | 60,850.75 | 40,763.34 | 59,755.24 | 27,740.25 | 36,404.11 |

| Other Liabilities & Provisions | 30,465.32 | 28,355.13 | 21,657.89 | 14,741.17 | 15,244.91 | 22,688.9 | 16,258.22 | 16,676.9 | 17,614.71 | 15,421.8 |

| Total Liabilities | 14,62,775.81 | 13,15,741.88 | 12,61,767.98 | 8,31,170.4 | 7,75,388.1 | 7,66,840.14 | 7,20,823.04 | 6,67,793.41 | 6,03,743.42 | 5,50,748.28 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 78,176.58 | 85,736.12 | 43,958.83 | 38,397.85 | 32,129.13 | 28,789.04 | 25,210 | 26,479.07 | 24,224.94 | 22,245.58 |

| Balances with Banks & money at Call | 76,932.23 | 46,910.66 | 67,390.88 | 37,595.18 | 43,158.91 | 66,672.97 | 63,121.65 | 49,144.02 | 31,709.23 | 22,972.87 |

| Investments | 3,95,996.72 | 3,72,167.76 | 3,92,983.25 | 2,40,465.64 | 2,02,128.22 | 2,00,305.98 | 1,86,725.44 | 1,57,845.89 | 1,49,876.95 | 1,43,785.5 |

| Advances | 8,30,833.98 | 7,28,185.68 | 6,74,230.08 | 4,71,827.72 | 4,58,249.2 | 4,33,734.72 | 4,19,493.15 | 4,12,325.8 | 3,80,534.41 | 3,49,269.12 |

| Fixed Assets | 12,051.07 | 10,673.61 | 11,020.9 | 7,239.07 | 6,224.85 | 6,349.33 | 6,273.25 | 5,222.73 | 3,551.48 | 3,419.74 |

| Other Assets | 68,785.24 | 72,068.06 | 72,184.05 | 35,644.94 | 33,497.77 | 30,988.11 | 19,999.55 | 16,775.9 | 13,846.41 | 9,055.46 |

| Total Assets | 14,62,775.82 | 13,15,741.89 | 12,61,767.99 | 8,31,170.4 | 7,75,388.08 | 7,66,840.15 | 7,20,823.04 | 6,67,793.41 | 6,03,743.42 | 5,50,748.27 |

| Contingent Liabilities | 6,44,471.87 | 6,05,180.05 | 3,83,279.78 | 2,10,800.74 | 3,05,400.13 | 3,04,127.7 | 3,32,831.33 | 3,35,795.92 | 2,73,945.39 | 2,16,274.78 |

| Bills for collection | 34,377.6 | 37,786.05 | 40,491.16 | 28,049.91 | 27,335.9 | 27,858.61 | 25,779.13 | 23,221.19 | 19,640.62 | 20,325.97 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 5,140.53 |

| Depreciation | 2,871.64 |

| P/L on Sales of Assets | -2.58 |

| Prov. and W/O (Net) | 17,897.56 |

| Others | -14.09 |

| Total Adjustments (PBT and Ext... | 22,945.12 |

| Operating Profit before Workin... | 28,085.65 |

| Loans and Advances | -1,18,492.65 |

| Investments | -29,448.23 |

| Change in Borrowing | 6,315.23 |

| Change in Deposits | 1,36,112.62 |

| Total Adjustments (OP before W... | -4,289.41 |

| Cash Generated from/(used in) ... | 23,796.24 |

| Direct Taxes Paid | -1,204.15 |

| Total Adjustments(Cash Generat... | -1,204.15 |

| Cash Flow before Extraordinary... | 22,592.09 |

| Net Cash from Operating Activi... | 22,592.09 |

| Purchased of Fixed Assets | -552.39 |

| Invest.In Subsidiaires | -180.08 |

| Net Cash used in Investing Act... | -732.47 |

| Proceed from Issue of Debentur... | 4,461.72 |

| Dividend Paid | -704.71 |

| Interest Paid | -2,467.94 |

| Net Cash used in Financing Act... | 1,274.98 |

| Net Profit before Tax and Extr... | 4,288.27 |

| Depreciation | 3,253.24 |

| Interest (Net) | 2,414.99 |

| Dividend Received | 84.37 |

| P/L on Sales of Assets | -2.56 |

| Prov. and W/O (Net) | 18,067.27 |

| Total Adjustments (PBT and Ext... | 23,648.58 |

| Operating Profit before Workin... | 27,936.84 |

| Loans and Advances | -1,17,522.17 |

| Investments | -25,575.8 |

| Change in Borrowing | 1,126.32 |

| Change in Deposits | 1,34,944.65 |

| Total Adjustments (OP before W... | -4,984.68 |

| Cash Generated from/(used in) ... | 22,952.17 |

| Direct Taxes Paid | -1,172.2 |

| Total Adjustments(Cash Generat... | -1,172.2 |

| Cash Flow before Extraordinary... | 21,779.97 |

| Net Cash from Operating Activi... | 21,779.97 |

| Purchased of Fixed Assets | -533.81 |

| Invest.In Subsidiaires | -232.8 |

| Net Cash used in Investing Act... | -682.24 |

| Proceed from Issue of Debentur... | 4,484 |

| Dividend Paid | -704.71 |

| Interest Paid | -2,414.99 |

| Net Cash used in Financing Act... | 1,364.3 |

Company Details

Registered Office |

|

| Address | HO 7 Bhikaiji Cama Place, |

| City | New Delhi |

| State | Delhi |

| Pin Code | 110607 |

| Tel. No. | 91-011-26102303/23323654/23323657 |

| Fax. No. | 91-011-26196456/23711663/23766079 |

| hosd@pnb.co.in | |

| Internet | http://www.pnbindia.in |

Registrars |

|

| Address | HO 7 Bhikaiji Cama Place |

| City | New Delhi |

| State | Delhi |

| Pin Code | 110607 |

| Tel. No. | 91-011-26102303/23323654/23323657 |

| Fax. No. | 91-011-26196456/23711663/23766079 |

| hosd@pnb.co.in | |

| Internet | http://www.pnbindia.in |

Management |

|

| Name | Designation |

| Ekta Pasricha | Company Sec. & Compli. Officer |

| Kalyan Kumar | Executive Director |

| Pankaj Joshi | Non Official Director |

| Sanjeev Kumar Singhal | Non Official Director |

| Anil Kumar Misra | Nominee (RBI) |

| Pankaj Sharma | Nominee (Govt) |

| Atul Kumar Goel | Managing Director & CEO |

| Vijay Dube | Executive Director |

| Rekha Jain | Director (Shareholder) |

| Binod Kumar | Executive Director |

| M. Paramasivam | Executive Director |

| K G Ananthakrishnan | Chairman & Independent Directo |