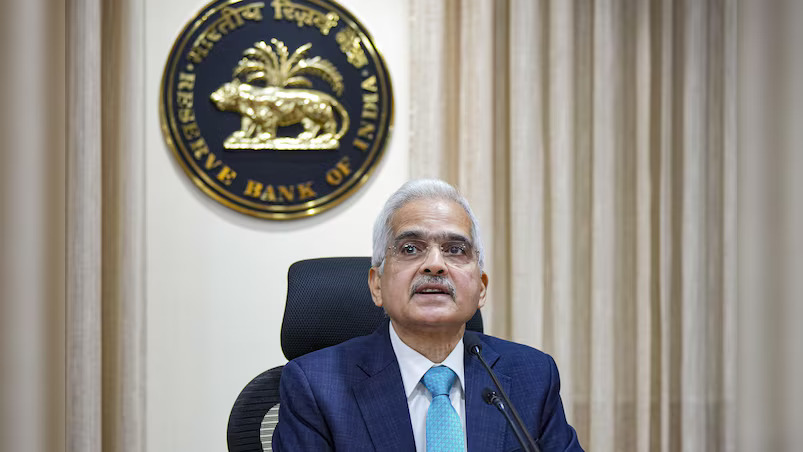

On August 8, RBI Governor Shaktikanta Das announced the latest Monetary Policy. The Monetary Policy Committee (MPC), which met from August 6 to August 8 for its third bi-monthly policy review of FY25, opted to keep the benchmark repo rate steady at 6.5%. The six-member MPC, headed by the RBI Governor, also decided to retain the policy stance of ‘withdrawal of accommodation.’

RBI Monetary Policy Updates: Repo rates remains unchanged at 6.50%

The RBI Monetary Policy Committee has decided to keep the repo rate unchanged at 6.50% for 9 consecutive policies.

RBI Monetary Policy Updates: MSF and SDF rates remain Unchanged

The Marginal Standing Facility (MSF) and Standing Deposit Facility (SDF) rates remain unchanged at 6.75% and 6.25%, respectively.

RBI Monetary Policy Updates: Shaktikanta Das view on inflation

During the meeting, Shaktikanta Das said, “While fuel group remains in disinflation, expected moderation in headline inflation in Q2 of this FY on account of favourable base may reverse in the coming quarters. In the third quarter, India has a substantial advantage that may pull down the inflation but the base effect will wear out.”

RBI Monetary Policy Updates: GDP forecast unchanged at 7.2% for FY25

The RBI Governor said that the central bank has kept the fiscal year 2025 GDP projection unchanged at 7.2% with ‘risks evenly balanced.’ The GDF forecast for Q1FY25 is projected at 7.2%, for Q2FY25 is projected at 7.2%, for Q3FY25 is projected at 7.3%, and for Q4FY25 is projected at 7.2%.

RBI Monetary Policy Updates: Inflation forecast for FY25

RBI has adjusted its CPI inflation forecast to

- Q1FY25 – 4.4%.

- Q2FY25 – 4.4% from 3.8%.

- Q3FY25 – 4.7% from 4.6%.

- Q4FY25 – 4.3% from 4.5%

The RBI governor has stressed that RBI cannot and should not become complacent despite a significant drop in core inflation, highlighting that food inflation pressures remain a concern.

RBI Governor Shaktikanta Das highlighted that food inflation, accounting for 46% of headline inflation, cannot be overlooked. He emphasised that persistently high food inflation poses risks of broader inflationary impacts.

Additionally, Das noted that core inflation reached historic lows in May and June, despite high food prices likely continuing through June. He also mentioned that some relief in food inflation might come from the progression of the southwest monsoon.

RBI Monetary Policy Updates: Das highlights 4 key issues in banking sector

- Retail customers are increasingly drawn to alternative investment avenues, causing banks to face funding challenges as deposit growth lags behind loan growth. Consequently, banks are resorting to short-term non-retail deposits and other instruments, which may lead to structural liquidity issues. Banks must prioritise the mobilisation of household financial savings.

- The excessive leverage through retail loans for consumption requires careful monitoring. Regulatory measures introduced by the RBI last November have slowed credit growth in certain sectors, yet some personal loan segments continue to grow rapidly. Constant monitoring is necessary.

- Banks and NBFCs must adhere to regulatory norms and monitor the end use of housing loans, which are growing rapidly. Some entities are not strictly following regulations on loan-to-value ratios, risk weights, and the end use of funds, leading to the risk of funds being used for speculative or unproductive activities. Banks and NBFCs should review and correct these practices.

- The growing reliance on Big Tech and third-party technology providers necessitates that banks and financial institutions establish robust risk management frameworks for IT, cybersecurity, and third-party outsourcing to maintain operational resilience.

RBI Monetary Policy Updates: Net FDI doubles and Forex reserves

In June and July, the Reserve Bank of India (RBI) executed two-way Liquidity Adjustment Facility (LAF) operations to align overnight rates with the repo rate. Net Foreign Direct Investment (FDI) inflows more than doubled in the April to June 2024 quarter compared to the same period the previous year. Furthermore, India’s foreign exchange reserves reached an all-time high of $675 billion as of August 2, 2024.

RBI Monetary Policy Updates: Strengthening manufacturing activity

RBI Governor Shaktikanta Das highlighted that inflation is gradually declining across various economies, although medium-term global growth continues to face significant hurdles. In contrast, the domestic economy is showing resilience, with manufacturing sectors gaining momentum due to increasing demand.

RBI Monetary Policy Updates: UPI tax payment limit increased

Shaktikanta Das has announced that the RBI has increased the UPI tax payment limit from Rs 1 lakh to Rs 5 lakh per transaction. The RBI governor added, “Currently, the transaction limit for UPI is Rs 1 lakh except for certain category of payments which have higher transaction limits. It has now been decided to enhance the limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction. This will further ease tax payments by consumers through UPI,”

RBI Monetary Policy Updates: Country’s current account deficit

India’s current account deficit (CAD) has been moderated to 0.7% in 2023-24 from 2.0% of GDP in 2022-23 due to lower trade deficit and robust services and remittances receipts. Das added, “In Q1:2024-25, merchandise trade deficit widened as imports grew faster than exports. Buoyancy in services exports and strong remittance receipts are expected to keep CAD within sustainable level in Q1:2024-25. We expect CAD to remain eminently manageable during the current financial year,”

RBI Monetary Policy Updates: Continuous Cheque Clearing under Cheque Truncation System (CTS)

The current Cheque Truncation System (CTS) processes cheques within a two-day clearing cycle. To improve efficiency and customer experience, the RBI plans to transition CTS to continuous clearing with ‘on-realisation-settlement.’ This means cheques will be scanned, presented, and cleared within a few hours continuously during business hours, reducing the clearing cycle from T+1 days to just a few hours.

RBI Monetary Policy Updates: Introduced delegated payments via UPI

With 424 million UPI users, the RBI sees potential for further growth in the user base. To facilitate this, the RBI proposes introducing “Delegated Payments,” allowing a primary user to set transaction limits for a secondary user on their bank account. This feature aims to expand digital payment use across the country.