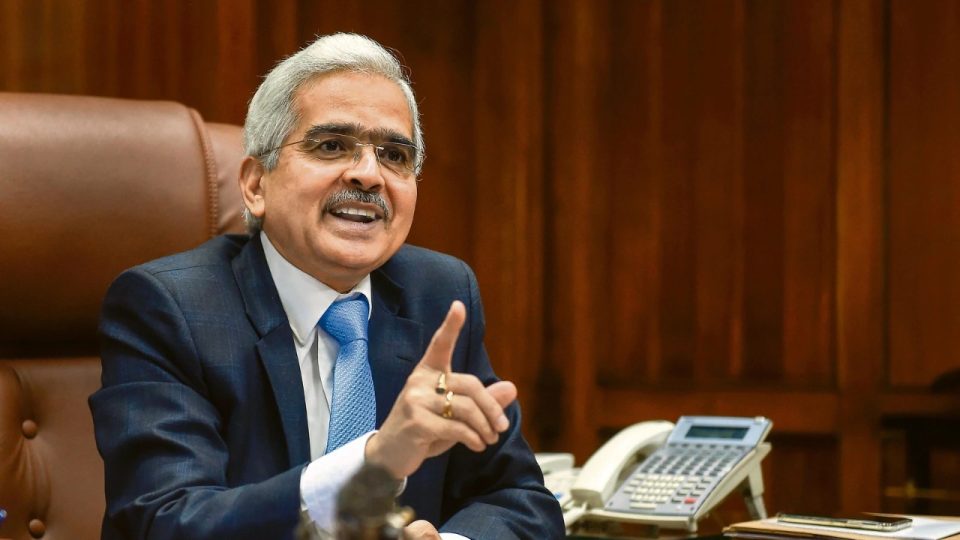

On Wednesday, RBI Governor Shaktikanta Das will hold a meeting with CEOs of public sector banks to discuss the sustainability of slow deposit growth and high credit demand.

According to the Reserve Bank of India (RBI), deposits rose 9.6% year-on-year, up from 10.2% a year earlier, while credit operations increased 17.9% from 6.5% a year earlier.

According to the agenda circulated for the meeting, the officials said that sustainability would be discussed, including pricing and slow deposit growth. They also noted that asset quality in the retail and MSME sectors would be reviewed.

The meeting will also review the functioning of the digital banking unit launched by Prime Minister Narendra Modi last month.

A well-capitalised banking system supported the strong growth performance in the first half of the financial year with higher credit disbursements in the retail, industrial and services sectors.

Non-food credit growth nearly doubled, from 8.7% in March 2022 to 16.4% in September 2022, reflecting not only the current acceleration in economic activity but also expectations for continued acceleration going forward. Industrial credit has been boosted by increased bank credit to MSMEs with the help of the ECLG scheme.

In August, the Union Cabinet approved an additional Rs 50,000 crore under the Emergency Credit Line Guarantee Scheme (ECLGS) to ensure the flow of low-cost credit to the hospitality and related industries hit hard by the COVID-19 pandemic.

The ECLGS limit was increased from Rs 4.5 lakh crore to Rs 5 lakh crore, with the additional amount earmarked for businesses in the hospitality and related industries.

This enhancement is expected to provide much-needed relief to businesses in these sectors by incentivising lenders to provide additional credit of up to Rs 50,000 crore at a low cost.

Announced in May 2020 following the COVID-19 outbreak, ECLGS aims to help various industries, especially the MSME sector, access credit at a prime rate of 7%. As of August 5, 2022, ECLGS has approved about Rs 3.67 lakh crore in loans.