Digital payment and financial services platform, Paytm has planned for providing collateral-free loans of up to Rs 500,000 at low-interest rate with unique daily EMI product customization for MSMEs. In the last financial year, the company has processed loans worth Rs 550 crore that has benefited over a lakh merchant partner.

Paytm continues to offer collateral-free loans in Paytm’s Business app under the ‘Merchant Lending Program’. The algorithm determines the credit-worthiness of the merchant which is based on the daily transactions and arrives with a pre-qualified loan offering. Loan repayment amount will be collected from the daily settlement of merchant with Paytm and if the merchant is able to repay the loan then there will be no prepayment charges.

Bhavesh Gupta, CEO – Lending, Paytm said, “With our collateral-free instant loans, we are trying to help kirana stores & other small business owners who have been left behind by the traditional banking sector and do not have easy access to loans and credit. Going forward, we will especially focus on EDC merchants and provide higher loan amount based on their EDC transactions.”

The company has digitised the entire process of loan starting from the application procedure to the approval to disbursal without additional documents which is required in partnership with banks and NBFCs (Non-Banking Financial Company). It is on a mission for providing instant credit for those who don’t have access to loans from traditional banks due to the lack of collateral or credit score.

Dr. Reddy Outlook for the Week (April 03, 2023 – April 07, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (April 03, 2023 – April 07, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 3.55%

Dr Reddy Share Price: 4622.75

Weekly High: 4656.50

Weekly Low: 4465.05

Weekly Range: 158.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4772 |

| RESISTANCE 1 | 4697 |

| SUPPORT 1 | 4506 |

| SUPPORT 2 | 4390 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4506 levels, Minor resistance on the upside is capped around 4697 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4390 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4772.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4772 on upside and 4390 on downside.

Dr. Reddy Outlook for the Week (Mar 27, 2023 – March 31, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 27, 2023 – March 31, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 0.63%

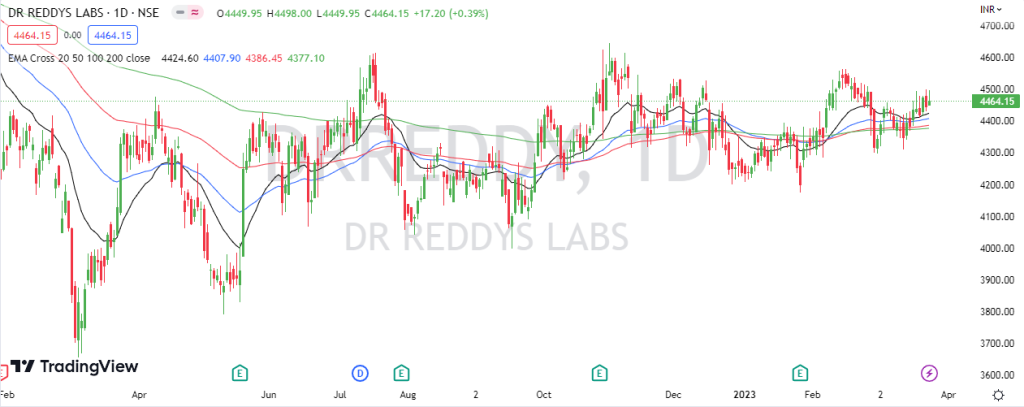

Dr Reddy Share Price: 4464.15

Weekly High: 4499.50

Weekly Low: 4309.20

Weekly Range: 28.00 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4547 |

| RESISTANCE 1 | 4505 |

| SUPPORT 1 | 4415 |

| SUPPORT 2 | 4367 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4415 levels, Minor resistance on the upside is capped around 4505 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4367 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4547.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4547 on upside and 4367 on downside.

Dr. Reddy Outlook for the Week (Mar 20, 2023 – March 24, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 20, 2023 – March 24, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

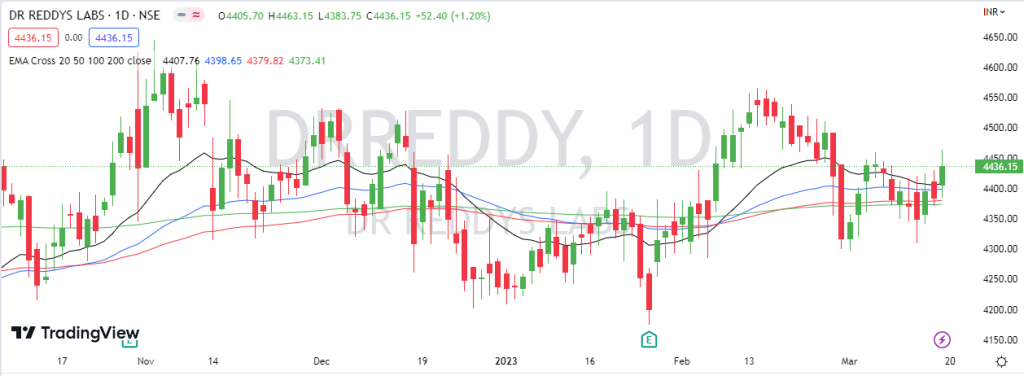

Stock closed the Weekly on positive note gaining 0.92%

Dr Reddy Share Price: 4436.15

Weekly High: 4463.15

Weekly Low: 4309

Weekly Range: 40.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4526 |

| RESISTANCE 1 | 4496 |

| SUPPORT 1 | 4342 |

| SUPPORT 2 | 4248 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4342 levels, Minor resistance on the upside is capped around 4496 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4248 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4526.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4526 on upside and 4248 on downside.

Dr. Reddy Outlook for the Week (Mar 13, 2023 – March 17, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 13, 2023 – March 17, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on negative note loosing 0.96%

Dr Reddy Share Price: 4395.55

Weekly High: 4458.80

Weekly Low: 4350.00

Weekly Range: 42.40 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4509 |

| RESISTANCE 1 | 4452 |

| SUPPORT 1 | 4344 |

| SUPPORT 2 | 4293 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4344 levels, Minor resistance on the upside is capped around 4452 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4293 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4509.

Stock is trading on 200 days exponential moving average, suggests long term trend is nutral. EquityPandit predicts Range for the Weekly as 4509 on upside and 4293 on downside.

Dr. Reddy Outlook for the Week (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

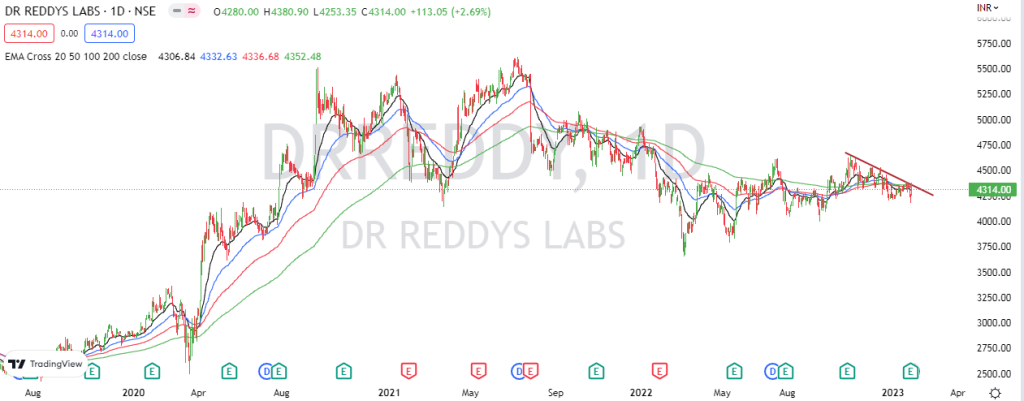

Stock closed the Weekly on negative note loosing 0.84%

Dr Reddy Share Price: 4314.00

Weekly High: 4380.90

Weekly Low: 4175.10

Weekly Range: 36.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4494 |

| RESISTANCE 1 | 4404 |

| SUPPORT 1 | 4199 |

| SUPPORT 2 | 4084 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4199 levels, Minor resistance on the upside is capped around 4404 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4084 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4494.

Stock is trading below 200 days exponential moving average, suggests long term trend is bearish. EquityPandit predicts Range for the Weekly as 4494 on upside and 4084 on downside.