Real estate firm Shriram Properties which approached the Securities and Exchange Board of India (SEBI) in December 2018 to float an Initial Public Offering; has received a green signal to launch IPO through which it plans to raise Rs. 1,250 crore.

According to the latest update by SEBI, the firm obtained the regulator’s observations on April 9.

The equities will be listed on Bombay Stock Exchange and the National Stock Exchange and company is likely to host pre-IPO placement of up to Rs. 100 crore. The management of the company’s public issue will be in the hands of Axis Capital, Edelweiss Financial Services, Nomura Financial Advisory and Securities and JM Financial.

Shriram Properties, part of the Shriram Group, is a real estate development firm primarily focusing on developing residential properties in South India.

Read EquityPandit’s Nifty Outlook for the Week

Dr. Reddy Outlook for the Week (April 03, 2023 – April 07, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (April 03, 2023 – April 07, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 3.55%

Dr Reddy Share Price: 4622.75

Weekly High: 4656.50

Weekly Low: 4465.05

Weekly Range: 158.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4772 |

| RESISTANCE 1 | 4697 |

| SUPPORT 1 | 4506 |

| SUPPORT 2 | 4390 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4506 levels, Minor resistance on the upside is capped around 4697 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4390 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4772.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4772 on upside and 4390 on downside.

Dr. Reddy Outlook for the Week (Mar 27, 2023 – March 31, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 27, 2023 – March 31, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 0.63%

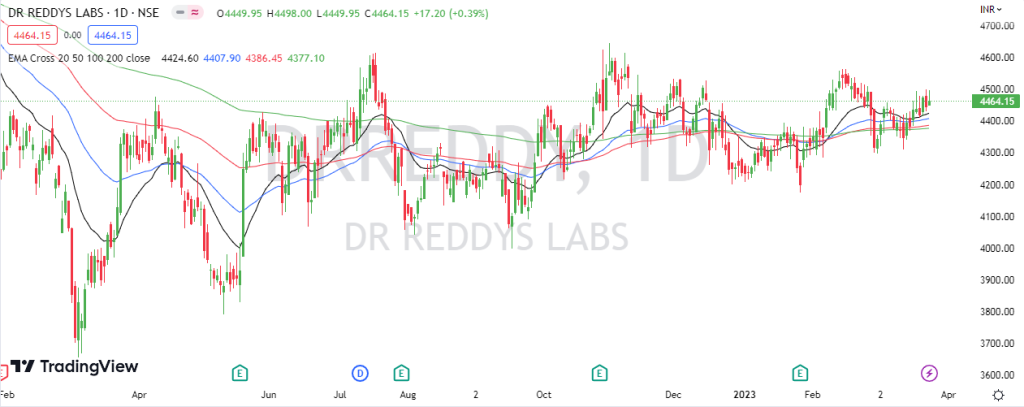

Dr Reddy Share Price: 4464.15

Weekly High: 4499.50

Weekly Low: 4309.20

Weekly Range: 28.00 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4547 |

| RESISTANCE 1 | 4505 |

| SUPPORT 1 | 4415 |

| SUPPORT 2 | 4367 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4415 levels, Minor resistance on the upside is capped around 4505 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4367 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4547.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4547 on upside and 4367 on downside.

Dr. Reddy Outlook for the Week (Mar 20, 2023 – March 24, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 20, 2023 – March 24, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 0.92%

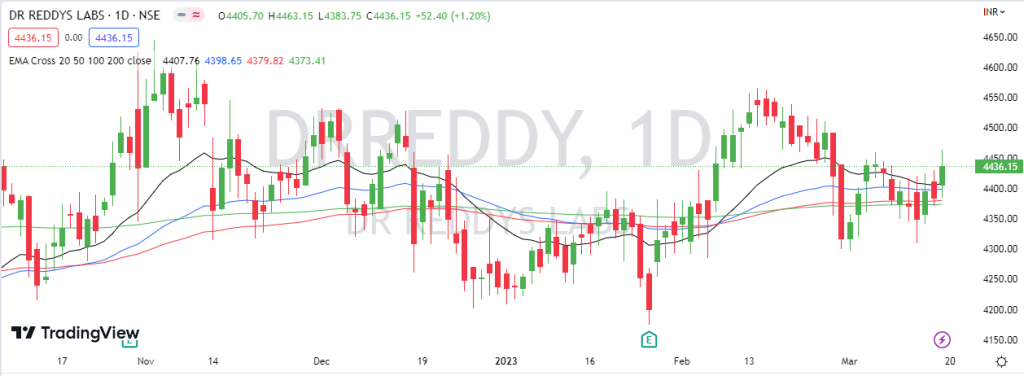

Dr Reddy Share Price: 4436.15

Weekly High: 4463.15

Weekly Low: 4309

Weekly Range: 40.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4526 |

| RESISTANCE 1 | 4496 |

| SUPPORT 1 | 4342 |

| SUPPORT 2 | 4248 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4342 levels, Minor resistance on the upside is capped around 4496 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4248 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4526.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4526 on upside and 4248 on downside.

Dr. Reddy Outlook for the Week (Mar 13, 2023 – March 17, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 13, 2023 – March 17, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on negative note loosing 0.96%

Dr Reddy Share Price: 4395.55

Weekly High: 4458.80

Weekly Low: 4350.00

Weekly Range: 42.40 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4509 |

| RESISTANCE 1 | 4452 |

| SUPPORT 1 | 4344 |

| SUPPORT 2 | 4293 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4344 levels, Minor resistance on the upside is capped around 4452 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4293 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4509.

Stock is trading on 200 days exponential moving average, suggests long term trend is nutral. EquityPandit predicts Range for the Weekly as 4509 on upside and 4293 on downside.

Dr. Reddy Outlook for the Week (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on negative note loosing 0.84%

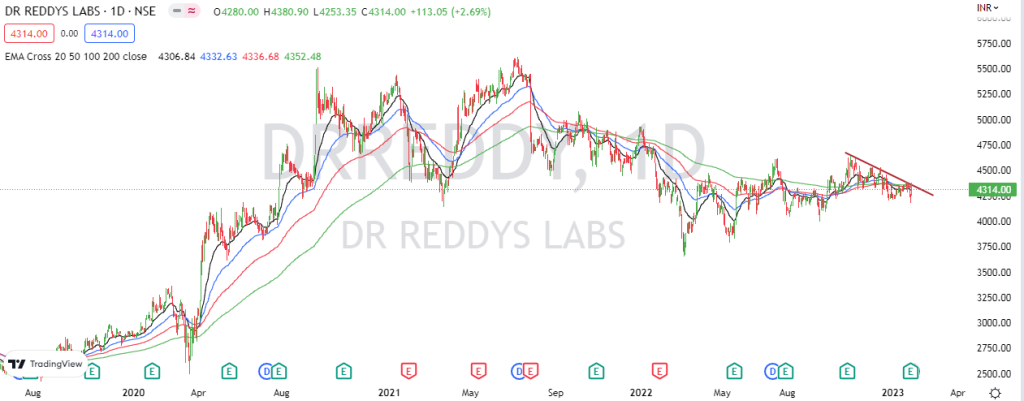

Dr Reddy Share Price: 4314.00

Weekly High: 4380.90

Weekly Low: 4175.10

Weekly Range: 36.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4494 |

| RESISTANCE 1 | 4404 |

| SUPPORT 1 | 4199 |

| SUPPORT 2 | 4084 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4199 levels, Minor resistance on the upside is capped around 4404 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4084 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4494.

Stock is trading below 200 days exponential moving average, suggests long term trend is bearish. EquityPandit predicts Range for the Weekly as 4494 on upside and 4084 on downside.