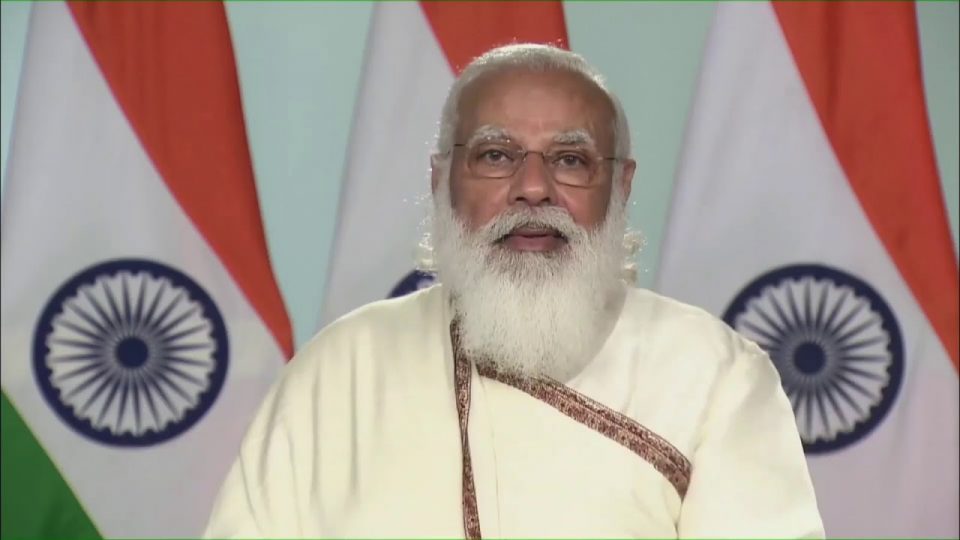

Prime Minister Narendra Modi on Friday stressed increasing credit to businesses to meet the needs of a fast reflating economy and said financial products will have to be tailor-made for fintech and startups. He said that although the government’s endeavor is to promote the private sector, the public sector still needs to have its presence in banking and insurance to support the poor. Speaking at a webinar on Budget announcements on Financial Services, Modi said to help medium and small businesses during the COVID pandemic, 90 lakh Micro, Small, and Medium Enterprises (MSMEs) were given credit worth Rs 2.4 trillion.

“Supporting MSME and startups and expanding credit flow to them is necessary. The government has undertaken reforms and opened up sectors like farms, coal, and space. Now it’s the responsibility of the financial sector to understand the aspirations of rural and smaller cities and make them the strength of Aatmanirbhar Bharat. “As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on the creation of new and better financial products for Startups and Fintech,” Modi said.

Stating that Kisan Credit has helped small farmers and those involved in animal husbandry to come out with the grasp of informal lending, Modi said the private sector now will have to think of innovative financial products for this section of society. He said the government has a clear vision for the financial services sector and is taking steps to make it vibrant, proactive, and strong.

“The pace at which we have to take the country forward in the 21st century, proactive participation of the private sector is important. The government’s vision is clear about the financial sector, with no place for ifs and buts. The government’s highest priority is that every depositor and investor experience trust and transparency,” he said.

RELIANCE 1,272.55 -12.85 (-1.00%)  TCS 3,635.50 -22.20 (-0.61%)

TCS 3,635.50 -22.20 (-0.61%)  HDFCBANK 1,805.95 -15.50 (-0.85%)

HDFCBANK 1,805.95 -15.50 (-0.85%)  HINDUNILVR 2,243.85 -26.85 (-1.18%)

HINDUNILVR 2,243.85 -26.85 (-1.18%)  INFY 1,598.15 -33.55 (-2.06%)

INFY 1,598.15 -33.55 (-2.06%)  HDFC 2,729.95 -17.05 (-0.62%)

HDFC 2,729.95 -17.05 (-0.62%)  BHARTIARTL 1,737.55 +3.85 (0.22%)

BHARTIARTL 1,737.55 +3.85 (0.22%)  KOTAKBANK 2,143.35 -27.50 (-1.27%)

KOTAKBANK 2,143.35 -27.50 (-1.27%)  ICICIBANK 1,335.40 -9.00 (-0.67%)

ICICIBANK 1,335.40 -9.00 (-0.67%)  ITC 407.05 -2.85 (-0.70%)

ITC 407.05 -2.85 (-0.70%)  BAJFINANCE 8,864.95 -206.65 (-2.28%)

BAJFINANCE 8,864.95 -206.65 (-2.28%)  MARUTI 11,731.70 -165.60 (-1.39%)

MARUTI 11,731.70 -165.60 (-1.39%)  HCLTECH 1,633.30 +7.05 (0.43%)

HCLTECH 1,633.30 +7.05 (0.43%)  SBIN 763.35 -9.70 (-1.25%)

SBIN 763.35 -9.70 (-1.25%)  NESTLEIND 2,243.35 -12.20 (-0.54%)

NESTLEIND 2,243.35 -12.20 (-0.54%)  ASIANPAINT 2,326.20 -4.15 (-0.18%)

ASIANPAINT 2,326.20 -4.15 (-0.18%)  WIPRO 267.25 -3.85 (-1.42%)

WIPRO 267.25 -3.85 (-1.42%)  DMART 3,944.00 -54.40 (-1.36%)

DMART 3,944.00 -54.40 (-1.36%)  AXISBANK 1,095.60 -24.00 (-2.14%)

AXISBANK 1,095.60 -24.00 (-2.14%)  LT 3,442.60 -27.10 (-0.78%)

LT 3,442.60 -27.10 (-0.78%)  HDFCLIFE 668.50 -5.00 (-0.74%)

HDFCLIFE 668.50 -5.00 (-0.74%)  SUNPHARMA 1,757.70 -8.30 (-0.47%)

SUNPHARMA 1,757.70 -8.30 (-0.47%)  ULTRACEMCO 11,399.35 -28.70 (-0.25%)

ULTRACEMCO 11,399.35 -28.70 (-0.25%)  ONGC 239.70 -2.50 (-1.03%)

ONGC 239.70 -2.50 (-1.03%)  BAJAJFINSV 1,942.70 -3.40 (-0.17%)

BAJAJFINSV 1,942.70 -3.40 (-0.17%)  BPCL 273.10 -5.95 (-2.13%)

BPCL 273.10 -5.95 (-2.13%)  POWERGRID 291.35 +0.20 (0.07%)

POWERGRID 291.35 +0.20 (0.07%)  TITAN 3,057.20 +2.05 (0.07%)

TITAN 3,057.20 +2.05 (0.07%)  BRITANNIA 4,849.80 +3.50 (0.07%)

BRITANNIA 4,849.80 +3.50 (0.07%)  NTPC 354.15 -13.00 (-3.54%)

NTPC 354.15 -13.00 (-3.54%)

TCS 3,635.50 -22.20 (-0.61%)

TCS 3,635.50 -22.20 (-0.61%)  HDFCBANK 1,805.95 -15.50 (-0.85%)

HDFCBANK 1,805.95 -15.50 (-0.85%)  HINDUNILVR 2,243.85 -26.85 (-1.18%)

HINDUNILVR 2,243.85 -26.85 (-1.18%)  INFY 1,598.15 -33.55 (-2.06%)

INFY 1,598.15 -33.55 (-2.06%)  HDFC 2,729.95 -17.05 (-0.62%)

HDFC 2,729.95 -17.05 (-0.62%)  BHARTIARTL 1,737.55 +3.85 (0.22%)

BHARTIARTL 1,737.55 +3.85 (0.22%)  KOTAKBANK 2,143.35 -27.50 (-1.27%)

KOTAKBANK 2,143.35 -27.50 (-1.27%)  ICICIBANK 1,335.40 -9.00 (-0.67%)

ICICIBANK 1,335.40 -9.00 (-0.67%)  ITC 407.05 -2.85 (-0.70%)

ITC 407.05 -2.85 (-0.70%)  BAJFINANCE 8,864.95 -206.65 (-2.28%)

BAJFINANCE 8,864.95 -206.65 (-2.28%)  MARUTI 11,731.70 -165.60 (-1.39%)

MARUTI 11,731.70 -165.60 (-1.39%)  HCLTECH 1,633.30 +7.05 (0.43%)

HCLTECH 1,633.30 +7.05 (0.43%)  SBIN 763.35 -9.70 (-1.25%)

SBIN 763.35 -9.70 (-1.25%)  NESTLEIND 2,243.35 -12.20 (-0.54%)

NESTLEIND 2,243.35 -12.20 (-0.54%)  ASIANPAINT 2,326.20 -4.15 (-0.18%)

ASIANPAINT 2,326.20 -4.15 (-0.18%)  WIPRO 267.25 -3.85 (-1.42%)

WIPRO 267.25 -3.85 (-1.42%)  DMART 3,944.00 -54.40 (-1.36%)

DMART 3,944.00 -54.40 (-1.36%)  AXISBANK 1,095.60 -24.00 (-2.14%)

AXISBANK 1,095.60 -24.00 (-2.14%)  LT 3,442.60 -27.10 (-0.78%)

LT 3,442.60 -27.10 (-0.78%)  HDFCLIFE 668.50 -5.00 (-0.74%)

HDFCLIFE 668.50 -5.00 (-0.74%)  SUNPHARMA 1,757.70 -8.30 (-0.47%)

SUNPHARMA 1,757.70 -8.30 (-0.47%)  ULTRACEMCO 11,399.35 -28.70 (-0.25%)

ULTRACEMCO 11,399.35 -28.70 (-0.25%)  ONGC 239.70 -2.50 (-1.03%)

ONGC 239.70 -2.50 (-1.03%)  BAJAJFINSV 1,942.70 -3.40 (-0.17%)

BAJAJFINSV 1,942.70 -3.40 (-0.17%)  BPCL 273.10 -5.95 (-2.13%)

BPCL 273.10 -5.95 (-2.13%)  POWERGRID 291.35 +0.20 (0.07%)

POWERGRID 291.35 +0.20 (0.07%)  TITAN 3,057.20 +2.05 (0.07%)

TITAN 3,057.20 +2.05 (0.07%)  BRITANNIA 4,849.80 +3.50 (0.07%)

BRITANNIA 4,849.80 +3.50 (0.07%)  NTPC 354.15 -13.00 (-3.54%)

NTPC 354.15 -13.00 (-3.54%)