On Monday, Berkshire Hathaway Inc. said that it has begun betting in pharmaceutical sector by investing in the stocks of four large drugmakers.

As of September 30, Warren Buffett’s Hathaway disclosed $5.7 billion stakes of new healthcare which includes more than $1.8 billion in each of Abbvie Inc., Bristol-Myers Squibb Co., Merck & Co. and $136 million in Pfizer Inc., according to the regulatory filing.

James Armstrong, President, Henry H. Armstrong & Associates, Pittsburgh which owns Berkshire stock said that the COVID-19 pandemic has made situation differently to think about the healthcare industry. “The sector has become more efficient as big drug companies partner with smaller, inventive rivals,” he added.

During the third quarter, Berkshire Hathaway also took $276 million stake in T-Mobile US Inc. and has sold $1.3 billion stake in Costco Wholesale Corp. the sold stake in Costco Wholesale helped in capital gains as stock prices were up on groceries and home supplies during the Covid-19 pandemic. It pared its holdings in four banks including JPMorgan Chase, Wells Fargo , PNC and M&T.

India’s Industrial Growth Slows to 2.9% in February on Weak Manufacturing

India’s factory output (IIP) grew 2.9% in February 2025, slowing from 5.2% in January due to weaker growth across key sectors.

Manufacturing and mining growth eased to 2.9% and 1.6%, respectively, while electricity generation improved to 3.6% from 2.4% in January.

Primary goods growth slowed to 2.8% from 5.5%, capital goods rose 8.2% versus 10.3%, and infrastructure/construction goods grew 6.6% from 7.4%.

Consumer durables grew 3.8%, down from 7.2% in January, while consumer non-durables contracted 2.1% after a 0.3% decline.

The IIP index for February stood at 151.3, with mining at 141.9, manufacturing at 148.6, and electricity at 194.0.

Key manufacturing drivers were basic metals (5.8%), motor vehicles and trailers (8.9%), and non-metallic mineral products (8.0%), supported by increased production of steel, auto components, and cement.

Stocks Insights? Let the Analyst Guide You.

The future of investing is here!

Unicorn Signals leverages advanced AI technology to provide you with powerful market predictions and actionable stock scans. Download the app today and 10x your trading & investing journey!

China Hints at Rate Cuts to Offset Trump’s Tariffs

A Chinese state newspaper signalled the need for monetary easing as US trade tensions threaten economic growth, suggesting the central bank should cut interest rates and banks’ reserve requirements.

The report stated that such measures could stabilise markets, boost confidence, and mitigate external shocks.

Chinese stocks rose for the third day, driven by stimulus expectations and hopes for a trade deal with the US. The urgency for easing increased after US President Donald Trump raised tariffs on Chinese imports to 125% while pausing levies on other trade partners.

Meanwhile, China’s consumer deflation extended for a second month in March, adding to economic concerns.

The People’s Bank of China has repeatedly pledged to lower borrowing costs and reserve requirements, fueling a rally in China’s bond market.

Stay Ahead with Stocks. Ask the Analyst.

Tired of missing hot stocks? Unicorn Signals provides powerful tools like stock scans and more help you make informed trading decisions. Download now and take control of your portfolio!

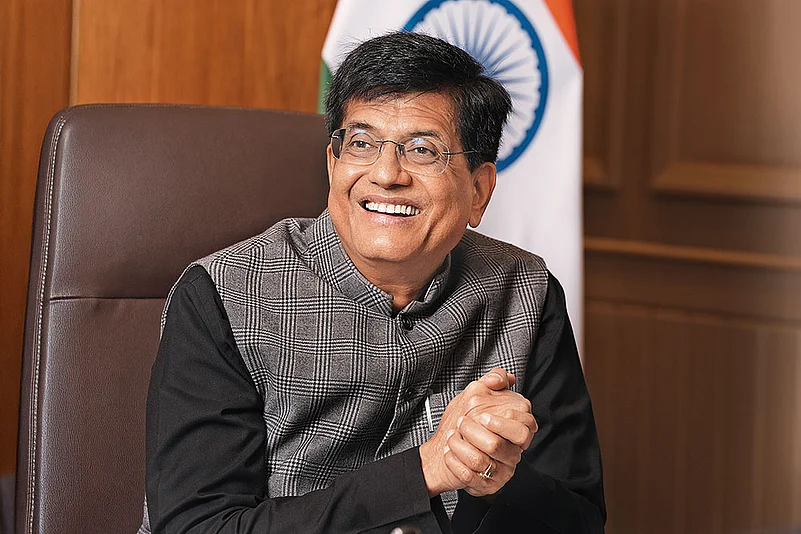

Piyush Goyal to Discuss Export Strategies Amid Trump’s Tariff Moves

Union Minister Piyush Goyal will meet exporters at Vanijya Bhawan in New Delhi today from 3 PM to 5 PM to discuss challenges posed by US President Donald Trump’s reciprocal tariffs.

The meeting will focus on strategies to mitigate their impact, with exporters exploring new markets in gems, jewellery, electronics, textiles, and apparel.

Senior Ministry officials, along with representatives from Export Promotion Councils (EPCs) and the Federation of Indian Export Organisations (FIEO), will participate, according to PTI (Press Trust of India Ltd).

Earlier today, Goyal emphasised that India’s best interests remain the priority in trade negotiations. Speaking at the Dubai India business forum in Mumbai, he reaffirmed that ‘India First’ is the guiding principle, assuring business leaders that trade agreements will support the country’s long-term economic goals.

Wondering About A Stock? The Analyst Has Answers.

The future of investing is here!

Unicorn Signals leverages advanced AI technology to provide you with powerful market predictions and actionable stock scans. Download the app today and 10x your trading & investing journey!

RBI May Cut Rates on 9th April Amid Global Tariff Pressures

With global trade tensions rising due to tariff hikes, all eyes are on the Reserve Bank of India’s (RBI) policy decision on 9th April. Experts expect the Monetary Policy Committee (MPC) to weigh these risks while focusing on domestic factors.

A 25-bps rate cut is widely anticipated, with inflation cooling, growth slowing, crude oil prices falling, and US bond yields dipping. While many foresee further reductions in June, opinions differ on the RBI’s stance—about half expect a shift to ‘accommodative,’ while 40% believe it may remain ‘neutral’ amid global uncertainties.

Most predict the repo rate could bottom out around 5.5%, implying a total 75-bps cut. No major liquidity surprises are expected, as the RBI has already eased conditions through open market operations and currency swaps. Further liquidity measures would be market-positive.

Higher global tariffs could shave 30–60 bps off India’s GDP growth, but the RBI will likely maintain or slightly lower its forecast. On inflation, 60% expect no change, while 40% foresee a slight revision to 4–4.1%.

Overall, the policy is expected to be dovish, with the RBI balancing global risks and domestic growth. Further rate cuts may be on the horizon.

Got Stock-Related Questions? The Analyst is Ready.

Unlock profitable opportunities every day! Unicorn Signals provides actionable intraday trading signals for stocks and futures. Don’t miss out – download Unicorn Signals and start winning now!

India Raises Excise Duty by Rs 2 on Petrol & Diesel; Retail Prices Unchanged

On 7th April, the Indian government announced a Rs 2 per litre hike in Special Additional Excise Duty (SAED) on petrol and diesel, effective from 8th April.

With this revision, SAED on petrol will rise from Rs 11 to Rs 13 per litre and diesel from Rs 8 to Rs 10 per litre. Despite the hike, the Petroleum Ministry confirmed that retail prices will remain unchanged. Petroleum Minister Hardeep Singh Puri assured consumers that the increase would not be passed on to them, stating, “This will not be passed on to the consumer.”

Puri explained that while crude oil prices have dropped to around $60 per barrel, state-run oil marketing companies (OMCs) manage inventory purchased at an average of $75 per barrel, as they typically hold stock for over 45 days. He added that OMCs may consider price revisions if crude stabilises between $60 and $65 per barrel.

This move comes amid a sustained decline in global crude prices, driven by rising supply from non-OPEC (Organisation of the Petroleum Exporting Countries) producers and weaker demand. The downturn has been further intensified by trade tensions following tariffs imposed by US President Donald Trump.

Curious About Petroleum Stocks? Ask the Analyst.

Ready to invest like a pro? Unicorn Signals app equips you with 100+ Free tools and knowledge you need to succeed. Download the Unicorn Signals app and gain access to daily stock lists and insightful market analysis and much more!