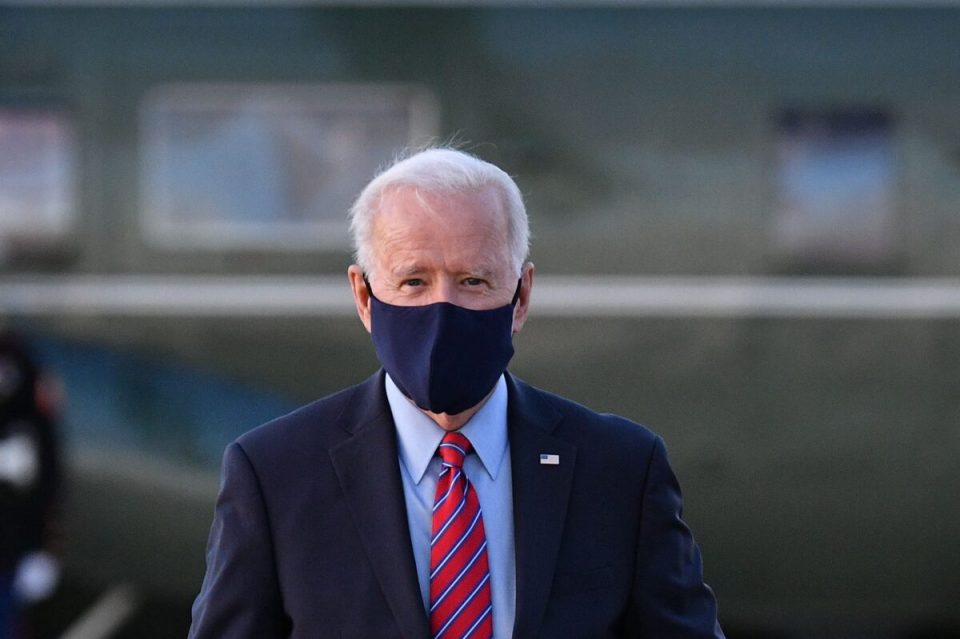

US President Joe Biden will propose a tax hike on the investment gains of the wealthiest individuals to pay for his new plan to help US families, a top White House economist said Monday. Biden this week is expected to lay out his $1.8 trillion American Families Plan that would provide national child care, paid family leave and free community college, using higher taxes on the rich to offset the hefty price tag.

The increased levy on the profits earned from sales of stocks and other assets will only impact those earning $1 million a year, a narrow sliver of American taxpayers comprising 500,000 people, said Brian Deese, head of the White House National Economic Council.

“This change will only apply to three tenths of a percent of taxpayers, which is not the top one percent, it’s not even the top one half of one percent,” he told reporters, citing 2018 tax filing data.

The change will help “to offset the long term cost of those investments by making reforms to our tax code that reward work and not just wealth,” Deese said.

He did not provide any details of the new higher tax, but media reports last week cited officials saying the plan will increase the capital gains tax rate to 39.6 percent from 20 percent. Coupled with a 3.8 percent tax charged to wealthy investors to pay for Obamacare health insurance program, the top capital gains tax rate could rise to 43.4 percent — the highest since the 1920s, according to the Tax Foundation, and independent research group.