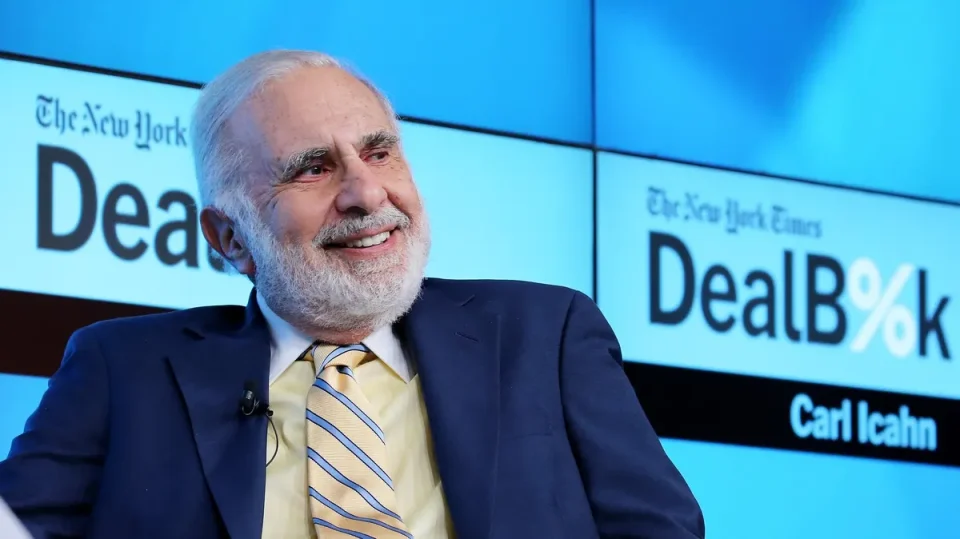

Icahn Enterprises (IEP) shares jumped as much as 22% after Carl Icahn announced that he had reconstructed $3.7 billion in personal loans, leading to a billion-dollar jump in the net worth of the 87-year-old founder.

Shares of IEP closed the trading session at $34.69, 20.20% higher than the previous close price. The stock hit its highest level on the day since being targeted by a Hindenburg report in May 2023. The report accused the company of overvaluing its holdings and relying on a “Ponzi-like” structure to pay dividends.

Icahn amended a personal loan agreement with his flagship company Icahn Enterprises, to remove a link between his obligation to post collateral and his holding company’s share price.

The new agreement converts the margin debt into a three-year loan with five major banks, which means the loans are no longer tied to the company’s stock price. Although, Icahn is committed to adding collateral if the firm’s net asset value falls below a predetermined amount.

To reach the deal, Icahn has had to pledge 95% of his outstanding IEP shares, amounting to nearly 60% stake in the company and has agreed to make a $500 million principal payment before September.

Live

Live