The Government of India plans to sell 5-10% stakes in Coal India, Hindustan Zinc and Rashtriya Chemicals and Fertilisers (RCF), Bloomberg reported on November 25. The report suggested that selling small stakes in state-owned enterprises would boost the stock market and revenues in the fiscal year’s final quarter. The government wants to sell some of the shares through an offer for sale (OFS) mechanism.

A sale at the lower end of the range could net the centre about Rs 16,500 crore, or $2 billion, in current values, according to calculations reported by Bloomberg.

Moneycontrol reported in May this year that the union cabinet had approved the sale of the government’s entire stake in Hindustan Zinc Limited.

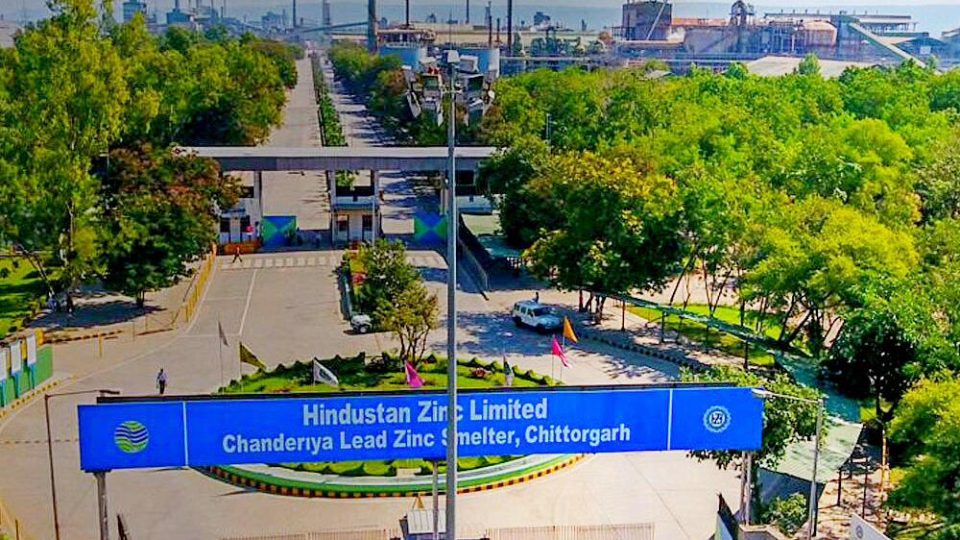

Hindustan Zinc is a government-owned company. In 2002, the government sold a 26% stake in the company, which was acquired by the Vedanta Group led by Anil Agarwal. The mining giant later acquired a further stake in the company, bringing its stake to 64.92%.

Meanwhile, under its divestment plan, the government plans to make four major sale offers over the next four periods – Coal India, NTPC, Hindustan Zinc and RITES, CNBC-TV18 reported earlier this month.

The government also plans to sell its 10-20% stake in Rashtriya Chemicals Fertilisers (RCF) and National Fertilisers (NFL) this year, according to other media reports.

The divestment target for 2023-24 may be set at around Rs 65,000 crore, Financial Express (FE) reported. According to information available on the Department of Investment and Public Asset Management (DIPAM) website, divestment proceeds so far, this financial year have exceeded Rs 24,000 crore.

Live

Live