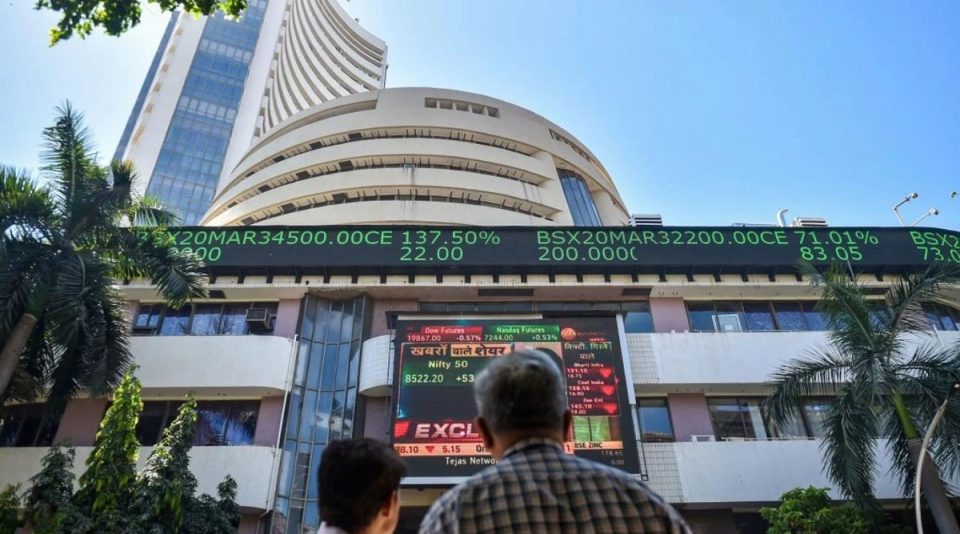

Several significant global events have significantly impacted the US and International stock markets since the turn of the millennium. This includes the Dot-Com bust, the WTC terrorist attack, the US Subprime crisis, Stimulus packages, the European debt crisis, the US Presidential Elections, Trade Tariffs, the outbreak of the COVID-19 pandemic, etc had been the Pillar-breakers of the Indian Stock Market since last decades.

The Indian stock market, too, felt the effects of these happenings. Here, this will examine the reasons for these occurrences and their impact on the Indian stock market as well as the US and other worldwide stock markets.

The Technological Bubble Burst- A 2000s Story

With their cutting-edge goods and services, IT businesses have significantly facilitated our lives through the use of technology. As a result, listed technological companies have traditionally been valued more. However, in 2000, greed took control, and IT companies’ prices soared on the US stock market and other International stock exchanges, including India. Finally, the NASDAQ plummeted, the overvaluation bubble burst and many IT businesses lost more than half of their value, declaring bankruptcy.

The US market accounts for an enfeeble portion of the revenue generated by Indian IT companies. Therefore, the NASDAQ meltdown also suffered significant effects on the Indian stock markets. The share prices of publicly traded IT firms like Infosys, Wipro, and others plummeted, and Sensex as a whole also fell.

Terrorists Attack In the US

The terrorist attack on the World Trade Centre occurred in 2001, just as the US market was beginning to recover from the Dot-Com Crash suffered the previous year. The WTC Attack had a terrific effect on the US economy, but the Dot-Com bust primarily affected the IT sector. All three of the major US Indices, i.e. the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ, witnessed significant drops after the Terrorist incident.

The WTC Attack shook the whole International economy, causing a fall in stock prices all over the place. The Terrorist Attack on the World Trade Centre occurred when the Indian stock market recovered from the Dot-Com bust in 2000.

A Boom Driven By Low-Interest Rates And Easy Access To Capital

The US Federal Reserve (US Central Bank) implemented a loose monetary policy to help the US Economy recover from the downturn brought on by the twin shocks of the Dot-Com bust and the WTC Terrorist Attack. The US Federal lowered interest rates and provided the necessary liquidity to stimulate the economy. However, other Central banks all over the world adopted the loose monetary policy approach at the same time the US Federal slashed interest rates. The RBI lowered interest rates as well. A global economic resurgence resulted from the stance, which bolstered stock markets.

One of the best bull markets was experienced between 2002 and 2008 in the US and other International stock markets. During this time, Sensex and Nifty both prospered.

Subprime Crisis Caused By High-Interest Rates

The world’s stock markets had two periods of one of the best bull markets from 2002 to 2008. Global Central banks lowered interest rates during the initial phase, aiding the economy’s revival. Additionally, the low lending rates sparked a global real estate boom that included the US and India.

The second phase saw an increase in inflation and an overheating of many economies. As a result, Global central banks began tightening liquidity and raising interest rates. The rising interest rates were tolerated for a while. However, when interest rates continued to rise, many Americans could not pay the high EMIS and began to fall behind on their mortgages, vehicle loans, business loans, and other obligations.

The Subprime Crisis resulted from this, which began in the real estate industry before spreading to other facets of the US Economy. During this crisis, numerous US banks, insurance firms, hedge funds, and other financial institutions failed. US stock markets plummeted. Numerous banks and other financial organisations failed in other nations as well. India was also not exempt.

To escape from one of the worst recessions, the US, India, and many other nations’ economies had to turn once more to slack monetary and fiscal policy. Following the release of bailout/stimulus packages by the Governments of numerous countries, notably India and the US, the stock markets and economy began to rebound.

Downgrades To Sovereign Credit Ratings And High Debt

Due to poorly enforced monetary and fiscal policy (bailout packages) following the Subprime Crisis, many Governments’ debt loads increased between 2009 and 2012. It planted the seeds for the European debt crisis. For example, Greece, Portugal, Italy, Ireland, Spain, and other European nations’ governments were unable to pay their debts and were in danger of going bankrupt.

Political instability during this period made issues worse as some administrations in these fragile European economies crumbled. The possibility of the European Union disintegrating was feared. Some of these European nations had their sovereign credit ratings reduced by credit rating organisations. All of this caused fear and a sell-off in international stock markets. The US and Indian stock markets were impacted by the worldwide sell-off that Europe caused.

Elections For President In US Politics

One of the candidates for the 2016 US Presidential Election was Donald Trump. Many individuals disliked the speeches he gave throughout his election campaigns. Electing the US President was considered bad news for the US and the world economy. When Donald Trump was elected as US President in 2016 and won the election, the market’s worries came true. The outcome was a decline in the US stock market and other stock markets worldwide, including India. However, the correction was only temporary, and markets eventually bounced again.

Pandemic COVID-19

The coronavirus, which started in China in 2019, significantly impacted the world economy in 2020. Many countries went into lockdown as the virus began infecting nations one by one. Global trade was severely impacted. Due to this, there was a significant market meltdown from March–April 2020, falling the major US Indices. In addition, the Sensex and Nifty crashed by around 50% as India entered one of the strictest national lockdowns.

Way Forward

We are more interconnected than before since we live in a globalised economy today. Some claim that India is cut off from world events and that we may disconnect from them. The stock market’s response to all the aforementioned global events demonstrates that we cannot isolate or detach ourselves from them. Like any other nation, India is impacted by world events. What counts after the worldwide incident is the Central Bank’s (RBI) and Central Government’s response in mitigating its effects and how rapidly we can recover from it.

As an investor, you must consider the previous worldwide events and adjust your investing choices accordingly. Such worldwide developments will affect Indian stock markets as they develop and impact your investment portfolio. By adopting a suitable asset allocation to multiple asset classes like equity, debt, gold, real estate, etc., you can be better prepared for such global shocks. It would help if you further diversify your portfolio by exposing large, mid, and small-cap stocks within an asset class like equity.