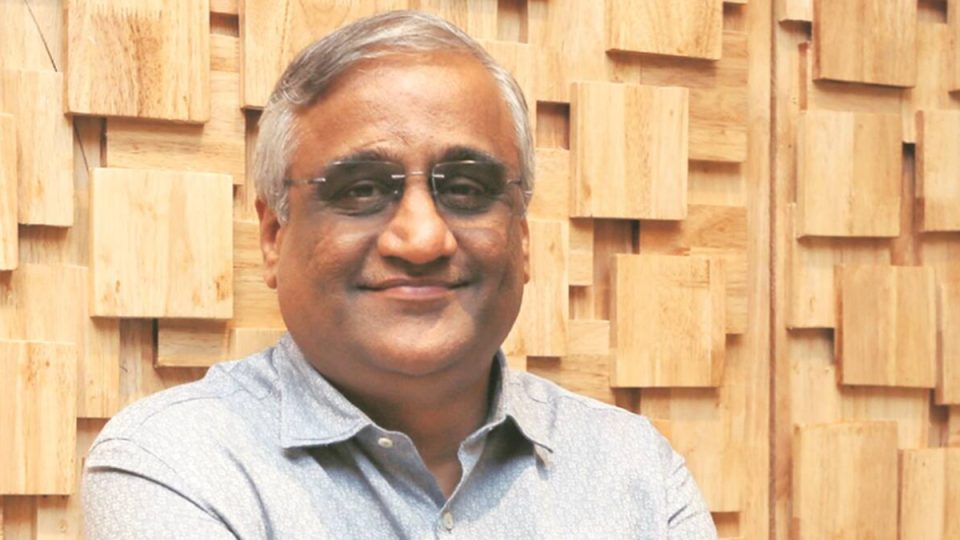

On March 16, Future Retail shares traded 4% higher after the Company’s Director and Executive Chairman, Kishore Biyani, withdrew his resignation, presented on January 23.

The withdrawal came after the debt-ridden company and enduring insolvency stated that the resolution professional objected to the contents of the resignation, requesting to recall the letter.

In the previous week, the resolution professional wrote an application against Future Retail’s former and present directors in the NCLT amid creditors’ massive losses and called for them to fund Rs 14,809 crore to be paid back to creditors.

In the last year of Future Retail’s accounts, the Securities and Exchange Board of India (SEBI) ordered a forensic audit from FY20, FY21, and FY22.

Since July 2022, Future Retail Group has undergone insolvency proceedings after the Bank of India filed an insolvency petition to National Company Law Tribunal (NCLT). About Rs 21,000 crore had been requested by 34 financial creditors till February 2023.

InGovern, an investment advisory firm, alleged fraudulent transactions commenced by promoters and directors of FRL and the fund’s mismanagement. On Biyani’s resignation, the advisory firm said, “Mr Biyani is renouncing all responsibility of helping the firm recover assets or safeguard that there is any sustained value for sale to investors. If media reports are to be believed amid the non-cooperation of the Biyanis, the Resolution Professional also decides to approach the NCLT. The facts make it imperative that the SEBI and RBI mediate to confirm that shareholder wealth is secured and can be recovered.”

Recently, the All India Garment Manufacturers and Suppliers Association (AIGMVA) also asked Biyani to pay 200 crores of dues outstanding from 2019. Future Retail’s market cap has plummeted 94% in the last year.

The stock was trading 3.92% higher at Rs 2.65 on the NSE at 11 am, while the benchmark Nifty was trading 0.28% higher at 17,019.70.

Live

Live