The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) has kept repo rates unchanged at 6.5%, in line with widespread expectations. This decision came after the announcement of the Interim Budget on February 1, 2024.

This marks the sixth consecutive time the repo rate was kept unchanged. The last adjustment in the repo rate occurred in February 2023, when it was increased from 6.25% to the current 6.5%.

Consequently, the central bank has kept the standing deposit facility (SDF) rate, the marginal standing facility (MSF) rate, and the Bank Rate unchanged at 6.25%, 6.75% and 6.75%, respectively.

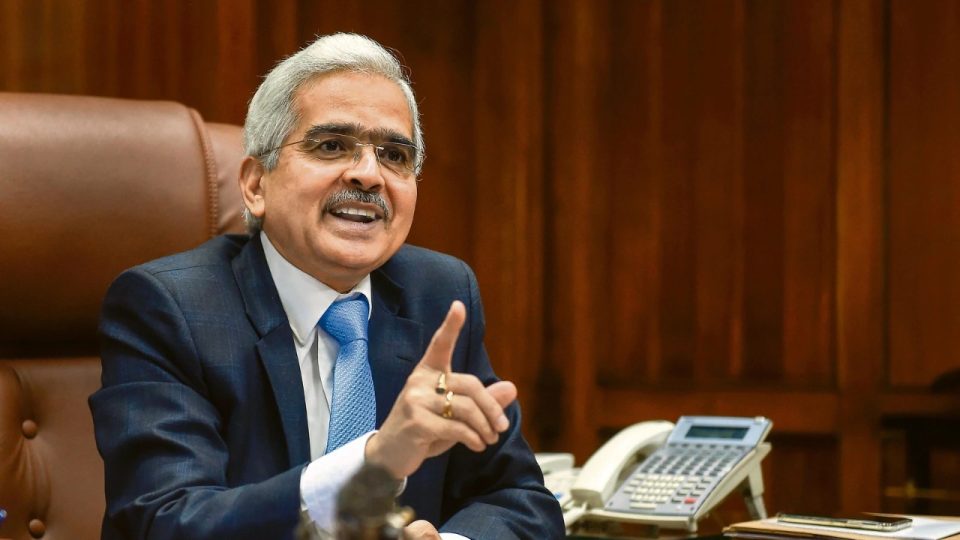

The RBI MPC commenced its first 3-day bimonthly meeting in 2024 on February 6 and concluded its discussions. RBI Governor Shaktikanta Das unveiled the committee’s decision today at 10 am. Chaired by the RBI Governor, the other members of the RBI MPC include 2 deputy governors and 3 external members.

RBI Governor Shaktikanta Das said that the panel has also decided to remain focused on withdrawing the accommodative stance to ensure that inflation progressively aligns with the target. He will also address a post-policy press conference at noon today after the MPC decision announcement.

GDP Growth Projection

Governor Das said that the momentum in domestic economic activities remains strong amid strong investment activity. According to the National Statistical Office’s (NSO) first advance estimates (FAE), the Real Gross Domestic Product (GDP) is expected to grow by 7.3% year-on-year (YoY) in 2023-24, making the 3rd successive year of growth above 7%.

RBI projects real GDP growth for FY25 at 7%, with Q1 at 7.2%, Q2 at 6.8%, Q3 at 7% and Q4 at 6.9%, considering demand, consumption, investment and other factors.

Inflation Targets

Uncertainty in food inflation, primarily the shocks in vegetable prices, continues to drive the pick-up in headline inflation in November and December. The RBI expects global growth to remain steady in 2024.

Taking into account food inflation, vegetable prices, weather events, crude oil prices and other factors and assuming a normal monsoon next year, RBI pegged CPI inflation for 2024-25 at 4.5%, with Q1 at 5%, Q2 at 4%, Q3 at 4.6% and Q4 at 4.7%. CPI (consumer price index) inflation is projected at 5.4% for 2023-24, with Q4 at 5%.

Live

Live