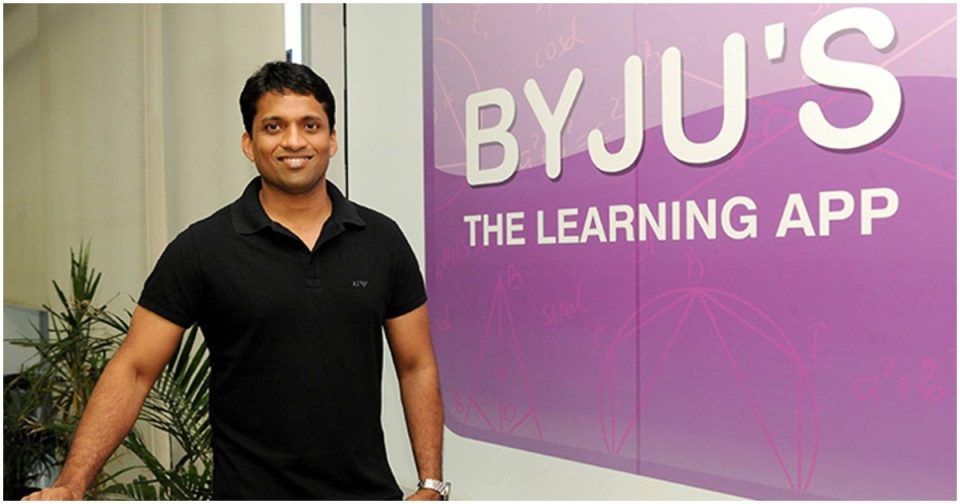

The founder of Byju’s, the troubled edtech company, Byju Raveendran, admitted on Thursday afternoon that he erred, misjudged the market, overstated his potential for growth, and now his venture, which was previously valued at $22 billion, is essentially worth “zero.”

In a speech, Raveendran claimed that when funding dried up in 2022, the company’s reckless acquisition of more than two dozen businesses to grow into new markets proved disastrous. Earlier this year, TechCrunch claimed that Byju’s intended to go public in early 2022, with a $50 billion valuation offered by a number of investment bankers.

Many of his more than 100 investors, he claimed, had pushed him to pursue rapid development into as many as 40 regions. He went on, though, to say that the same investors changed their minds when world markets crashed when Russia invaded Ukraine, putting the venture capital industry into a tailspin.

According to Raveendran, a number of his investors “ran away,” and the startup was unable to secure new funding since three important backers, including Prosus Ventures, Peak XV, and Chan Zuckerberg Initiative, left the board last year.

Citing governance concerns, representatives of the three aforementioned companies and auditor Deloitte departed the startup’s board last year.

Byju’s has since entered insolvency proceedings, and Raveendran, who no longer controls the company, said: “It’s worth zero. What valuation are you talking about? It’s worth zero.”

BlackRock, UBS, Lightspeed, QIA, Bond, Silver Lake, Sofina, Verlinvest, Tencent, Canada Pension Plan Investment Board, General Atlantic, Tiger Global, Owl Ventures, and the World Bank’s IFC are among the investors in Byju’s, which was formerly the most valuable company in India. To date, it has raised almost $5 billion.

Tired of guessing stocks to trade in daily?

Unicorn Signals empowers you with powerful tools like daily stock scans for Intraday, Swing & Investing, Market Predictions and much more. Download the Unicorn Signals app today and take control of your investments!