About the Company

Awfis Space Solutions Ltd. is one of the major companies in India that offers flexible workspace solutions. They provide various workspace options, including co-working solutions, flexible desks, mobility solutions, and custom office spaces for different businesses. It has launched its initial public offer (IPO) yesterday, i.e. on May 22, 2024.

Their solutions are tailored for different team sizes and can be contracted for various durations, from one hour to several years. Over time, they have expanded from offering co-working spaces to providing integrated workspace solutions.

They also provide services for the design, construction, maintenance, and management of flexible workspace needs through Awfis Transform and Awfis Care. Additionally, they offer services such as food and beverages, IT support, infrastructure services, and event hosting and meeting arrangements.

Awfis started as a co-working space provider in 2015 in Delhi and has since expanded to include 4,000 seats across Delhi, Mumbai, and Bangalore. They received funding from various sources, including USD 20 million in Series B funding from Sequoia India and USD 30 million in Series D funding led by ChrysCapital.

In 2021, Awfis partnered with Prestige Group to establish six centers in Bengaluru, Hyderabad, and Chennai.

They also entered the Premium Workspace Segment with the launch of Awfis Gold, opening its first premium category center in Mumbai and currently operating five other Gold centers in Bengaluru, Hyderabad, and Chennai.

In September 2023, the company announced plans to launch an initial public offering (IPO). Later that year, in December, it filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for the IPO and announced its plan to go public.

Awfis operates in all Tier 1 cities and seven Tier 2 cities, covering 16 cities and 48 micro markets in India. Their clients benefit from increased accessibility to workspaces, community engagement, and consistent quality across all their centers.

The company’s extensive network allows it to adapt to evolving workplace trends and provides flexibility to work from multiple locations or remotely. They have been expanding their presence to Tier 2 cities since Fiscal 2018, allowing them to support the establishment of dedicated centers for larger companies in these cities.

Their network, experience, and relationships across cities enable them to adapt their offerings to local market needs and support the growth of their office supply in recent years.

The Awfis Space Solutions Limited IPO opened for subscription on May 22, 2024, and will be closed on May 27, 2024. The company provides flexible workspace solutions for individuals, startups, small and medium enterprises, as well as large and multinational corporations.

The price band for the IPO is set at Rs 364 to Rs 383 per share, with a minimum lot size of 39 shares. A minimum investment of Rs 14,937 is needed by the Retail Investors.

The offer follows a book-building process, with 75% of the net offer allocated to qualified institutional buyers (QIBs), 15% reserved for non-institutional buyers, and a cap of 10% for retail buyers’ reservations.

The IPO’s lead book runners are ICICI Securities Limited, Axis Capital Limited, IIFL Securities Ltd, and Emkay Global Financial Services Ltd, with Bigshare Services Pvt Ltd serving as the registrar for the issue.

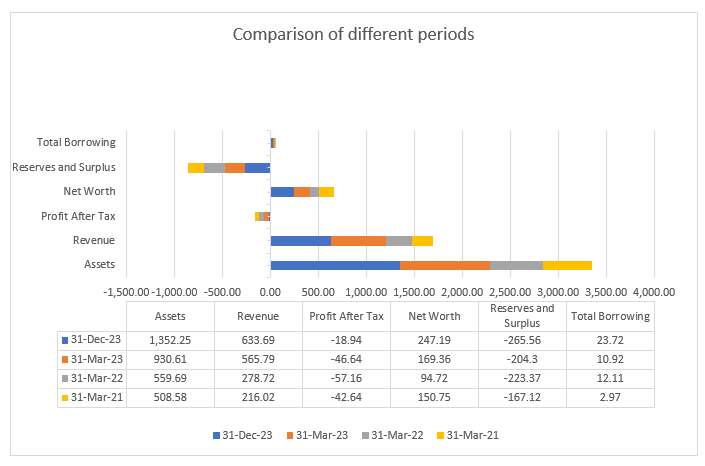

The company revenue increased to Rs 565 crore in fiscal year 2022-23 from Rs 278 crore in FY22. The company reported a net loss of Rs 46 crore in FY23, compared to Rs 57 crore in FY22.

In the first nine months of FY24, the company generated a revenue of Rs 633 crore and incurred a net loss of Rs 18 crore.

The company’s price-to-sales ratio was 4.9 times its FY23 earnings.

Awfis, a leading player in the Indian workspace solutions market, aims to continue building an industry-leading capital-efficient model to maintain market share and increase the percentage of operational centers and seats under the MA model.

The company plans to use the money from the offering to fund the following: establishing new centers, meeting working capital needs, and general corporate purposes.

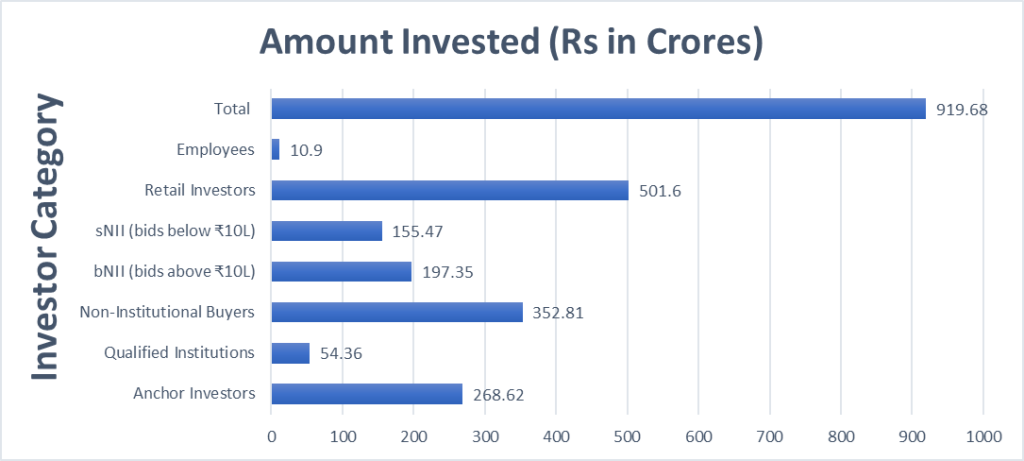

Subscription status as of May 23, 2024, IST 11:15:06 AM

Awfis Space Solutions IPO subscribed 2.78 times. The public issue subscribed 8.40 times in the retail category, 0.30 times in QIB, and 3.94 times in the NII category by May 23, 2024, 11:15:06 AM.

Total Applications: 258,239

Amount invested by different categories of Investors as of May 23, 2024, 11:15:06 AM.

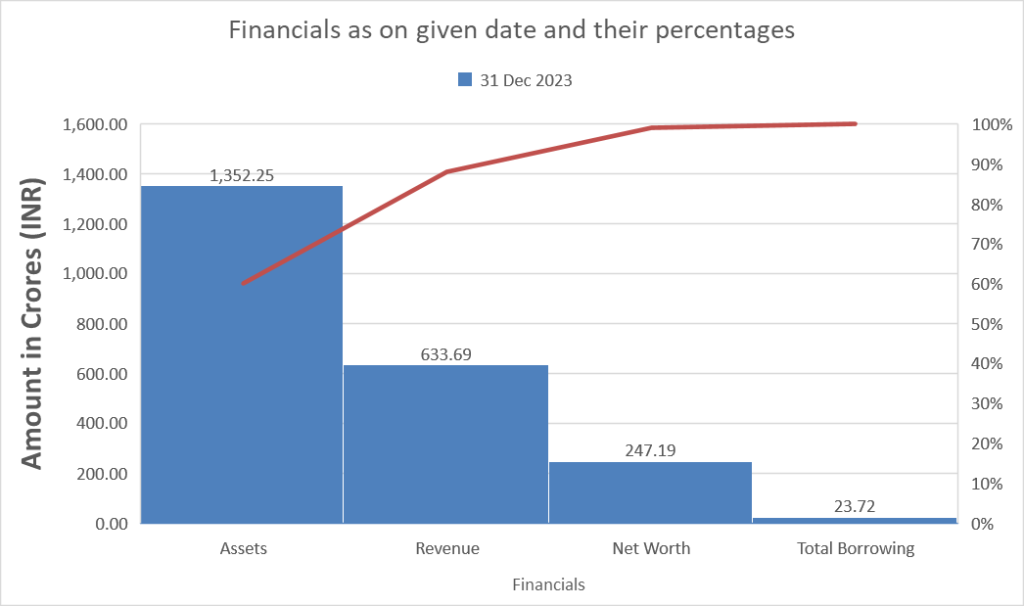

Financials as published by the company as on December 31, 2023

| Period Ended | 31 Dec 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 1,352.25 | 930.61 | 559.69 | 508.58 |

| Revenue | 633.69 | 565.79 | 278.72 | 216.02 |

| Profit After Tax | -18.94 | -46.64 | -57.16 | -42.64 |

| Net Worth | 247.19 | 169.36 | 94.72 | 150.75 |

| Reserves and Surplus | -265.56 | -204.30 | -223.37 | -167.12 |

| Total Borrowing | 23.72 | 10.92 | 12.11 | 2.97 |

a) Financials as on Dec 31, 2023

Comparison of financials for different periods

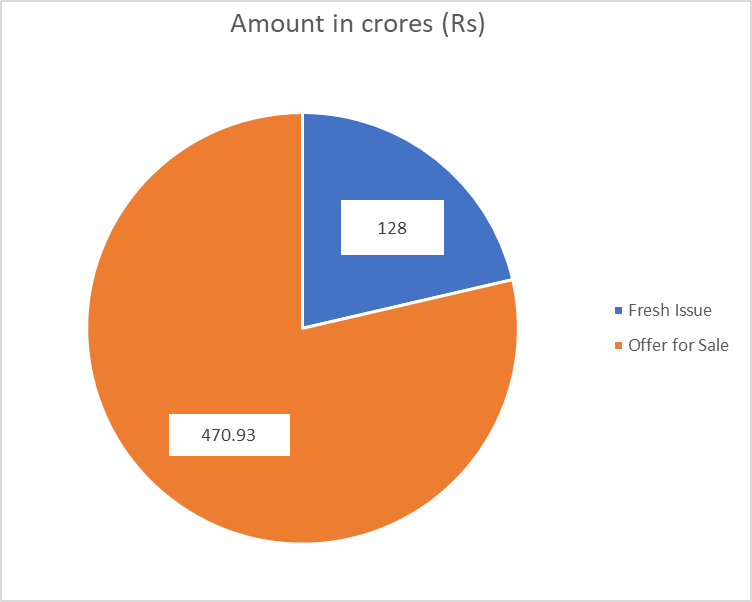

Issuance of Shares from different modes (till date)

| Particulars | Number of Shares Issued | Amount in crores (Rs) |

| Total Issue Size | 15,637,736 shares | 598.93 |

| Fresh Issue | 3,342,037 shares | 128 |

| Offer for Sale | 12,295,699 shares of Rs 10 | 470.93 |

The Awfis Space Solutions IPO includes a fresh issue of Rs 128 crore and an offer-for-sale (OFS) of approximately Rs 471 crores.

Awfis Space Solutions IPO opened on May 22, 2024, and will close on May 27, 2024.

Awfis Space Solutions IPO tentative timelines is as under –

| IPO Open Date | Wednesday, May 22, 2024 |

| IPO Close Date | Monday, May 27, 2024 |

| Basis of Allotment | Tuesday, May 28, 2024 |

| Initiation of Refunds | Wednesday, May 29, 2024 |

| The Credit of Shares to Demat | Wednesday, May 29, 2024 |

| Listing Date | Thursday, May 30, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on May 27, 2024 |

Risks associated as per the company’s Red Herring Prospectus (RHP) filed with SEBI

- Awfis Space Solutions has a history of net losses, negative earnings per share (EPS), and a negative return on net worth.

- The company has experienced negative cash flows in previous fiscal years and may continue to have negative cash flows in the future, according to Mastertrust.

- The company has entered into long-term fixed-cost leases, covering 1.94 million sq. ft. across 62 centers in 11 cities and 9 states, representing 33.57% of total seats as of December 31, 2023. This may result in an adverse impact on liquidity, results of operations, cash flows, and profitability.

To get a full list of the upcoming, current, and closed IPOs, check our Unicorn Signals App – IPO Scanners tool, and fetch the latest updates.