Adani Group of Company-led Ambuja Cement Ltd has announced the acquisition of Sanghi Industries Ltd at an enterprise value of Rs 5,000 crore.

The company will buy a 56.74% stake in Sanghi Industries Ltd from its existing promoter group, Ravi Sanghi and family, which is fully funded through internal accruals.

Ambuja Cement is set to buy up to 14,65,78,491 equity shares of Sanghi Industries, representing 56.74% of the voting share capital.

The company will make an open offer for up to 6,71,64,760 equity shares that, makes up 26% of the share capital for Rs 114.22 per share.

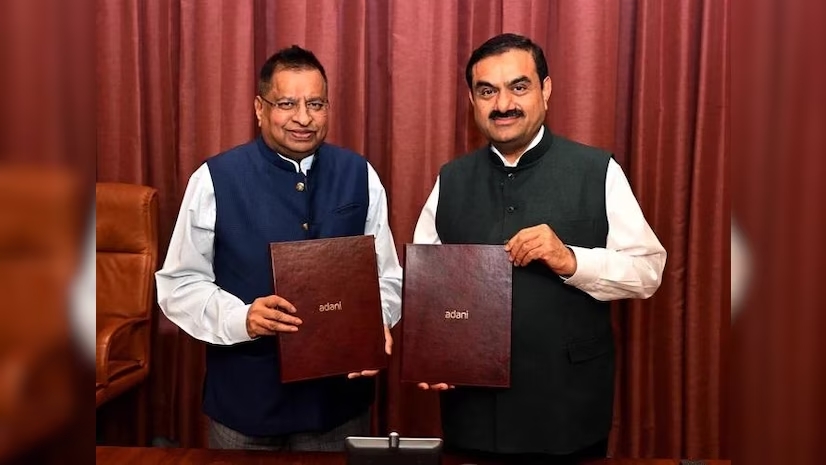

The acquisition is a significant step forward for Ambuja Cement’s growth journey. By joining hands with Sanghi Industries Ltd, the Adani Group-led Ambuja Cement is ready to expand its market presence, strengthen its portfolio, and solidify its position in the market as a leader in the construction material sector.

Gautam Adani, chairman of the Adani Group, said, “By joining hands with SIL, Ambuja is poised to expand its market presence, strengthen its product portfolio, and reinforce its position as a leader in the construction materials sector. With this acquisition, the Adani Group is well on course to achieve its target of 140 MTPA of cement manufacturing capacity by 2028 ahead of time,”

The acquisition will increase its cement capacity from 67.5 million tons per annum (MTPA) to 73.6 MTPA.

At 11:40 am, the share of Sanghi Industries was trading at Rs 105.40 or 4.98% above its previous close on NSE.

Live

Live