Shares of the quick-service restaurant (QSR) major Burger King India (BKIL) made a stellar debut on the BSE and NSE on December 14 listing at nearly double their issue price.

Shares of Burger King rallied up to 20 per cent to Rs 166.05 and hit a new high on the National Stock Exchange (NSE) in the early morning trade on Tuesday after logging a stellar debut at the bourses on Monday.

At 12:00 pm, BKIL locked in the 20 per cent upper circuit band, as compared to a 0.63 per cent decline in the Nifty50 index. On December 14, the stock of the quick-service restaurant closed at Rs 135, clocking a 125 per cent premium over its issue price of Rs 60 on the BSE. With today’s gain, the stock has rallied 167 per cent compared to its issue price.

Burger King is one of the fastest-growing international QSR chains in India. It got a massive response on its IPO which was oversubscribed by 157 times.

“At the current market price, BKIL fully captures its strong brand positioning, robust store expansion plans, and the bright growth prospects of the QSR industry in India. However given its weak financials, the valuation seems a little stretched vs players like Jubilant Food and Westlife Dev,” cautioned analysts at Motilal Oswal Financial Services.

Dr. Reddy Outlook for the Week (April 03, 2023 – April 07, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (April 03, 2023 – April 07, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 3.55%

Dr Reddy Share Price: 4622.75

Weekly High: 4656.50

Weekly Low: 4465.05

Weekly Range: 158.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4772 |

| RESISTANCE 1 | 4697 |

| SUPPORT 1 | 4506 |

| SUPPORT 2 | 4390 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4506 levels, Minor resistance on the upside is capped around 4697 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4390 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4772.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4772 on upside and 4390 on downside.

Dr. Reddy Outlook for the Week (Mar 27, 2023 – March 31, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 27, 2023 – March 31, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 0.63%

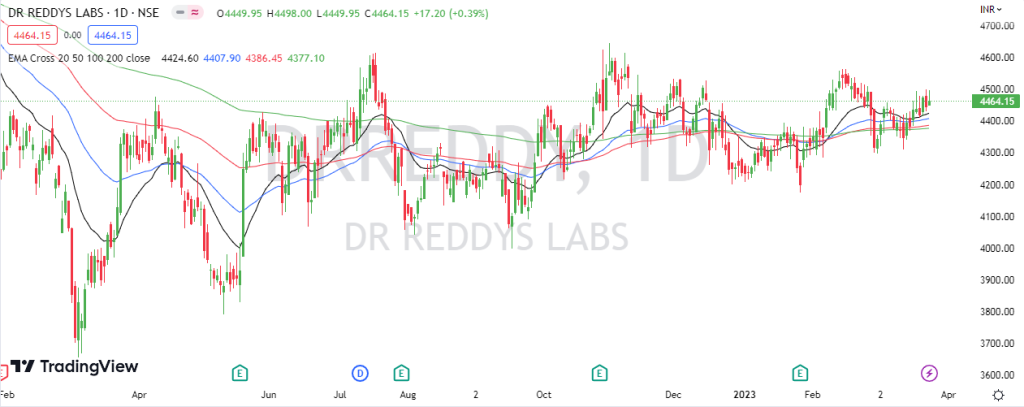

Dr Reddy Share Price: 4464.15

Weekly High: 4499.50

Weekly Low: 4309.20

Weekly Range: 28.00 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4547 |

| RESISTANCE 1 | 4505 |

| SUPPORT 1 | 4415 |

| SUPPORT 2 | 4367 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4415 levels, Minor resistance on the upside is capped around 4505 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4367 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4547.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4547 on upside and 4367 on downside.

Dr. Reddy Outlook for the Week (Mar 20, 2023 – March 24, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 20, 2023 – March 24, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on positive note gaining 0.92%

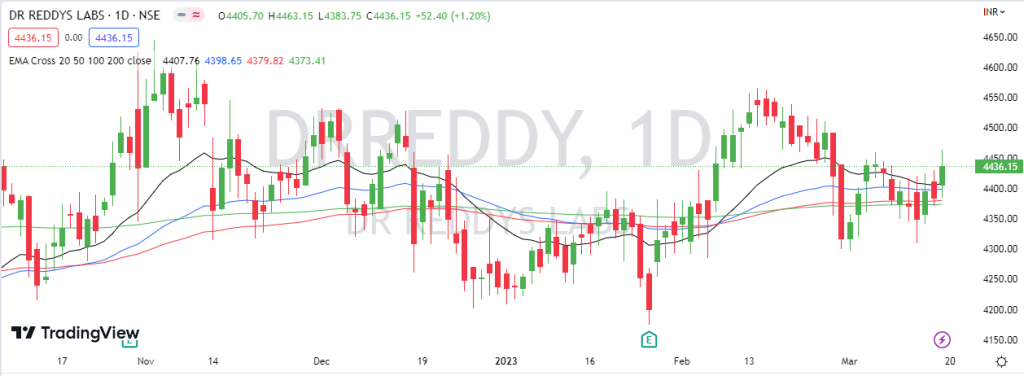

Dr Reddy Share Price: 4436.15

Weekly High: 4463.15

Weekly Low: 4309

Weekly Range: 40.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4526 |

| RESISTANCE 1 | 4496 |

| SUPPORT 1 | 4342 |

| SUPPORT 2 | 4248 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4342 levels, Minor resistance on the upside is capped around 4496 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4248 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4526.

Stock is trading above 200 days exponential moving average, suggests long term trend is bullish. EquityPandit predicts Range for the Weekly as 4526 on upside and 4248 on downside.

Dr. Reddy Outlook for the Week (Mar 13, 2023 – March 17, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Mar 13, 2023 – March 17, 2023)

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on negative note loosing 0.96%

Dr Reddy Share Price: 4395.55

Weekly High: 4458.80

Weekly Low: 4350.00

Weekly Range: 42.40 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4509 |

| RESISTANCE 1 | 4452 |

| SUPPORT 1 | 4344 |

| SUPPORT 2 | 4293 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4344 levels, Minor resistance on the upside is capped around 4452 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4293 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4509.

Stock is trading on 200 days exponential moving average, suggests long term trend is nutral. EquityPandit predicts Range for the Weekly as 4509 on upside and 4293 on downside.

Dr. Reddy Outlook for the Week (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

DRREDDY Weekly Outlook and Analysis:

For the Week: (Jan 30, 2023 – Feb 03, 2023)

Check DRREDDY Full Analysis At Unicorn Signals

BSE: 500180| NSE: DRREDDY| ISIN: INE040A01026| SECTOR: PHARMA

Stock closed the Weekly on negative note loosing 0.84%

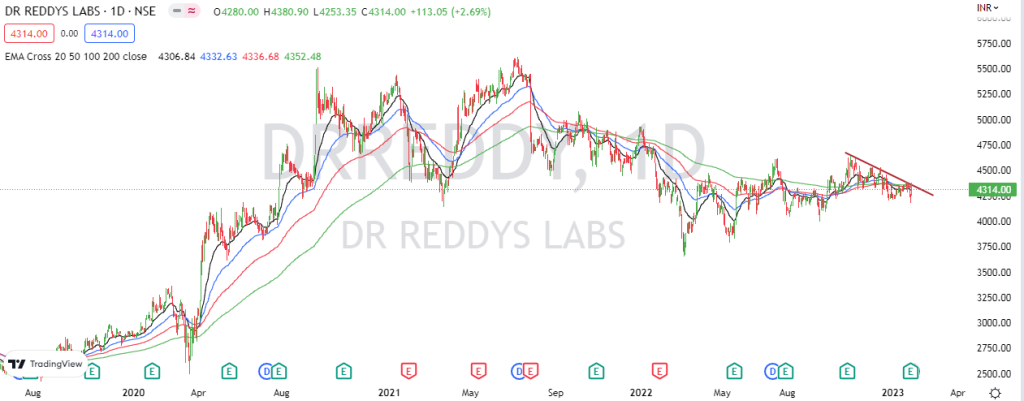

Dr Reddy Share Price: 4314.00

Weekly High: 4380.90

Weekly Low: 4175.10

Weekly Range: 36.60 Points

Weekly Support & Resistance For DR. Reddy:

| RESISTANCE 2 | 4494 |

| RESISTANCE 1 | 4404 |

| SUPPORT 1 | 4199 |

| SUPPORT 2 | 4084 |

Technically on the daily charts EquityPandit’s Analyst see: Minor support on the downside lies at 4199 levels, Minor resistance on the upside is capped around 4404 levels.

If stock breaches minor support on the downside and closes below it we may see fresh break down and stock can drag towards Major Support on lower side @ 4084 and If stock breaches minor resistance on the upside and closes above it we may see fresh breakout and stock can head towards Major Resistances Level @ 4494.

Stock is trading below 200 days exponential moving average, suggests long term trend is bearish. EquityPandit predicts Range for the Weekly as 4494 on upside and 4084 on downside.