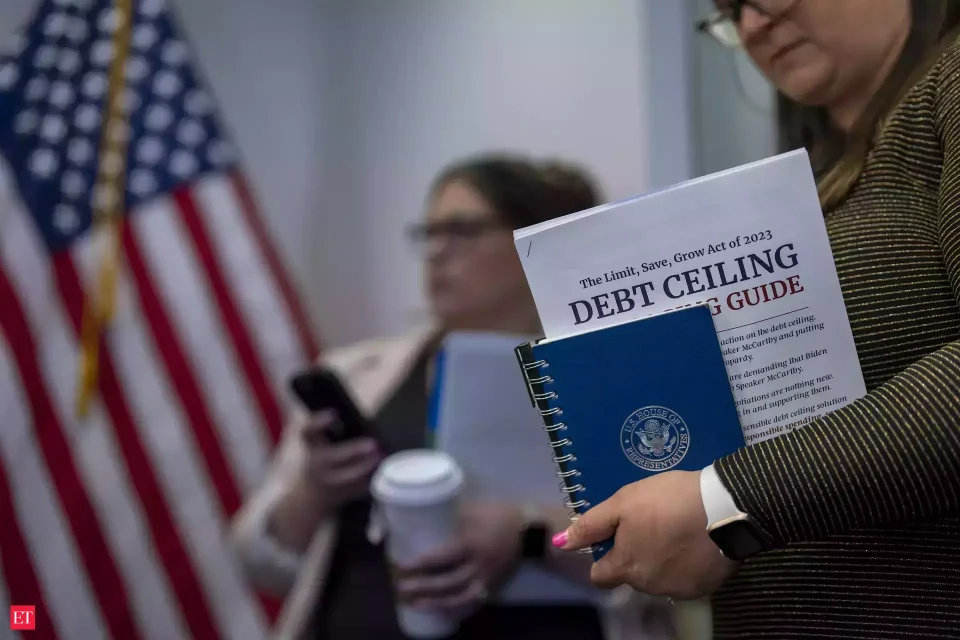

As the debate over lifting the debt ceiling in the United States continues to create uncertainty, gold has emerged as an increasingly attractive investment option.

The precious metal has been trading near its all-time highs and could hit a new record any day. Although there has been a slight pullback in recent weeks, gold has experienced a significant increase of 11% year to date and 25% since its low in November.

While it is difficult to make precise predictions about the market impact of a US default, analysts believe that gold will remain a safe haven for investors. A US default would be a historical moment that could have far-reaching consequences for Wall Street and impact global markets.

Lawmakers have made little progress in reaching a deal to raise the debt ceiling, and time is running out. The lack of resolution could potentially lead to a near-term rise in the price of gold. Even if a deal is eventually reached, the financial uncertainty leading up to the deadline could drive market flows towards gold.

Treasury Secretary Janet Yellen has warned that the government could run out of money as early as June 1. According to Bloomberg’s Markets Live Pulse survey, more than half of finance professionals surveyed stated that gold is their preferred asset if the US government fails to meet its obligations.

Even apart from the default scenario, other factors support the rise of gold to new record highs. Credit default swaps have reached their highest level since 2008. Ongoing gold purchases by global central banks, demand from countries like China and India, and international interest rate cuts favour gold as a non-interest-bearing asset. The dollar could weaken, causing the price of gold, denominated in dollars, to rise.

Gold still has the potential to outperform other investments, given the current direction of the US economy and the risks at hand. Gold is the most likely asset to bear the burden of these market dynamics in such a scenario and may serve as a safe haven for those concerned about a potential default.

Live

Live