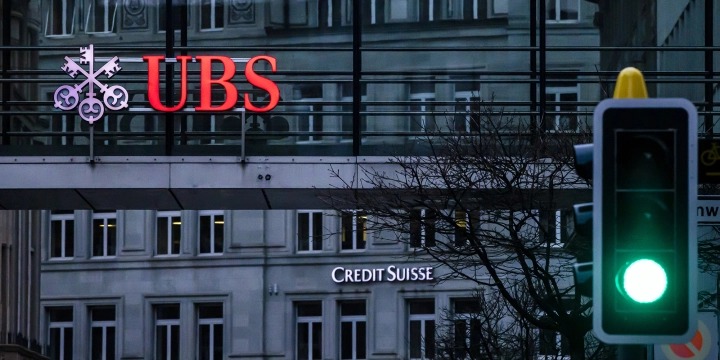

Banks, including Credit Suisse and UBS, are under scrutiny as the US Justice Department investigates whether financial professionals helped Russian oligarchs evade sanctions, according to people familiar with the matter.

The people said that UBS was included in the US government’s recent wave of subpoenas. The information requests came before the crisis engulfed Credit Suisse, leading UBS to propose buying its rival.

Two people familiar with the matter said that the subpoenas were also issued to employees of some major US banks.

The Justice Department’s investigation is focused on determining which bank employees worked with sanctioned clients and how they were vetted over the past few years, one of the people said. The bankers and consultants may be subject to further investigation to determine whether they broke any laws.

Credit Suisse was known for catering to wealthy Russians before Russia’s invasion of Ukraine led to the expansion of sanctions. At its peak, the bank managed over $60 billion in assets for Russian clients and generated $500 million to $600 million in annual revenue for Credit Suisse.

When it ceased business with individual Russian clients last May, Credit Suisse held about $33 billion for them, 50% more than UBS, despite its larger wealth management business.

The Justice Department launched the KleptoCapture task force last year to impose sanctions on wealthy Russians who are political allies of President Vladimir Putin. The US government has seized multiple yachts, private jets and luxury homes.

Last month, the US began seizing homes owned by sanctioned oligarch Viktor Vekselberg in New York, Florida and the Hamptons.

Some have also been accused of helping oligarchs hide assets. British businessman Graham Bonham-Carter was arrested in October on charges of illegally moving $1 million to protect sanctioned billionaire Oleg Deripaska’s US property. A former senior FBI agent was also charged with helping Deripaska violate sanctions in January.

Banks could face severe penalties for violating US sanctions. BNP Paribas agreed to pay nearly $9 billion in 2014 after admitting to US allegations it processed transactions for sanctioned Sudanese, Iranian and Cuban entities. In 2019, Standard Chartered agreed to pay over $1 billion to settle a Justice Department investigation. A former bank employee has pleaded guilty to conspiring to violate US sanctions on Iran.

As the Credit Suisse rescue plan rolled out over the weekend, UBS expressed widespread concern about taking on potential legal liability for its rival. The Swiss government has said it will insure UBS against losses of up to 9 billion Swiss francs ($9.8 billion) on the deal.

In early March, Deputy US Attorney Lisa Monaco said the Justice Department responded to an “uncertain geopolitical environment” by strengthening its national security division, which enforces sanctions violations.

“Corporate crime and national security overlap like never before, and the department is restructuring to meet this challenge,” Monaco said.