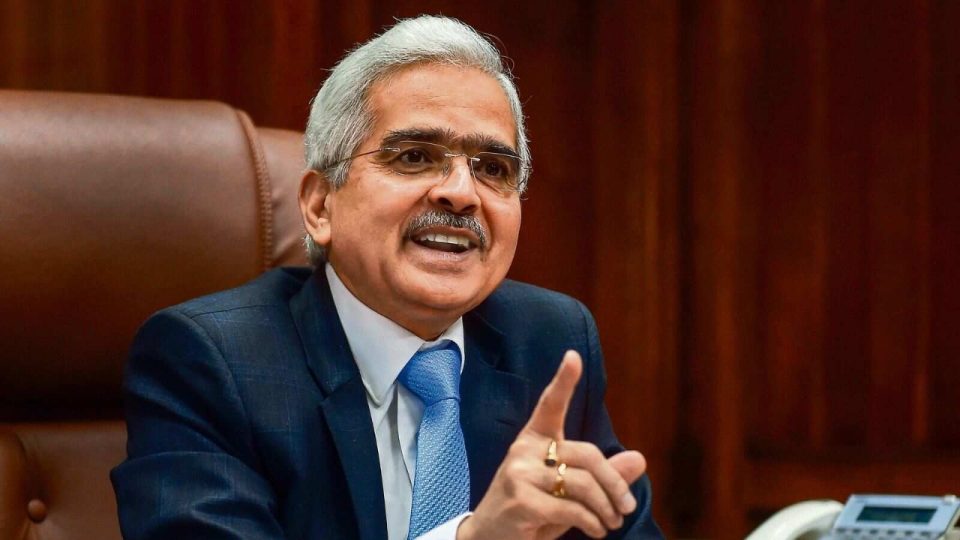

Shaktikanta Das, governor of the Reserve Bank of India, wants to reduce India’s inflation from its peak to 4% within two years.

In an interview with the television network ET Now on Tuesday, Das stated that “inflation has peaked and price hikes are getting anchored,” adding that there is “no room for complacency” and that the central bank is monitoring all incoming data.

To keep inflation within its target range of 2%–6%, the RBI increased the policy repurchase rate by 140 basis points since May, including two consecutive half-point increases in June and August. In July, consumer prices dropped for three months but are still above the 6% threshold.

“We won’t make many growth sacrifices as we steadily move toward the 4% inflation objective,” Das added. Additionally, he said that constant bond yields show that possible price control by central bank operations was achieved.

Regarding inflation, Indian bonds had their losses cut down. Compared to an intraday high of 7.31%, the 10-year bond yield was trading one basis point higher at 7.28%. On the back of a decline in petroleum prices and a resumption of foreign money inflows, bond yields have also gradually decreased after rising following the August decision. Bond markets are operating in a well-organized way. Only when we notice a disruption in the market will we enter,” Das said.

Inflation Has Peaked, ‘Will Approach 4% Target Steadily’, Says RBI Governor

Click here to check market prediction for next trading session.

Live

Live