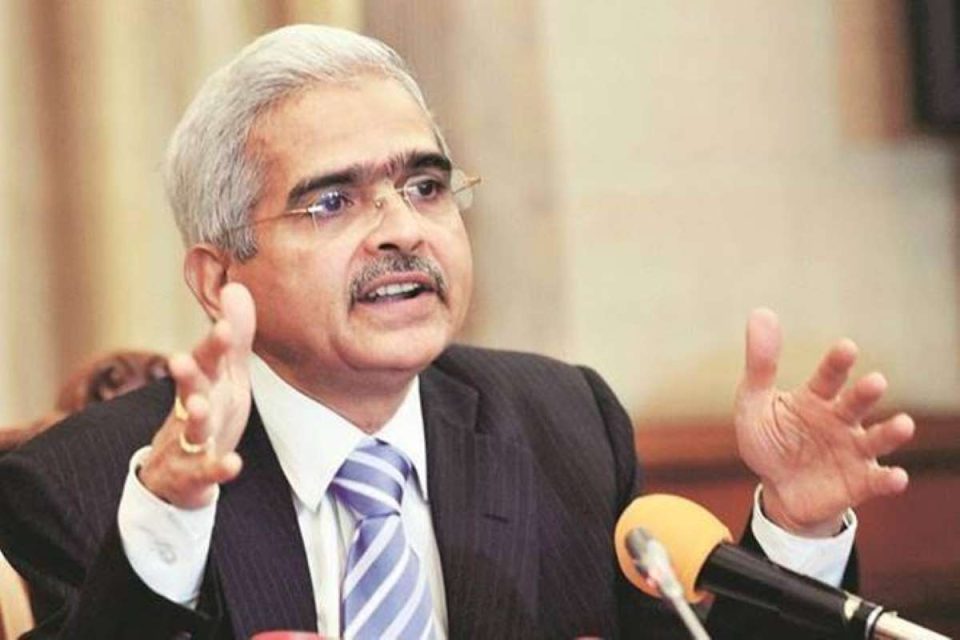

Reserve Bank of India (RBI) Governor Shaktikanta Das launched UPI for feature phones called UPI123Pay. He also introduced a 24×7 helpline for digital payments, i.e. ‘DigiSaathi’. UPI on feature phones will help people in rural areas who cannot afford a smartphone participate in UPI transactions. “This decade will witness a transformative shift in the digital payments ecosystem in the country,” Das said.

- What is Stock Order : Types, Differences & How Order Works

- India’s Business Activity Hits 3-Month High in Nov Amid Rising Costs

- Trudeau to Cut Sales Tax and Send Checks to Canadians Ahead of Election

- Ashwini Vaishnaw Encourages German Companies to Invest in India

- Flipkart Appoints Dan Bartlett to Board

Das also highlighted the necessity to focus on cyber security aspects and said systems need to be prepared to face such risks. UPI 123Pay will allow its users to use feature phones for all transactions except scan and pay. And It wouldn’t need an internet connection for transactions. This idea for UPI in feature phones was thought to increase digital penetration of financial services and help a large group of people who don’t have access to smartphones or reliable internet services to do transactions digitally.