Jindal Steel & Power Ltd

NSE :JINDALSTEL BSE :532286 Sector : Steel

About Company: Jindal Steel & Power Ltd is one of the India’s leading steel producers with significant presence in sectors like mining and power generation. The group has global presence through subsidiaries, mainly in Australia, Botswana, Indonesia, Mauritius, Mozambique, Madagascar, Namibia, South Africa, Tanzania and Zambia.

Daily Chart of Jindal Steel:

Technical Outlook of Jindal Steel:

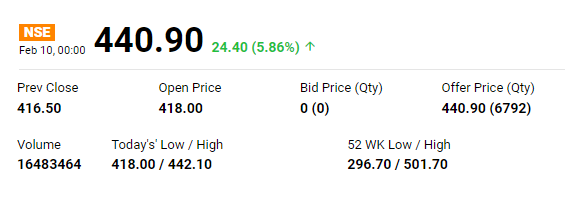

On Thursday 10th Feb 2022 Jindal Steel and Power gained 5.86% and was up by Rs. 24.40 per share, Finally closed at 440.90 on NSE. In the intraday trade stock gained in first hour of trade and then traded sideways for the remaining day. On the Daily chart stock is forming Ascending Tringle Pattern which is marked on the chart above. Stock is approaching towards resistance line which lies around 450- 452 level.

After company announced Q3 FY22 results we have seen buying in stock. It formed two green candles with increase in volumes since last two trading sessions. Stock is trading above 20,50,100,200 Exponential moving averages which indicates momentum in the stock.

Looking at the price pattern on daily chart, Moving averages and increase in volumes with increase in price in the last two trading session we recommend buying Jindal steel and Power around current price 438- 440, Expected targets on the upside should be kept at 450 for short term and 520 for long term. Stop loss should be maintained below 400. As risk and rewards are not favorable for short term trades we suggest only seasonal trades to take long position in stock with suggest targets and stop loss.