LTIMindtree Ltd

NSE :LTIM BSE :540005 Sector : IT - SoftwareBuy, Sell or Hold LTIM? Ask The Analyst

BSE

Mar 28, 00:00

4492.40

-166.40 (-3.57%)

prev close

4658.80

OPEN PRICE

4360.00

volume

29030

Today's low / high

4360.00 / 4625.05

52 WK low / high

4240.00 / 6764.80

bid price (qty)

0 (0)

offer price (qty)

0 (0)

NSE

Mar 28, 00:00

4491.35

-164.55 (-3.53%)

prev close

4655.90

open price

4540.05

volume

447846

Today's' low / high

4475.00 / 4626.40

52 WK low / high

4239.00 / 6767.95

bid price (qty)

0 (0)

offer price (qty)

4491.35 (242)

| 28 Mar 4491.35 (-3.53%) | 27 Mar 4655.90 (0.78%) | 26 Mar 4619.75 (0.29%) | 25 Mar 4606.40 (-0.30%) | 24 Mar 4620.40 (2.22%) | 21 Mar 4520.25 (2.24%) | 20 Mar 4421.15 (1.28%) | 19 Mar 4365.45 (-1.80%) | 18 Mar 4445.55 (1.97%) | 17 Mar 4359.80 (-2.40%) | 13 Mar 4467.05 (-0.42%) | 12 Mar 4485.90 (-3.62%) | 11 Mar 4654.45 (-0.35%) | 10 Mar 4670.95 (-1.08%) | 07 Mar 4721.95 (-2.10%) | 06 Mar 4823.10 (1.04%) | 05 Mar 4773.50 (1.89%) | 04 Mar 4685.00 (-3.09%) | 03 Mar 4834.20 (3.61%) | 28 Feb 4665.95 (-4.36%) | 27 Feb 4878.60 (-1.70%) |

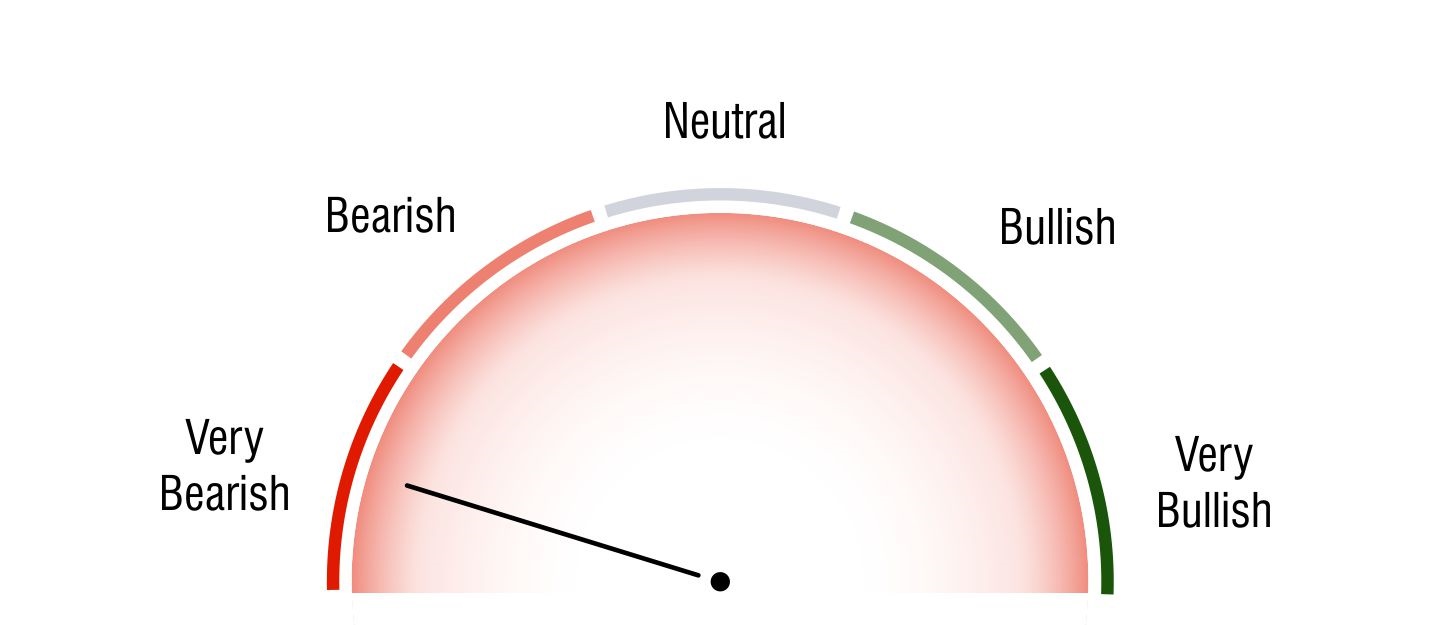

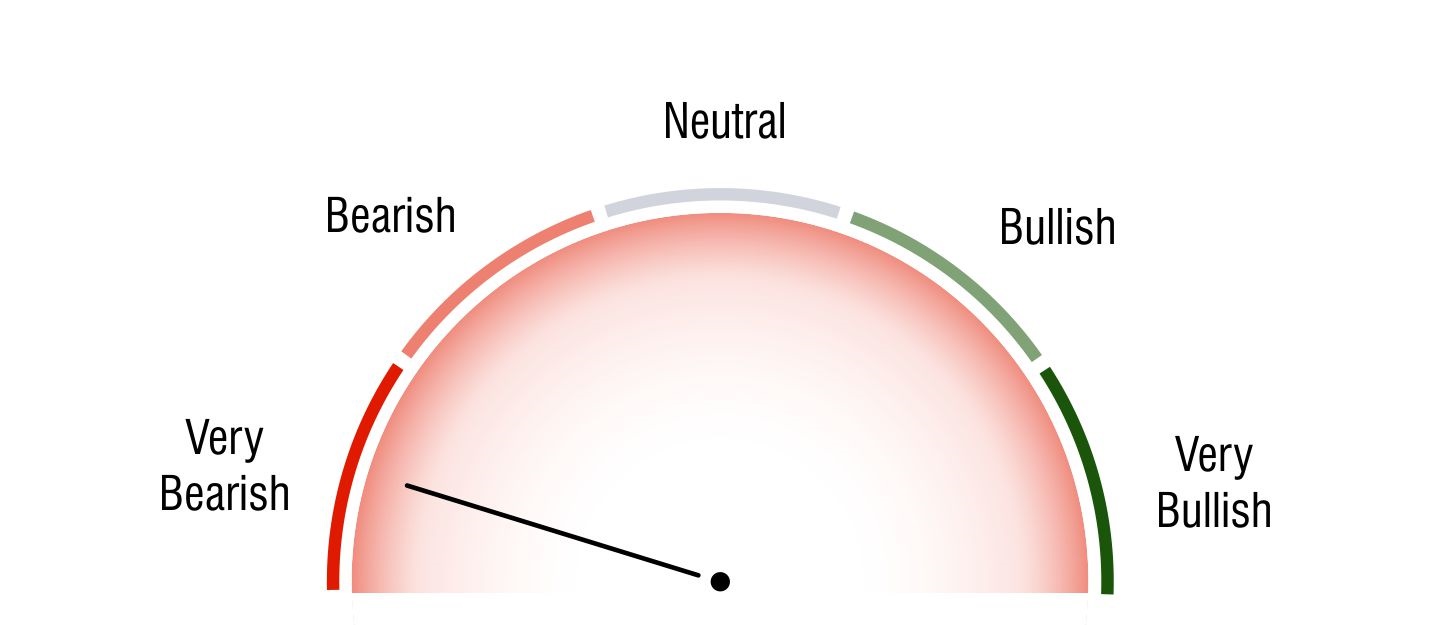

Technical Analysis

Short Term Investors

Neutral

Medium Term Investors

Very Bearish

Long Term Investors

Very Bearish

Moving Averages

5 DMA

Bearish

4599.2

10 DMA

Bearish

4511.53

20 DMA

Bearish

4594.8

50 DMA

Bearish

5244.3

100 DMA

Bearish

5648.67

200 DMA

Bearish

5726.4

Intraday Support and Resistance

(Based on Pivot Points) NSE : 4491.35 | BSE : 4492.40

Updated On Mar 28, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 4738.24 | 4682.32 | 4532.99 | - | - |

| R2 | 4682.32 | 4624.49 | 4519.11 | 4672.43 | - |

| R1 | 4586.84 | 4588.75 | 4505.23 | 4567.06 | 4634.58 |

| P | 4530.92 | 4530.92 | 4530.92 | 4521.03 | 4554.79 |

| S1 | 4435.44 | 4473.09 | 4477.47 | 4415.66 | 4483.18 |

| S2 | 4379.52 | 4437.35 | 4463.59 | 4369.63 | - |

| S3 | 4284.04 | 4379.52 | 4449.72 | - | - |

Key Metrics

EPS

150.58

P/E

29.83

P/B

6.56

Dividend Yield

1.45%

Market Cap

1,33,072 Cr.

Face Value

1

Book Value

684.3

ROE

25.05%

EBITDA Growth

1,804.8 Cr.

Debt/Equity

0.1

Shareholding History

Quarterly Result (Figures in Rs. Crores)

LTIMindtree Ltd Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 9236.1 | 9100.5 | 9369.7 | 9731.8 | 9873.4 | |

| PROFIT | 1168.9 | 1099.9 | 1133.8 | 1251 | 1085.4 | |

| EPS | 39.5 | 37.16 | 38.3 | 42.25 | 36.65 |

LTIMindtree Ltd Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 8919.1 | 8814.1 | 9095.7 | 9407.2 | 9503.2 | |

| PROFIT | 1135.3 | 1093.6 | 1106.2 | 1220.2 | 1041.5 | |

| EPS | 38.36 | 36.95 | 37.37 | 41.21 | 35.17 |

Profit & Loss (Figures in Rs. Crores)

LTIMindtree Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 5077.45 | 6036.1 | 6687.6 | 7732.6 | 9748.1 | 11207.8 | 12644.2 | 26874.5 | 33739.9 | 36218.9 | |

| PROFIT | 769.25 | 838.21 | 956.26 | 1111.85 | 1515.9 | 1520.1 | 1936.1 | 3948.3 | 4408.3 | 4582.1 | |

| EPS | 0 | 0 | 55.15 | 64.67 | 87.1 | 87.39 | 110.75 | 133.45 | 149 | 154.89 |

LTIMindtree Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 4833.18 | 5798.9 | 6381.2 | 7431.8 | 9236.2 | 10605.9 | 11791.5 | 25734 | 32477.1 | 34963.3 | |

| PROFIT | 773.21 | 858.12 | 922.98 | 1103.53 | 1400.58 | 1454.17 | 1788.4 | 3912.3 | 4248.2 | 4485.9 | |

| EPS | 211.58 | 50.36 | 54.83 | 67.45 | 84.78 | 89.22 | 102.19 | 132.17 | 143.52 | 151.55 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 29.6 | 29.6 | 29.6 | 17.5 | 17.4 | 17.4 | 17.2 | 17.1 | 17 | 16.13 |

| Reserves Total | 19,987.5 | 16,562.5 | 14,257.6 | 7,285.9 | 5,386.6 | 4,876.4 | 3,842.6 | 3,127.2 | 2,107.5 | 2,010.22 |

| Equity Application Money | 0.1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Shareholders Funds | 20,017.2 | 16,592.1 | 14,287.2 | 7,303.4 | 5,404 | 4,893.8 | 3,859.8 | 3,144.3 | 2,124.5 | 2,026.35 |

| Minority Interest | 9.2 | 7.1 | 5.7 | 3.7 | 1.1 | 0.8 | 1.3 | 0.8 | 0.5 | 0.39 |

| Secured Loans | 40.7 | 125.3 | 51.9 | 0 | 0 | 0 | 0 | 0 | 28 | 87.78 |

| Unsecured Loans | 2,029.9 | 1,415.9 | 205.6 | 798.3 | 911.9 | 0 | 0 | 0 | 26.6 | 129.75 |

| Total Debt | 2,070.6 | 1,541.2 | 257.5 | 798.3 | 911.9 | 0 | 0 | 0 | 54.6 | 217.53 |

| Other Liabilities | 47.5 | 212.4 | 1,186.7 | 128.7 | 321.4 | 122.7 | 132.1 | 28.5 | 23.5 | 64.21 |

| Total Liabilities | 22,144.5 | 18,352.8 | 15,737.1 | 8,234.1 | 6,638.4 | 5,017.3 | 3,993.2 | 3,173.6 | 2,203.1 | 2,308.48 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 8,572.3 | 6,890.4 | 6,279.4 | 3,174.5 | 3,110.3 | 1,831.3 | 1,436.1 | 1,140.7 | 1,108.2 | 683.43 |

| Less: Accumulated Depreciation | 3,591.5 | 3,211.3 | 2,806.5 | 1,268.5 | 1,190.6 | 901.4 | 755.5 | 598.8 | 470.6 | 0 |

| Net Block | 4,980.8 | 3,679.1 | 3,472.9 | 1,906 | 1,919.7 | 929.9 | 680.6 | 541.9 | 637.6 | 683.43 |

| Capital Work in Progress | 550.7 | 902.3 | 502.8 | 66.2 | 59.2 | 11.5 | 6.8 | 1.3 | 19.5 | 25.18 |

| Investments | 8,743.6 | 5,458.3 | 6,048.4 | 3,729.5 | 2,218.8 | 1,740.3 | 1,264.4 | 940.6 | 42.9 | 103.55 |

| Inventories | 3 | 3.3 | 4.1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sundry Debtors | 5,706 | 5,623.4 | 4,557.4 | 2,083.5 | 2,312.1 | 1,826.3 | 1,396.2 | 1,169.7 | 1,166.1 | 1,090.12 |

| Cash and Bank Balance | 2,816 | 2,932 | 1,837.3 | 759.4 | 525.2 | 415 | 363.3 | 379.5 | 203.5 | 200.92 |

| Loans and Advances | 3,568 | 3,885.3 | 3,142.7 | 1,660.2 | 1,273.1 | 1,188.6 | 1,140.7 | 838.9 | 607.8 | 630.87 |

| Total Current Assets | 12,093 | 12,444 | 9,541.5 | 4,503.1 | 4,110.4 | 3,429.9 | 2,900.2 | 2,388.1 | 1,977.4 | 1,921.91 |

| Current Liabilities | 4,395.2 | 4,144.5 | 3,969.3 | 2,102.9 | 1,909.5 | 1,398.1 | 1,128.6 | 1,052.2 | 785.5 | 364.24 |

| Provisions | 1,004.6 | 984.1 | 865.5 | 368.6 | 266.9 | 248.2 | 214.8 | 191.5 | 148.8 | 281.54 |

| Total Current Liabilities & Provisions | 5,399.8 | 5,128.6 | 4,834.8 | 2,471.5 | 2,176.4 | 1,646.3 | 1,343.4 | 1,243.7 | 934.3 | 645.78 |

| Net Current Assets | 6,693.2 | 7,315.4 | 4,706.7 | 2,031.6 | 1,934 | 1,783.6 | 1,556.8 | 1,144.4 | 1,043.1 | 1,276.13 |

| Deferred Tax Assets | 466.8 | 476.2 | 38.7 | 213.3 | 304.7 | 235.9 | 319 | 292 | 283.6 | 80.06 |

| Deferred Tax Liability | 260.5 | 110 | 10.5 | 162.2 | 92.6 | 87 | 140.1 | 165.7 | 87.1 | 103.86 |

| Net Deferred Tax | 206.3 | 366.2 | 28.2 | 51.1 | 212.1 | 148.9 | 178.9 | 126.3 | 196.5 | -23.8 |

| Other Assets | 969.9 | 631.5 | 978.1 | 449.7 | 294.6 | 403.1 | 305.7 | 419.1 | 263.5 | 243.98 |

| Total Assets | 22,144.5 | 18,352.8 | 15,737.1 | 8,234.1 | 6,638.4 | 5,017.3 | 3,993.2 | 3,173.6 | 2,203.1 | 2,308.47 |

| Contingent Liabilities | 712.8 | 418.4 | 386.3 | 305.5 | 304.5 | 250.4 | 0 | 577.8 | 735.5 | 656.9 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 29.6 | 29.6 | 29.6 | 17.5 | 17.4 | 17.4 | 17.2 | 17.1 | 17 | 16.13 |

| Reserves Total | 19,268.8 | 15,947.4 | 13,845.5 | 6,924.3 | 5,211.4 | 4,696.1 | 3,701.4 | 2,959.8 | 1,947.1 | 1,909.33 |

| Equity Application Money | 0.1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Shareholders Funds | 19,298.5 | 15,977 | 13,875.1 | 6,941.8 | 5,228.8 | 4,713.5 | 3,718.6 | 2,976.9 | 1,964.1 | 1,925.46 |

| Secured Loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 28 | 87.78 |

| Unsecured Loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 26.6 | 129.75 |

| Total Debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 54.6 | 217.53 |

| Other Liabilities | 1,690 | 1,352.5 | 1,149.2 | 726.2 | 1,003.3 | 32.3 | 48.4 | 28.5 | 23.5 | 64.21 |

| Total Liabilities | 20,988.5 | 17,329.5 | 15,024.3 | 7,668 | 6,232.1 | 4,745.8 | 3,767 | 3,005.4 | 2,042.2 | 2,207.2 |

| APPLICATION OF FUNDS : | ||||||||||

| Gross Block | 7,010.6 | 5,399 | 4,669 | 1,706.8 | 1,708 | 778.4 | 653.9 | 588.9 | 548 | 791.03 |

| Less : Accumulated Depreciation | 2,791 | 2,468.1 | 2,118.7 | 673.7 | 556.5 | 463.7 | 381.2 | 303 | 227.6 | 453.78 |

| Net Block | 4,219.6 | 2,930.9 | 2,550.3 | 1,033.1 | 1,151.5 | 314.7 | 272.7 | 285.9 | 320.4 | 337.25 |

| Capital Work in Progress | 476.9 | 856 | 471.9 | 43 | 40 | 8.2 | 6.8 | 1.2 | 18.9 | 24.3 |

| Investments | 9,203.3 | 5,919.4 | 6,711 | 4,382.4 | 2,873.5 | 2,260 | 1,560.4 | 1,231.1 | 322.5 | 457.54 |

| Inventories | 3 | 3.3 | 4.1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sundry Debtors | 5,372.1 | 5,318.5 | 4,327.6 | 2,024.3 | 2,176.7 | 1,729.3 | 1,327.5 | 1,122.6 | 1,101.1 | 1,031.44 |

| Cash and Bank Balance | 2,590.7 | 2,656.1 | 1,718 | 402.5 | 371.4 | 215.4 | 249.8 | 190.6 | 122.2 | 133.43 |

| Loans and Advances | 3,462.4 | 3,806.7 | 2,963.4 | 1,525.1 | 1,219.9 | 1,155.6 | 1,112.5 | 820.9 | 592.1 | 684.18 |

| Total Current Assets | 11,428.2 | 11,784.6 | 9,013.1 | 3,951.9 | 3,768 | 3,100.3 | 2,689.8 | 2,134.1 | 1,815.4 | 1,849.05 |

| Current Liabilities | 4,541.5 | 4,180.3 | 3,965.1 | 1,972.5 | 1,829.2 | 1,254.6 | 1,062.5 | 1,038.1 | 770.7 | 412.81 |

| Provisions | 927.7 | 924.6 | 826.6 | 348 | 255.4 | 226.2 | 189.4 | 169.4 | 142 | 279.2 |

| Total Current Liabilities & Provisions | 5,469.2 | 5,104.9 | 4,791.7 | 2,320.5 | 2,084.6 | 1,480.8 | 1,251.9 | 1,207.5 | 912.7 | 692.01 |

| Net Current Assets | 5,959 | 6,679.7 | 4,221.4 | 1,631.4 | 1,683.4 | 1,619.5 | 1,437.9 | 926.6 | 902.7 | 1,157.05 |

| Deferred Tax Assets | 201.4 | 361.4 | 31 | 47.9 | 296 | 212.8 | 253 | 290.2 | 276.6 | 56.6 |

| Deferred Tax Liability | 0 | 2.6 | 0 | 0 | 82.5 | 56.4 | 61.1 | 146.3 | 56.8 | 64.28 |

| Net Deferred Tax | 201.4 | 358.8 | 31 | 47.9 | 213.5 | 156.4 | 191.9 | 143.9 | 219.8 | -7.68 |

| Other Assets | 928.3 | 584.7 | 1,038.7 | 530.2 | 270.2 | 387 | 297.3 | 416.7 | 257.9 | 238.73 |

| Total Assets | 20,988.5 | 17,329.5 | 15,024.3 | 7,668 | 6,232.1 | 4,745.8 | 3,767 | 3,005.4 | 2,042.2 | 2,207.19 |

| Contingent Liabilities | 712.8 | 501.2 | 462.7 | 379.1 | 676.1 | 611.2 | 593.9 | 577.8 | 735.1 | 656.5 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 4,584.6 |

| Depreciation | 818.9 |

| Interest (Net) | -79.7 |

| P/L on Sales of Assets | -7.1 |

| P/L on Sales of Invest | -314 |

| Prov. and W/O (Net) | 76.5 |

| P/L in Forex | 26.3 |

| Total Adjustments (PBT and Ext... | 2,058.1 |

| Operating Profit before Workin... | 6,642.7 |

| Trade and 0ther Receivables | 504.6 |

| Inventories | 0.3 |

| Trade Payables | 422.3 |

| Total Adjustments (OP before W... | 597.5 |

| Cash Generated from/(used in) ... | 7,240.2 |

| Direct Taxes Paid | -1,570.7 |

| Total Adjustments(Cash Generat... | -1,570.7 |

| Cash Flow before Extraordinary... | 5,669.5 |

| Net Cash from Operating Activi... | 5,669.5 |

| Purchased of Fixed Assets | -843.2 |

| Sale of Fixed Assets | 10.2 |

| Purchase of Investments | -31,997 |

| Sale of Investments | 28,666.5 |

| Interest Received | 257.3 |

| Net Cash used in Investing Act... | -3,918.4 |

| Proceeds from Issue of shares ... | 1.2 |

| Proceed from Deposits | 58.6 |

| Of the Short Term Borrowings | -86.6 |

| Of Financial Liabilities | -247.8 |

| Dividend Paid | -1,775.3 |

| Interest Paid | -218.9 |

| Net Cash used in Financing Act... | -2,268.8 |

| Net Profit before Tax and Extr... | 4,485.9 |

| Depreciation | 760.4 |

| Interest (Net) | -89.3 |

| P/L on Sales of Assets | -7.1 |

| P/L on Sales of Invest | -314.9 |

| Prov. and W/O (Net) | 72.6 |

| P/L in Forex | 19.1 |

| Total Adjustments (PBT and Ext... | 1,907.4 |

| Operating Profit before Workin... | 6,393.3 |

| Trade and 0ther Receivables | 525.2 |

| Inventories | 0.3 |

| Trade Payables | 453 |

| Total Adjustments (OP before W... | 650 |

| Cash Generated from/(used in) ... | 7,043.3 |

| Direct Taxes Paid | -1,513.7 |

| Total Adjustments(Cash Generat... | -1,513.7 |

| Cash Flow before Extraordinary... | 5,529.6 |

| Net Cash from Operating Activi... | 5,529.6 |

| Purchased of Fixed Assets | -796.1 |

| Sale of Fixed Assets | 10.2 |

| Purchase of Investments | -31,997 |

| Sale of Investments | 28,666.5 |

| Interest Received | 252.2 |

| Cancellation of Investment in ... | 2.6 |

| Net Cash used in Investing Act... | -3,834.1 |

| Proceeds from Issue of shares ... | 1.2 |

| Proceed from Deposits | 58.6 |

| Of Financial Liabilities | -242.7 |

| Dividend Paid | -1,775.3 |

| Interest Paid | -204.4 |

| Net Cash used in Financing Act... | -2,162.6 |

Company Details

Registered Office |

|

| Address | L & T House, Ballard Estate |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400001 |

| Tel. No. | 91-22-67525656 |

| Fax. No. | 91-22-67525893 |

| investor@lntinfotech.com | |

| Internet | http://www.lntinfotech.com |

Registrars |

|

| Address | L & T House |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400001 |

| Tel. No. | 91-22-67525656 |

| Fax. No. | 91-22-67525893 |

| investor@lntinfotech.com | |

| Internet | http://www.lntinfotech.com |

Management |

|

| Name | Designation |

| A M Naik | Founder Chairman |

| S N Subrahmanyan | Vice Chairman |

| R Shankar Raman | Non Executive Director |

| Sanjeev Aga | Independent Director |

| Sudhir Chaturvedi | President & Whole-time Dir. |

| Nachiket Deshpande | Whole Time Director & COO |

| JAMES VARGHESE ABRAHAM | Independent Director |

| Vinayak Chatterjee | Independent Director |

| Debashis Debiprasad Chatterjee | Managing Director & CEO |

| APURVA PUROHIT | Independent Director |

| Bijou Kurien | Independent Director |

| Chandrasekaran Ramakrishnan | Independent Director |

| Angna Arora. | Company Sec. & Compli. Officer |

| Venugopal Lambu | Whole Time Director & CEO |