1,997.30

(1.62%)

31.90

BHARTIARTL Performance

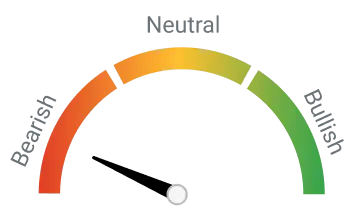

Short Term Investors

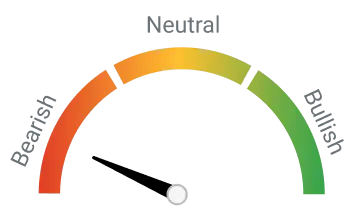

Medium Term Investors

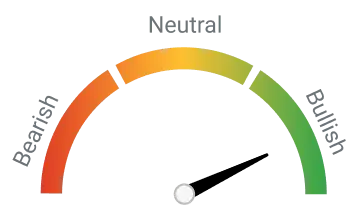

Long Term Investors

₹1,00,000

--

--

--

1997.3

(1.62%) 31.90| Pivots | Classic | Fibonacci | Camarilla | Woodie's | Demark's |

|---|

| Indicator | Value | Action |

|---|---|---|

| Loading... | ||

| Indicator | Value | Action |

|---|---|---|

| Loading... | ||

| Period | SMA | EMA |

|---|---|---|

| Loading... | ||

| Duration | Returns |

|---|---|

| Loading... | |

| Name | Designation |